Current Status of Bitcoin in Uganda 🇺🇬

Currently, the landscape of Bitcoin in Uganda is steadily evolving as more individuals and businesses are starting to embrace its potential. The awareness and usage of Bitcoin as a digital currency are gradually gaining traction among the Ugandan population, showcasing a growing interest in alternative financial avenues. Various startups and exchanges are emerging to cater to this demand, contributing to the expanding presence of Bitcoin in the country. While still in its nascent stages, the current status of Bitcoin in Uganda reflects a promising trajectory towards mainstream adoption, signaling a shifting paradigm in the local financial sector.

Potential Benefits of Adopting Bitcoin 💰

When businesses in Uganda embrace Bitcoin, they open doors to faster and cheaper cross-border transactions. This digital currency transcends traditional banking hours, enabling seamless transactions at any time. Additionally, Bitcoin’s decentralization minimizes the risk of government interference or economic instability affecting transactions. With lower transaction fees compared to traditional banks, businesses can enhance their profit margins and potentially pass on these savings to consumers. Overall, adopting Bitcoin can streamline financial processes and foster greater financial inclusivity in Uganda.

Challenges and Concerns Surrounding Bitcoin 💡

Bitcoin in Uganda faces several challenges and concerns that need to be addressed for its widespread acceptance. Security risks, including hacking and scams, are major worries for both individual users and businesses. The lack of clear regulations and potential for fraud also contribute to the apprehension surrounding Bitcoin. Additionally, the volatility of the cryptocurrency market raises concerns about its reliability as a form of investment. Overcoming these obstacles is crucial for Bitcoin to gain trust and become a viable currency option in Uganda.

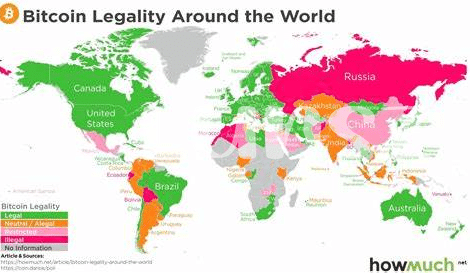

Regulatory Framework for Bitcoin in Uganda 📝

In Uganda, the regulatory framework for Bitcoin is a crucial aspect that requires careful consideration to ensure both legality and security in its adoption. Establishing clear guidelines and regulations can help protect consumers, prevent fraud, and promote the responsible use of Bitcoin within the country. By creating a transparent and supportive regulatory environment, Uganda can potentially harness the benefits of Bitcoin while mitigating potential risks associated with this emerging digital asset. This proactive approach will be essential in shaping the future landscape of Bitcoin within the Ugandan economy.

To explore further insights into the legal recognition of Bitcoin in various countries, including the ongoing debate in Tunisia, check out this informative article: is bitcoin recognized as legal tender in tuvalu?.

Impact of Bitcoin on the Ugandan Economy 📈

Bitcoin’s integration into the Ugandan economy has sparked a wave of digital transformation, offering a gateway to financial inclusion for many previously underserved individuals. With its decentralized nature, Bitcoin presents an opportunity to streamline cross-border transactions and reduce the high costs associated with traditional banking systems. Moreover, the use of Bitcoin as a medium of exchange has the potential to empower small businesses and drive innovation in various sectors, ultimately contributing to economic growth and stability.

The adoption of Bitcoin in Uganda has not been without challenges, as regulatory uncertainties and concerns over volatility persist. However, the increasing acceptance of Bitcoin by merchants and the growing number of cryptocurrency exchanges in the region signal a shifting landscape towards mainstream acceptance. As more Ugandans embrace the digital currency, the impact on the economy is expected to be profound, reshaping financial practices and paving the way for a more inclusive and efficient financial ecosystem.

Future Outlook and Predictions for Bitcoin in Uganda 🔮

In considering the future outlook and predictions for Bitcoin in Uganda, the evolving landscape suggests a growing acceptance and integration of digital currencies into everyday transactions. With increasing awareness and technological advancement, the potential for Bitcoin to streamline financial processes and provide greater financial inclusion for Ugandans is promising. However, regulatory clarity and infrastructure development will be crucial in ensuring a secure and stable environment for cryptocurrency adoption in the country. Looking ahead, the trajectory of Bitcoin in Uganda is poised for continued growth, paving the way for innovative financial solutions and greater economic empowerment for the population.