Current Bitcoin Aml Regulations in Ethiopia 🇪🇹

Ethiopia’s current approach to Bitcoin AML regulations reflects a growing awareness of the need for financial oversight in the digital currency space. The country has taken steps to address money laundering concerns by requiring cryptocurrency exchanges to register with regulatory authorities and implement robust AML measures. While these regulations aim to protect consumers and uphold financial integrity, there are challenges in effectively enforcing and monitoring compliance. The evolving landscape of Bitcoin AML regulations in Ethiopia underscores the importance of balancing innovation with regulatory safeguards as the country navigates the complexities of digital currency adoption.

Challenges of Implementing Aml Laws 🤔

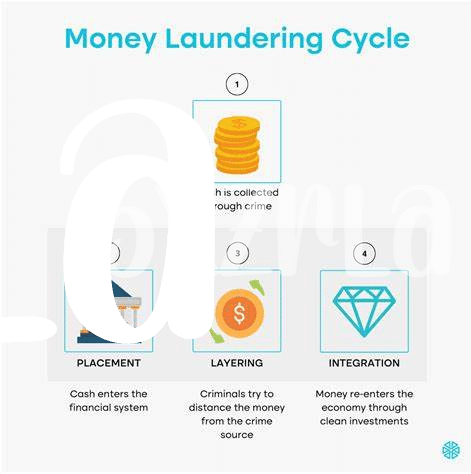

Challenges arise when implementing anti-money laundering (AML) laws, requiring careful navigation to ensure compliance. The complexity of the regulatory landscape, coupled with technological advancements outpacing legal frameworks, presents a significant hurdle. Understanding the intricacies of AML requirements and integrating them into Bitcoin operations can be daunting, especially when balancing innovation with regulatory obligations.

In an evolving digital environment, staying abreast of AML laws and ensuring adherence poses a continuous challenge. Leveraging innovative solutions and fostering collaboration between industry players and regulators is pivotal in addressing these obstacles and fostering a compliant ecosystem. Anticipating and proactively overcoming hurdles in AML implementation is crucial for the sustainable growth of Bitcoin and the broader cryptocurrency sector.

Impact of Aml Regulations on Bitcoin Adoption 💡

The implementation of AML regulations in Ethiopia has the potential to significantly influence the adoption of Bitcoin within the country. By creating a framework of guidelines and compliance measures, AML regulations can enhance trust and credibility in the Bitcoin ecosystem, attracting more users and investors. As individuals and businesses become more confident in the security and legitimacy of Bitcoin transactions, the adoption of this digital currency is likely to increase, paving the way for its mainstream acceptance in Ethiopia.

Stakeholder Perspectives on Regulatory Future 🌍

When considering the regulatory future of Bitcoin in Ethiopia, stakeholders express a mix of cautious optimism and skepticism. Some believe that stringent AML regulations could stifle innovation and adoption, placing undue burdens on businesses and individuals transacting with Bitcoin. On the other hand, there is a recognition that robust AML measures are necessary to prevent illicit activities and protect consumers. Stakeholders emphasize the importance of finding the right balance between regulation and innovation to ensure that Bitcoin can flourish in a safe and secure ecosystem.

For further insights on the impact of AML regulations on Bitcoin adoption, you can refer to a recent article on Wikicrypto News discussing the bitcoin anti-money laundering (AML) regulations in eswatini.

Emerging Trends in Global Aml Practices 📈

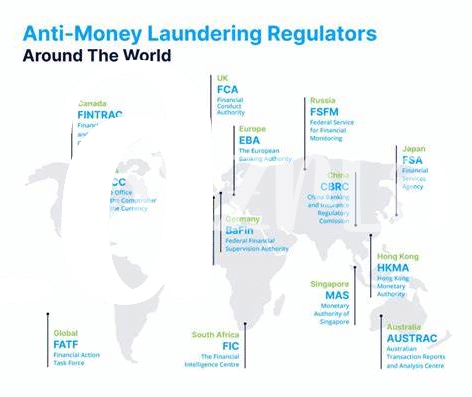

Fast-paced technological advancements and increasing digitalization are reshaping the landscape of global AML practices. Innovations like artificial intelligence and machine learning are revolutionizing the detection and prevention of money laundering activities. Moreover, collaborative efforts between regulatory bodies and financial institutions are enhancing information sharing and strengthening the fight against financial crimes. As AML regulations continue to evolve, the focus is shifting towards a more risk-based approach, where resources are allocated based on the level of threat posed by different entities. This shift is enabling more targeted and effective AML measures, ultimately leading to a more robust and efficient financial ecosystem.

Recommendations for the Future of Bitcoin Aml 🔮

In order to enhance the future landscape of Bitcoin AML, it is imperative to focus on streamlined regulatory frameworks that prioritize both compliance and innovation. Encouraging collaboration between regulatory bodies, industry stakeholders, and technology experts can lead to the development of robust AML solutions tailored to the unique challenges and opportunities presented by the digital currency space. Embracing emerging technologies such as blockchain analytics and artificial intelligence for enhanced transaction monitoring and risk assessment is essential in combating illicit activities while fostering legitimate use cases for Bitcoin. Additionally, fostering international cooperation and information sharing can strengthen the effectiveness of AML efforts on a global scale, promoting a more secure and transparent environment for digital asset transactions.

Insert the link to bitcoin anti-money laundering (aml) regulations in Denmark with anchor “Bitcoin Anti-Money Laundering (AML) Regulations in El Salvador” using the