Rise of Crypto-integrated Traditional Banks 🚀

The integration of cryptocurrency into traditional banking systems marks a significant shift towards a more inclusive financial landscape. By embracing digital assets, banks aim to cater to the evolving needs of tech-savvy customers and stay relevant in a rapidly changing industry. This fusion of traditional banking services with cryptocurrency opens up new opportunities for users to access and manage their digital assets seamlessly, enhancing the overall banking experience. As these crypto-integrated banks continue to emerge, they pave the way for a future where the boundaries between traditional and digital finance blur, offering customers a diverse range of financial services under one roof.

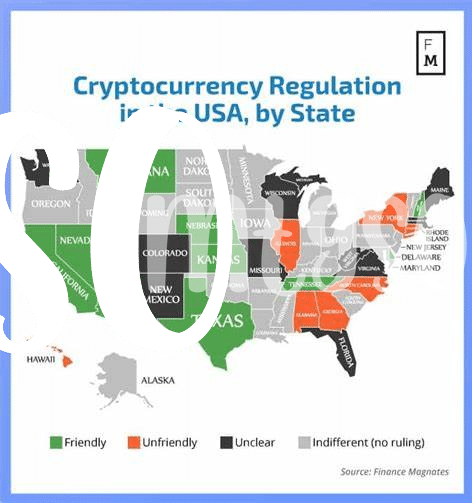

Regulatory Challenges and Compliance Matters 📜

The future landscape of Bitcoin banking services in the US poses several critical challenges and opportunities. Adhering to regulatory frameworks and compliance standards is paramount in ensuring the legitimacy and stability of these emerging financial institutions. As the adoption of digital currencies continues to grow, navigating the evolving regulatory environment will be crucial to the success of Bitcoin banking services in the United States.

.subplots@GetMapping this complex digital finance ecosystem right will require a delicate balance between innovation and oversight. By addressing regulatory challenges proactively and embracing compliance measures, Bitcoin banks can establish trust with customers and authorities alike. The future of Bitcoin banking services in the US hinges on effectively managing these regulatory and compliance matters in tandem with technological advancements and changing consumer preferences.

Advancements in Digital Wallet Technology 💳

Advancements in Digital Wallet Technology are revolutionizing how individuals manage their finances. With the integration of cutting-edge encryption methods and biometric authentication, digital wallets provide a secure and convenient way for users to store and access their funds. The seamless integration of contactless payment options and multi-currency support further enhances the user experience, making transactions swift and efficient. Additionally, the incorporation of blockchain technology ensures transparent and traceable transactions, instilling trust and confidence in users as they engage with digital payment solutions.

Potential Impact on Consumer Banking Habits 💸

The rise of digital currencies, particularly Bitcoin, is revolutionizing how consumers approach banking services. This shift towards decentralized and digital assets has the potential to reshape consumer banking habits significantly. Traditional methods of savings, investments, and transactions may witness a transformation as individuals explore the benefits and opportunities presented by cryptocurrencies. As more people embrace Bitcoin and other digital currencies, the way they interact with financial institutions and manage their money could evolve, ushering in a new era of financial independence and innovation. To explore more about the regulatory landscape in other countries, particularly in Vietnam, check out the latest updates on bitcoin banking services regulations in Vietnam.

Cybersecurity Concerns in the Bitcoin Era 🔒

In the rapidly evolving landscape of digital transactions, the advent of Bitcoin banking services has brought forth a new era of challenges in cybersecurity. The decentralized nature of cryptocurrencies poses unique risks, requiring robust measures to safeguard against potential threats such as hacking and data breaches. As financial institutions navigate this uncharted territory, a proactive approach to cybersecurity is paramount to ensuring the integrity and security of digital assets.

Evolving Role of Traditional Financial Institutions 🔄

Traditional financial institutions are finding themselves at a crossroads as the landscape of banking services evolves with the rise of cryptocurrencies like Bitcoin. They are now faced with the challenge of integrating these digital assets into their existing frameworks while staying competitive in a rapidly changing market. This shift requires them to adapt their traditional practices to accommodate the decentralized and digital nature of cryptocurrencies, reshaping the way they interact with customers and handle transactions. Amidst this transformation, traditional financial institutions are redefining their role in the financial ecosystem, embracing innovative technologies to meet the demands of a digital age.

You can learn more about the regulations governing Bitcoin banking services in the United Kingdom by visiting the official Bitcoin banking services regulations in Uganda.