🌍 Global Impact of Bitcoin Banking in Djibouti

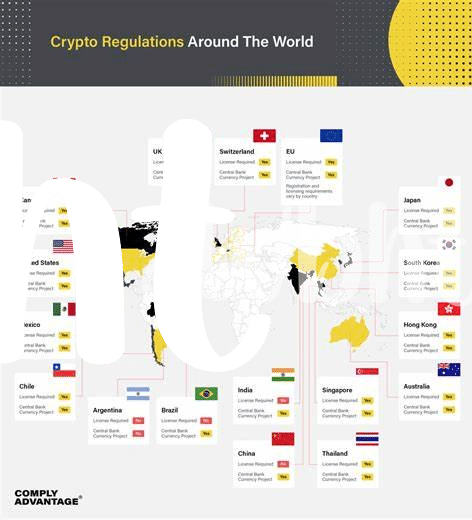

In an ever-connected world, the rise of Bitcoin banking in Djibouti has reverberations far beyond its borders. The global impact of this financial innovation extends to fostering cross-border transactions, promoting financial inclusion, and reshaping traditional banking systems. As Djibouti navigates its regulatory roadmap, the ripple effects of Bitcoin adoption are felt on a global scale, influencing how financial institutions and regulatory bodies interact with this disruptive technology. The intersection of local adoption and international implications paints a dynamic landscape for the future of Bitcoin banking in Djibouti.

📝 Djibouti’s Current Regulatory Framework for Bitcoin

Djibouti’s stance on Bitcoin regulation is evolving, with a framework that seeks to balance innovation and consumer protection. The country is exploring ways to embrace digital currencies while ensuring compliance with international standards. This proactive approach aims to foster a secure environment for cryptocurrency transactions, encouraging growth in the sector. Djibouti’s current regulatory framework for Bitcoin reflects a commitment to staying abreast of technological advancements while safeguarding financial integrity. As the landscape continues to evolve, policymakers are working towards creating a conducive environment for the adoption of digital assets.

💡 Innovation and Challenges in Bitcoin Banking Sector

In the rapidly evolving landscape of Bitcoin banking in Djibouti, a wave of innovation is sweeping through the sector, promising new possibilities and reshaping traditional financial paradigms. As stakeholders embrace emerging technologies and digital currencies, the realm of possibilities expands, opening avenues for greater financial inclusivity and efficiency. However, alongside these innovations come inherent challenges, including regulatory uncertainties, security concerns, and the need to navigate complex technological infrastructures. Adapting to these challenges while harnessing the full potential of innovation is crucial for the sustainable growth and development of Bitcoin banking in Djibouti.

💰 Economic Opportunities and Risks of Bitcoin in Djibouti

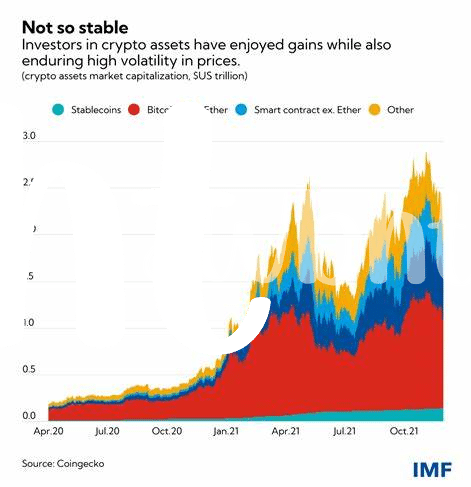

Djibouti stands at a pivotal juncture, poised to embrace the economic opportunities presented by Bitcoin while carefully navigating the associated risks. As the country explores the potential of digital currencies, stakeholders are acutely aware of the need for robust regulatory frameworks to safeguard against potential financial instability. The dynamic landscape of Bitcoin banking in Djibouti promises innovation and growth, offering the chance to tap into new markets and enhance financial inclusivity. However, prudent risk management strategies must be in place to mitigate volatility and ensure sustainable economic development in the long run.

For further insights on the impact of banking services on Bitcoin adoption, especially in the context of regulatory environments, refer to the comprehensive analysis provided by WikiCrypto News on bitcoin banking services regulations in Czech Republic.

🤝 Collaborative Efforts for Bitcoin Adoption in Djibouti

In Djibouti, various stakeholders are joining forces to propel the adoption of Bitcoin. Businesses, government entities, and local communities are collaborating to integrate Bitcoin into everyday transactions. This concerted effort aims to enhance financial inclusion, promote digital innovation, and foster economic growth in Djibouti. Through partnerships and knowledge-sharing, the collective endeavor towards Bitcoin adoption is paving the way for a more digitally inclusive future in the country.

🚀 Future Projections and Growth Potential for Bitcoin Banking

The future of Bitcoin banking in Djibouti holds great promise, with the potential for significant growth and innovation in the sector. As digital currencies continue to gain traction globally, Djibouti is poised to leverage this trend to enhance its financial landscape. The growth potential for Bitcoin banking in Djibouti is substantial, offering new avenues for financial inclusion, streamlined transactions, and increased efficiency in the overall banking sector. Collaborative efforts and strategic regulatory frameworks will play a crucial role in realizing the full potential of Bitcoin banking, paving the way for a dynamic and evolving financial ecosystem. For further insights into Bitcoin banking services regulations, you can explore the regulations in the Dominican Republic bitcoin banking services regulations in Costa Rica.