Decoding Bitcoin’s Roller Coaster Ride 🎢

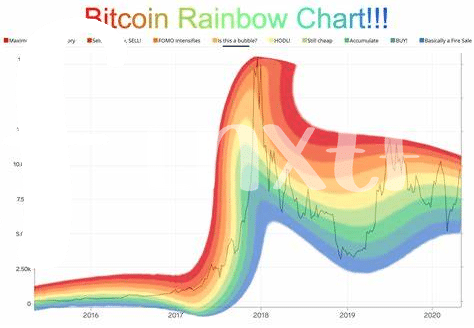

Imagine hopping on a wild amusement park ride, feeling your stomach drop and your heart race as you zoom up and down without knowing what twist or turn comes next. This is quite similar to watching Bitcoin’s value change over time. Just like the most thrilling rides, Bitcoin’s journey has seen some impressive highs and sudden drops, making it an adventurous choice for those looking to add some excitement to their investment portfolio. The reasons behind these fluctuations can seem as unpredictable as a sudden loop on a roller coaster, but they often tie back to changes in market interest, global economic events, or new rules set by governments around the world. Here’s a simple table showing a snapshot of Bitcoin’s major ups and downs:

| Year | High | Low | Notes |

|---|---|---|---|

| 2017 | $19,783 | $790 | 🚀 The Bull Run begins. |

| 2018 | $17,527 | $3,122 | 📉 A significant drop. |

| 2020 | $28,992 | $5,165 | 🌍 COVID-19 impacts. |

Just like the best roller coasters, the key to enjoying the ride without getting too overwhelmed lies in understanding the course ahead and preparing for the exhilarating experience.

Why Does Bitcoin’s Value Change So Much? 🌊

Imagine hopping on a super-fast roller coaster without knowing how steep the next drop will be – that’s a bit like investing in Bitcoin. The value of Bitcoin can zoom up high or dip low very quickly, much like the unpredictable turns of a roller coaster. This happens because of various factors like news about digital currencies, changes in how people feel about investing in them, or even big decisions made by governments around the world about how Bitcoin can be used. When lots of people want to buy Bitcoin, the price shoots up, but if many decide to sell, it drops. This back and forth creates a thrilling but uncertain adventure for investors. For those thinking about stepping into the world of Bitcoin, understanding this volatility is crucial. It’s a bit like learning the rules of the road before you start driving on it. And for those already onboard, it’s about keeping your eyes open and staying buckled up for whatever comes next. For more insights on making the most of your Bitcoin journey, including smart ways to manage your investment, take a peek at https://wikicrypto.news/filing-your-bitcoin-taxes-step-by-step-guide-for-beginners.

Peeking into Bitcoin’s Future Wallet 🚀

Looking forward, Bitcoin seems to be ready for a thrilling journey. It’s like standing at the edge of a diving board, preparing to leap into a future that could be filled with groundbreaking opportunities or unexpected challenges. Experts and enthusiasts alike are strapped in, eager to see where this digital currency will take us. The growth of technology, changes in global finance, and how governments respond to digital money will all play huge roles in shaping Bitcoin’s path. It’s a bit like trying to predict the weather in a month – you can have an idea, but surprises are always possible.

As we gaze into what tomorrow holds for Bitcoin, many are painting scenarios ranging from extreme optimism to cautious skepticism. On one hand, some believe we’re on the cusp of Bitcoin becoming a universally accepted form of payment and a safe haven for investors, much like digital gold. On the other hand, there are whispers of regulatory changes and technological challenges that could throw a wrench in the works. Regardless, diving into Bitcoin now involves a fascinating blend of risk and potential reward, making it an adventure for the brave at heart. Keeping an eye on emerging trends and understanding the forces that drive the digital currency’s value will be key for anyone looking to be part of Bitcoin’s next chapter. 🚀💼🔮

Investing in Bitcoin: Opportunities and Risks 🔍

Diving into the world of Bitcoin can be as thrilling as finding a treasure map. Imagine you’re setting sail on the high seas, where the promise of treasure comes with the risk of stormy waters. The allure of Bitcoin lies in its potential for significant returns. Stories of early investors turning modest sums into fortunes are akin to tales of discovering hidden chests of gold. Yet, just as a treasure map does not guarantee riches without peril, investing in Bitcoin carries its own set of risks. Its value can swing wildly due to factors like regulatory changes or shifts in investor sentiment, turning investment journeys into unpredictable adventures.

For those curious about starting their voyage into Bitcoin, understanding how to protect and manage your investment is key. A good starting point is learning about bitcoin wallet types for beginners. These digital wallets are essential for anyone looking to buy or invest in Bitcoin, providing a secure place to store digital coins. Just as a sailor must learn to navigate through tumultuous waters, investors must strategize to weather Bitcoin’s volatility. This could mean setting aside only a portion of your investment funds for Bitcoin, or keeping a steady hand when the market dips, ready to wait for the potential highs ahead. As with any voyage, the key to success lies in preparation, courage, and a bit of caution ⚓🌟.

Strategies to Navigate Bitcoin’s Volatility 💡

Riding the Bitcoin roller coaster can be daunting, but fear not, for there are clever ways to hold on tight without falling off. Think of it like planting a garden. You wouldn’t just toss seeds and hope for the best; similarly, investing in Bitcoin requires a plan. Start with dollar-cost averaging, which is like watering your plants a little at a time, consistently. Instead of trying to buy low and sell high (which is as tricky as predicting rain in the desert), you invest a fixed amount regularly, rain or shine. This method smooths out the highs and lows over time.

Another strategy is diversification, or not putting all your eggs in one basket. Just as a garden thrives with a variety of plants, your investment portfolio can flourish with a mix of assets. Beyond Bitcoin, consider spreading your investments across other cryptocurrencies, stocks, and bonds. This way, when Bitcoin’s price takes a dive, your financial garden still has a chance to grow. Keeping a calm head and sticking to your strategy is crucial, as is remembering, in the world of Bitcoin, patience tends to pay off. 👀💡🌱

| Strategy | Description | Benefit |

| Dollar-Cost Averaging | Investing a fixed amount regularly. | Reduces the impact of volatility. |

| Diversification | Spreading out investments across different assets. | Minimizes risks and potential losses. |

Bitcoin: a New Era of Digital Gold? 🏆

In the vast and often unpredictable world of cryptocurrencies, imagining Bitcoin as the digital age’s equivalent to gold isn’t too far-fetched. Picture this: centuries ago, explorers and merchants valued gold for its rarity and its use as a reliable trading medium. Fast forward to today, and we see Bitcoin emerging with similar traits. Its digital scarcity and increasing acceptance position it as a unique store of value, sparking discussions about its role as the “digital gold” of our times. Amid the shifting sands of the financial landscape, this notion isn’t just poetic but grounded in the evolving ways we perceive and interact with money.

However, the journey of Bitcoin from an obscure digital currency to a potential digital gold is intertwined with hurdles and milestones. Like the gold rushes of old, it invites both skepticism and excitement, offering a canvas of opportunity for the bold. For those looking to dive deeper into the specifics, especially around the nuances of getting involved while staying informed about regulations, a good starting point is to explore bitcoin philanthropic initiatives in 2024. This resource sheds light on the bridge between embracing digital currencies and understanding their impact beyond the market – from taxation guidelines for beginners to the broader implications of Bitcoin’s integration into our daily lives.