Growing Trend of Aml Regulations in Cryptocurrency 📈

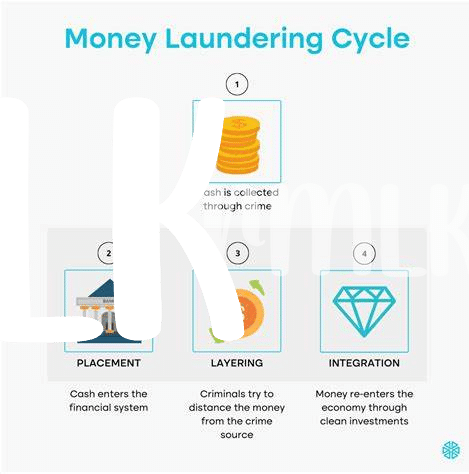

The growing trend of AML regulations in cryptocurrency reflects a shift towards enhancing transparency and accountability in the digital financial landscape. As virtual assets like Bitcoin gain mainstream acceptance, regulatory bodies are stepping up efforts to combat money laundering and illicit activities within the decentralized realm. This proactive approach aligns with the evolving nature of financial crime and underscores the importance of adapting regulatory frameworks to address emerging challenges and risks effectively.

Buoyed by technological advancements and cross-border collaboration, the enforcement of AML policies in the realm of cryptocurrency marks a pivotal moment in reshaping the future landscape of financial security. Leveraging innovative tools and strategies, regulators are pioneering new ways to monitor and track transactions in real-time, fostering a more secure and compliant ecosystem for digital asset transactions. As the regulatory landscape continues to evolve, the synergy between innovation and regulation will play a crucial role in supporting the sustainable growth and legitimacy of cryptocurrencies within the global economy.

Implications of Bitcoin Use in North Korea 💰

As Bitcoin gains popularity in North Korea, its use presents both opportunities and challenges. The decentralized nature of cryptocurrencies offers a way for individuals to bypass traditional financial systems, potentially enabling illicit activities in a country known for its secretive regime. On one hand, Bitcoin could provide a means for North Korean citizens to access global markets and financial services that are otherwise restricted. However, the anonymity and lack of oversight associated with cryptocurrencies could also facilitate money laundering and circumvention of international sanctions, raising concerns for regulatory authorities and international organizations.

Challenges in Implementing Aml Policies in Secretive Regimes 🕵️♂️

Navigating the intricate web of financial regulations in secretive regimes presents a unique set of challenges. The lack of transparency and restricted access to information make enforcing Anti-Money Laundering (AML) policies particularly arduous. In countries like North Korea, where governmental control is tightly woven into everyday life, monitoring illicit financial activities becomes a delicate balance between uncovering hidden transactions and respecting the boundaries imposed by the regime. Staying ahead of evolving evasion tactics requires innovative solutions that can adapt to the clandestine nature of financial operations in these environments.

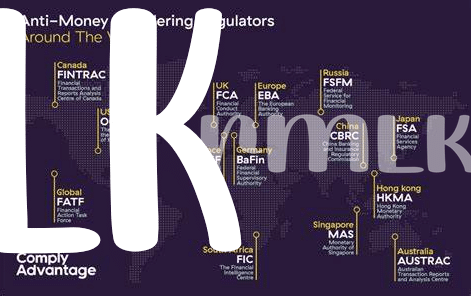

International Efforts to Combat Illicit Bitcoin Activities 🌎

International efforts to combat illicit Bitcoin activities are gaining momentum as governments and regulatory bodies collaborate to address the challenges posed by digital currencies. Various initiatives, such as information sharing and regulatory frameworks, are being developed to track and prevent illegal activities in the Bitcoin space. These efforts aim to enhance transparency and accountability within the cryptocurrency ecosystem, ensuring a safer environment for users and investors. By working together on a global scale, countries can strengthen their enforcement measures and stay ahead of illicit actors who seek to exploit the decentralized nature of Bitcoin transactions.

To learn more about how countries are implementing enforcement measures to ensure compliance with Bitcoin AML regulations, you can visit the insightful resource on bitcoin anti-money laundering (AML) regulations in Oman by clicking here.

The Role of Technology in Enhancing Aml Monitoring 🖥️

Technology plays a crucial role in enhancing Anti-Money Laundering (AML) monitoring practices, providing advanced tools for detecting suspicious activities and ensuring compliance with regulations. With the use of innovative solutions like blockchain analysis and artificial intelligence, financial institutions and regulatory bodies can strengthen their ability to track and analyze transactions in real-time, effectively combating money laundering and illicit activities within the cryptocurrency space. These technological advancements not only streamline the monitoring process but also contribute to a more secure and transparent financial ecosystem, fostering trust and confidence in the rapidly evolving world of digital assets.

Future Outlook: Balancing Innovation and Regulation ⚖️

In navigating the evolving landscape of Bitcoin AML policies, it is imperative to strike a delicate balance between fostering innovation within the cryptocurrency realm and upholding robust regulatory measures. Embracing advancements in technology to bolster AML monitoring capabilities can offer a promising pathway forward, enhancing the detection and prevention of illicit activities while preserving the essence of decentralization that underpins cryptocurrencies’ appeal. By fostering collaborative efforts between industry stakeholders, regulatory bodies, and technology innovators, a harmonious coexistence of innovation and regulation can be sustained, paving the way for a more secure and transparent cryptocurrency ecosystem.

For further insights on Bitcoin anti-money laundering (AML) regulations in Norway, you can explore the detailed regulations outlined in this informative resource on [bitcoin anti-money laundering (AML) regulations in North Macedonia]().