Current State of Bitcoin Aml Regulations in Spain 🇪🇸

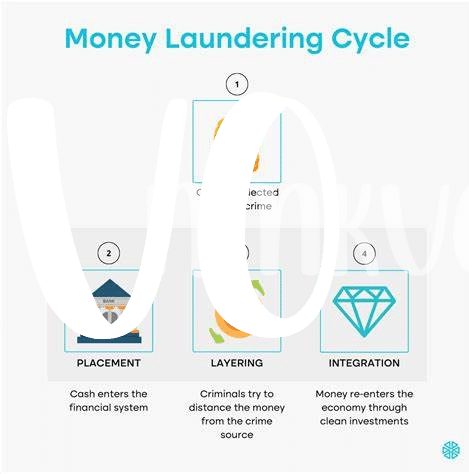

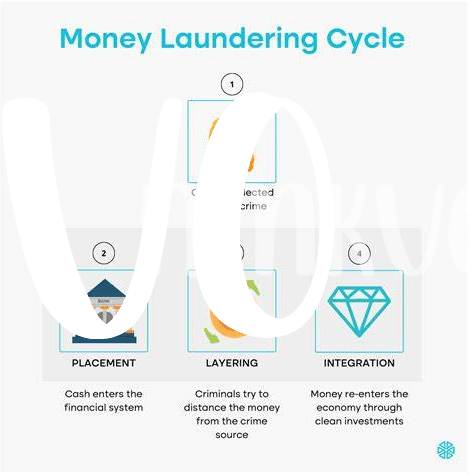

In recent years, Spain has been actively working to establish clear guidelines regarding Anti-Money Laundering (AML) compliance for Bitcoin transactions. The regulatory landscape surrounding Bitcoin AML in Spain has seen notable developments and updates to adapt to the evolving digital currency ecosystem. Various authorities have been focused on enhancing transparency and accountability within the cryptocurrency sector, aiming to mitigate potential risks associated with financial crimes.

As Spain continues to refine its approach to Bitcoin AML regulations, businesses and individuals engaging in cryptocurrency transactions must stay abreast of the current regulatory requirements. The implementation of effective AML measures is crucial in fostering a secure and compliant environment for Bitcoin transactions, aligning with Spain’s broader efforts to address AML challenges in the digital asset space.

Challenges and Gaps in Existing Compliance Measures 🕵️♂️

With the evolving landscape of Bitcoin AML compliance in Spain, the identification of challenges and gaps in existing compliance measures becomes paramount. The complex nature of digital currencies, coupled with the rapid pace of technological advancements, poses significant hurdles for regulatory frameworks to keep pace effectively. Inadequate resources, lack of uniformity in international standards, and the decentralized nature of cryptocurrencies contribute to potential vulnerabilities in AML compliance. Addressing these gaps will require a collaborative effort among industry stakeholders, policymakers, and regulatory bodies to enhance transparency, mitigate risks, and ensure the sustainable growth of the digital asset ecosystem.

Latest Developments and Trends in the Industry 📈

In recent months, the Bitcoin industry in Spain has witnessed a notable surge in adoption and investment. Market analysts point to a combination of factors driving this growth, including increasing institutional interest, regulatory clarity, and broader consumer awareness. One of the key trends shaping the industry is the emergence of advanced blockchain analytics tools that enhance AML compliance efforts. These tools enable businesses to conduct real-time monitoring of transactions, identify potential risks, and ensure adherence to regulatory requirements. Additionally, there is a growing emphasis on collaboration between industry players and regulatory authorities to establish standardized best practices and guidelines for AML compliance within the Bitcoin sector.

As the industry continues to evolve, experts predict a greater emphasis on transparency and accountability, with an emphasis on integrating AML compliance into the core operations of Bitcoin businesses. This shift towards a more proactive and technology-driven approach is expected to streamline compliance processes, enhance overall security measures, and improve trust among stakeholders. Moreover, ongoing developments in regulatory frameworks and cross-border cooperation are likely to shape the future landscape of AML compliance in Spain, with a focus on promoting innovation while safeguarding against financial crimes.

Impact on Businesses and Individuals Using Bitcoin 💼

The rise of Bitcoin has brought about significant implications for both businesses and individuals engaged in cryptocurrency transactions. With its decentralized nature and pseudonymous transactions, Bitcoin poses challenges for traditional anti-money laundering (AML) efforts, requiring organizations to adapt and enhance their compliance measures. Businesses utilizing Bitcoin must navigate regulatory requirements to ensure transparency and accountability. Individuals engaging in Bitcoin transactions face the need for increased due diligence to mitigate potential risks associated with illicit activities. As the landscape evolves, stakeholders must stay ahead of regulatory developments to uphold integrity in the cryptocurrency space. Learn more about bitcoin anti-money laundering (AML) regulations in South Korea here.

Strategies for Ensuring Effective Aml Compliance 🛡️

When it comes to ensuring effective AML compliance in the evolving landscape of Bitcoin regulations, businesses and individuals must stay proactive and adaptable. Implementing robust identity verification processes and transaction monitoring systems are essential steps towards compliance. Embracing cutting-edge technologies like blockchain analytics can help in detecting and preventing illicit activities within Bitcoin transactions. Moreover, fostering a culture of compliance within the organization through regular training and awareness programs is crucial for maintaining AML standards. Collaboration with regulatory authorities and industry peers can also provide valuable insights and best practices for enhancing AML compliance strategies in the dynamic realm of digital currencies.

Future Outlook and Potential Changes on the Horizon 🔮

In the rapidly evolving landscape of Bitcoin AML compliance in Spain, the future holds a myriad of potential changes on the horizon. With advancements in technology and shifting regulatory frameworks, businesses and individuals navigating the realm of Bitcoin transactions must stay vigilant and adaptable. The emergence of innovative tools and methodologies aimed at enhancing AML compliance is set to redefine the landscape and reshape practices within the industry. As Spain continues to refine its approach to AML regulations concerning Bitcoin, stakeholders can anticipate both challenges and opportunities as they navigate this ever-changing terrain. Stay tuned for the evolving strategies and frameworks that will shape the future of Bitcoin AML compliance in Spain.

Insert link to bitcoin anti-money laundering (aml) regulations in Somalia with anchor bitcoin anti-money laundering (aml) regulations in Slovakia: bitcoin anti-money laundering (aml) regulations in Slovakia .