🌍 Bitcoin’s Beginnings: a Quick Global Recap

Imagine a world where digital gold does the magic, popping up mysteriously in 2009. This wasn’t your regular coin or paper money; it was Bitcoin. A brainchild of a person (or perhaps a group) known only by the pseudonym Satoshi Nakamoto. It’s like finding a treasure chest in the digital world, but instead of gold, it’s made of complex codes. Initially, Bitcoin whispered in the corners of the internet, a secret among tech enthusiasts and digital pioneers. It was the cool new thing you could own, like a rare digital collectible.

| Year | Event |

|---|---|

| 2009 | Bitcoin’s Birth |

| 2010 | First Real-world Transaction |

| 2012 | Gaining Momentum |

| 2014 | First Regulations Appear |

Slowly, whispers turned into conversations, conversations into debates, and before we knew it, Bitcoin stopped being just a tech geek’s hobby. It became a topic of interest for anyone sniffing around for the future of money – decentralized, without borders, and fascinatingly anonymous. People didn’t need to rely on banks or governments to make transactions. It was revolutionary, a freedom of sorts, but not without its skeptics nervous about what it meant for the traditional strings of finance and law.

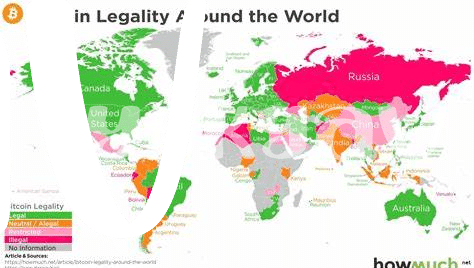

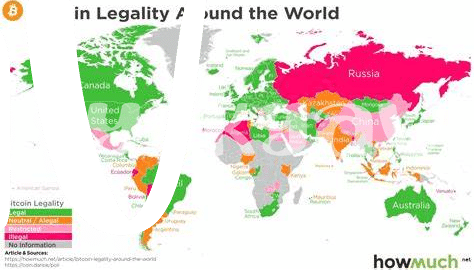

📈 the Surge of Centralized Regulation Efforts

As Bitcoin carved its path from a digital novelty to a household name, governments worldwide began racing to catch up with the pace of innovation. The increase in Bitcoin’s popularity and its entrance into mainstream financial markets has sparked significant attention from regulators. Their primary goal? To weave a safety net for investors, ensuring the digital currency’s wild ride has a layer of protection against potential pitfalls. This shift towards centralized regulation has stirred quite a debate, with many wondering how to maintain the currency’s original ethos of freedom and anonymity while keeping the market safe and reliable. Amidst this backdrop, countries have started to draft, propose, and enact a patchwork of regulations aimed at making the crypto space more transparent, accountable, and, ultimately, more secure for those who venture into it. To explore more about how Bitcoin’s journey is reshaping more than just financial systems, delve into the insights offered here: https://wikicrypto.news/decoding-the-myths-is-bitcoin-really-a-bubble.

🛡️ Protecting Investors: the Main Focus?

In the world of Bitcoin, with its twists and turns, keeping those who invest their hard-earned money safe has become a big talking point. It’s like having a safety net while walking a tightrope; you know it’s there to catch you if you slip. This idea has nudged governments around the globe into action, making sure that while the digital gold rush continues, no one is left unprotected. Imagine you’re in a vast, bustling market, but there are rules and guides to help you navigate safely. That’s what these regulations are trying to be – the helpful signs and friendly advisors ensuring you don’t fall victim to a bad deal. It’s not just about putting guardrails in place, though. There’s also a delicate dance to ensure that these protective measures do not stifle the innovation and freedom that make Bitcoin so unique. It’s a bit like trying to fly a kite – you need just the right amount of string. Too little, and your kite won’t soar; too much, and you could lose control. The goal is keeping that perfect balance, ensuring the sky is filled with the vibrant colors of kites flying safely and freely.

🌐 the Ripple Effect on Global Economies

When we zoom out to look at the big picture, we see how changes in Bitcoin regulation are making waves across global markets. It’s like throwing a stone into a pond – the ripples spread far and wide. Countries that once stood back are now leaning in, trying to figure out how to integrate Bitcoin into their financial systems without causing upheaval. This shift is not just about avoiding economic bumps; it’s about harnessing the power of digital currencies to fuel growth. For instance, remittances—an essential source of income for many families in developing countries—have become cheaper and faster, thanks to blockchain technology. By reducing the cost and increasing the speed of these transactions, Bitcoin is indirectly lifting economies and offering a beacon of hope for improved financial inclusion.

On the other side of the coin, we must consider how these changes are influencing the global competition for technological leadership. Nations are racing to craft regulations that attract cryptocurrency businesses, pushing forward into a future where bitcoin in popular culture in 2024 shapes not only how we think about money but also how we interact with it on an international scale. This chase is not just about staying relevant; it’s about setting the stage for the next wave of financial innovation, where digital assets could play a leading role in powering the economy, creating jobs, and fostering a new era of global financial connectivity.

🔒 Balancing Privacy with Regulation Necessities

In the world of Bitcoin, keeping everyone’s information safe while making sure rules are fair is like walking a tightrope. Imagine a place where everyone’s money secrets are safe, but where there are also rules to make sure no one is up to no good. That’s the dream, but getting there isn’t simple. Governments all over the globe are scratching their heads, trying to figure out how to do this. They want to prevent bad guys from causing trouble without peeking too much into what you or I are doing with our Bitcoin wallets. It’s a bit like putting a puzzle together where all the pieces need to fit just right.

This balancing act has big impacts, prompting a shift in how money moves around the world and how we think about our digital privacy. Here’s the tricky part: how do we make rules that help keep everyone’s money safe without giving away all our secrets? It’s a challenge that keeps smart people up at night, working hard to find solutions that work for everyone. As we move forward, it’s all about finding that sweet spot where safety and privacy meet. Check out the table below to see some key aspects of this balancing act:

| Aspect | Privacy Concerns | Regulatory Goals |

|---|---|---|

| Transaction Monitoring | 🔍 Limits on who can see what we’re doing with our money | 🛠️ Spotting and stopping bad actors in their tracks |

| Identity Verification | 🎭 Keeping our real-world identities safe from prying eyes | 🔏 Making sure people are who they say they are |

| Data Sharing | 📂 Deciding what information gets shared and with whom | ✅ Ensuring that shared data helps to prevent fraud |

Finding the balance between privacy and regulation is not only pivotal for securing trust but also for paving the way towards a more stable and inclusive financial future for all.

🚀 Future Predictions: Where We’re Headed

Looking into the crystal ball of Bitcoin’s future, we see a world where digital coins play a significant role in our daily transactions, akin to the role traditional money plays today. As nations grapple with the twin goals of fostering innovation and ensuring stability, we might expect a harmonized approach to regulation. This doesn’t mean a one-size-fits-all solution, but rather, a global understanding and respect for common standards that protect users while encouraging growth. This approach could pave the way for a seamless integration of Bitcoin into mainstream finance, simplifying transactions and making them more accessible to everyone, everywhere.

In this evolving landscape, education will be key. As more people understand what Bitcoin is and how it works, myths will dissipate. A crucial step toward debunking these myths is understanding the role of bitcoin forks and their impact in 2024. This knowledge will equip investors, regulators, and enthusiasts with the tools to navigate Bitcoin’s future confidently. By striking a balance between innovation and consumer protection, the future of Bitcoin looks bright, promising an era of unparalleled opportunities for global economic participation.