Growing Demand for ✨

The growing interest in Bitcoin wallet insurance in Sao Tome reflects a shifting landscape where digital asset protection is becoming paramount. As awareness of cybersecurity threats rises, individuals and businesses are increasingly seeking ways to safeguard their cryptocurrency investments. This surge in demand underscores the need for comprehensive insurance solutions tailored to the unique risks associated with holding virtual currencies. The evolving crypto ecosystem in Sao Tome is driving the push towards secure and reliable insurance options, signaling a promising future for financial protection in the digital realm.

Challenges in Insuring Digital Assets 💼

In the dynamic landscape of digital asset protection, the insurance sector faces a unique set of obstacles. Safeguarding intangible assets like Bitcoin poses challenges related to valuation, volatility, and security breaches. Insurers must navigate these complexities while ensuring adequate coverage and risk management strategies to meet the evolving needs of cryptocurrency investors. As the demand for insurance solutions in the crypto space grows, innovative approaches and regulatory frameworks will play a crucial role in shaping the future of Bitcoin wallet insurance.

Importance of Regulatory Clarity 📜

Regulatory clarity in the realm of digital asset insurance is akin to a guiding compass in uncharted waters. Clear and well-defined regulations serve as the cornerstone for establishing trust and credibility in the evolving landscape of Bitcoin wallet insurance. They not only provide a framework for insurers and stakeholders to operate within but also offer a sense of security for individuals looking to safeguard their investments. By fostering an environment of transparency and accountability, regulatory clarity paves the way for sustainable growth and innovation in the burgeoning field of insuring digital assets.

Innovations in Coverage Options 🚀

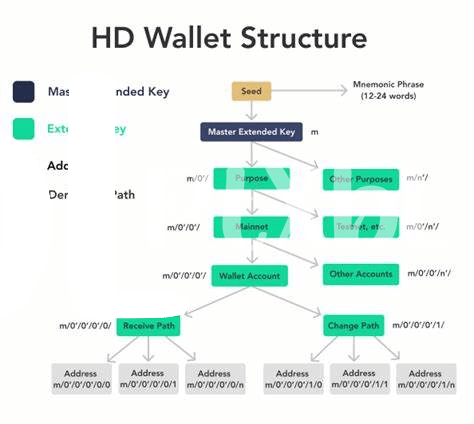

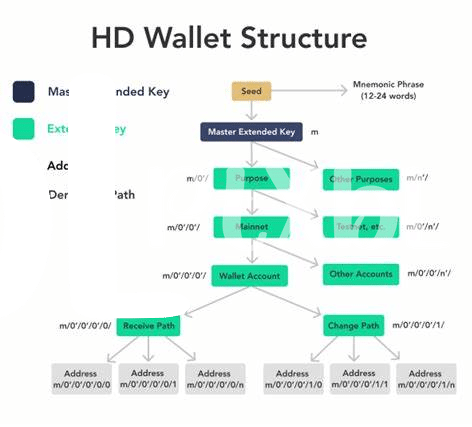

Innovations in Coverage Options 🚀 are reshaping the landscape of Bitcoin wallet insurance, offering tailored solutions to address evolving risks and needs. From multi-signature wallets to smart contract-based policies, these advancements provide enhanced security and flexibility for investors in Sao Tome. To learn more about cutting-edge insurance coverage for Bitcoin wallets and exchanges, check out this insightful article on emerging trends in the industry.

Impact of Blockchain Technology 🌐

Blockchain technology revolutionizes the security and transparency of financial transactions, offering a decentralized network that eliminates the need for intermediaries. By utilizing advanced cryptographic techniques, blockchain ensures that each transaction is secure, verifiable, and tamper-proof. This not only enhances the efficiency of processing transactions but also reduces the risk of fraud and enhances trust between parties. Additionally, blockchain’s immutable nature provides a reliable record of ownership, making it an invaluable tool for the future of Bitcoin wallet insurance in Sao Tome.

Future Trends in Safeguarding Investments 💰

The evolution of safeguarding investments is set to witness a transformative shift in the realm of Bitcoin wallet insurance. As the market adapts to new risks and challenges, novel approaches and technologies will emerge to fortify the security of digital assets. Techniques such as multi-signature wallets, smart contract insurance, and decentralized identity verification hold promise in enhancing the resilience of investment protection mechanisms. These advancements mark a pivotal juncture in the landscape of financial security for cryptocurrency holdings.

Insert link here: insurance coverage for bitcoin wallets and exchanges in seychelles