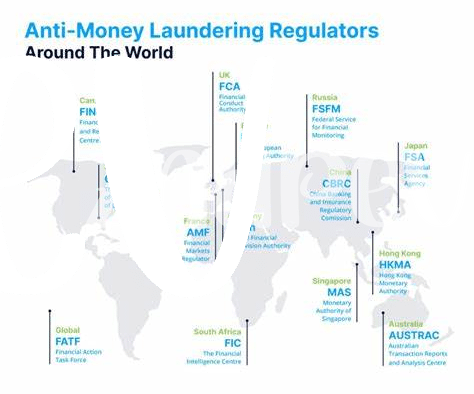

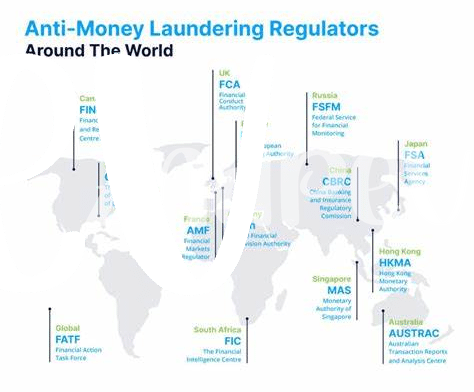

Introduction of Aml Regulations in Kazakhstan 🌱

The introduction of AML regulations in Kazakhstan marks a significant step towards enhancing transparency and security in financial transactions within the country. These regulations aim to combat money laundering and terrorist financing activities, setting guidelines for businesses and individuals to follow in their dealings. With the evolving landscape of digital assets like Bitcoin, the integration of AML regulations seeks to provide a framework that balances innovation and compliance. As Kazakhstan adapts to the changing global financial environment, the introduction of AML regulations reflects a commitment to fostering a trustworthy and sustainable financial ecosystem.

Impact of Aml Regulations on Bitcoin Transactions 💸

The introduction of AML regulations in Kazakhstan has brought significant changes to the landscape of Bitcoin transactions in the country. These regulations aim to enhance transparency and accountability in financial activities involving cryptocurrencies. As a result, Bitcoin users and businesses operating in Kazakhstan are now required to comply with strict AML procedures, including identity verification and transaction monitoring. The impact of these regulations on Bitcoin transactions is evident, with increased scrutiny and reporting requirements placing additional burdens on cryptocurrency exchanges. Despite challenges faced by the industry, the government has implemented measures to ensure compliance and mitigate risks associated with money laundering and illicit activities. Looking ahead, the future outlook for AML regulations in Kazakhstan remains dynamic, with ongoing developments shaping the regulatory environment for Bitcoin transactions. Navigating these requirements effectively will be crucial for individuals and businesses seeking to participate in the cryptocurrency market in Kazakhstan.

Challenges Faced by Cryptocurrency Exchanges 🛑

Cryptocurrency exchanges in Kazakhstan are grappling with a myriad of challenges, ranging from regulatory uncertainties to operational hurdles. The lack of clear guidelines on AML regulations has left many exchanges in a state of ambiguity, unsure of how to navigate the evolving landscape. Additionally, the constant vigilance required to ensure compliance with stringent AML requirements poses a significant burden on these platforms, often leading to increased operational costs and resource allocation.

Moreover, the dynamic nature of the cryptocurrency market further complicates matters for exchanges, as they must adapt swiftly to changing regulations and technological advancements. This fast-paced environment not only demands robust compliance mechanisms but also necessitates proactive measures to mitigate potential risks and safeguard against illicit activities. As exchanges strive to strike a balance between regulatory adherence and operational efficiency, they face an uphill battle in navigating the complex terrain of AML regulations in Kazakhstan.

Measures Taken by the Government for Compliance 📝

The government of Kazakhstan has been proactive in implementing regulations to ensure compliance within the cryptocurrency sector. Through collaboration with financial institutions and regulatory bodies, specific measures have been put in place to monitor and regulate Bitcoin transactions effectively. These measures focus on enhancing transparency, preventing illicit activities, and safeguarding the interests of investors and the overall financial system. By emphasizing compliance with anti-money laundering (AML) regulations, the government aims to create a framework that fosters trust and legitimacy in the use of Bitcoin within the country’s financial landscape.

For more insights into the evolving landscape of Bitcoin AML regulations, you can explore the comprehensive guide on bitcoin anti-money laundering (AML) regulations in Israel available at this link: bitcoin anti-money laundering (AML) regulations in Israel.

Future Outlook for Aml Regulations in Kazakhstan 🔮

The ongoing evolution of AML regulations in Kazakhstan reflects the country’s commitment to staying abreast of the dynamic cryptocurrency landscape. As regulations continue to adapt to technological advancements, there is a growing emphasis on enhancing oversight and increasing transparency in digital asset transactions. Stakeholders in the crypto space are closely monitoring these developments, recognizing both the challenges and opportunities they present for compliance. With a forward-looking approach, Kazakhstan aims to strike a balance between fostering innovation in the crypto sector and ensuring robust AML safeguards to protect against illicit activities. As the regulatory framework evolves, stakeholders can expect a continued focus on collaboration between industry players and authorities to shape a progressive AML landscape in Kazakhstan.

Recommendations for Navigating Aml Requirements in the Country 🚀

Navigating Anti-Money Laundering (AML) requirements in Kazakhstan can be a complex task for individuals and businesses involved in Bitcoin transactions. To ensure compliance with regulations, it is essential to stay updated on the evolving AML laws in the country. Engaging with regulatory authorities and seeking legal counsel can provide valuable insights into the specific AML requirements that need to be met. Additionally, implementing robust internal controls and conducting regular audits can help mitigate the risks associated with non-compliance. Collaborating with local compliance experts and leveraging technological solutions tailored to AML compliance can also streamline the process of adhering to regulatory standards in Kazakhstan.

For more information on Bitcoin AML regulations in other jurisdictions, such as Jamaica, you can refer to the Bitcoin Anti-Money Laundering (AML) regulations in Jamaica here: bitcoin anti-money laundering (aml) regulations in Jordan.