Understanding Tax Guidelines in Singapore 📝

Tax guidelines in Singapore provide clarity for crypto investors on their tax obligations. Understanding these guidelines is essential to ensure compliance with regulatory requirements. By familiarizing themselves with the tax framework, investors can navigate the complexities of reporting their crypto activities with confidence. This knowledge empowers investors to make informed decisions and proactively manage their tax responsibilities in the crypto space. Partnering with tax professionals can also offer valuable insights and guidance tailored to individual circumstances.

Reporting Obligations for Crypto Investments 💰

Understanding Tax Guidelines in Singapore 📝

When it comes to crypto investments in Singapore, investors need to be aware of their reporting obligations to stay compliant with tax regulations. The Monetary Authority of Singapore (MAS) requires all individuals and entities involved in crypto investments to accurately report their transactions and holdings. This includes disclosing details of acquisitions, disposals, and any income generated from these investments. By fulfilling these reporting obligations promptly and accurately, crypto investors can ensure transparency and accountability in their financial activities, ultimately contributing to the overall integrity of the tax system.

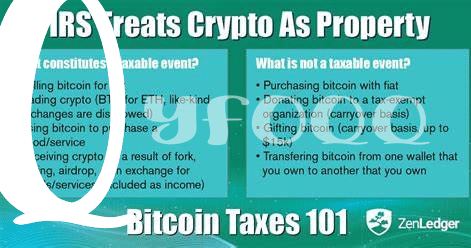

Types of Taxable Events in Crypto Transactions 💸

Understanding the different taxable events that can occur during cryptocurrency transactions is crucial for investors in Singapore. Each time a crypto asset is sold, exchanged for another asset, or used to make a purchase, it may result in a taxable event. These events trigger a reporting requirement to the tax authorities. Additionally, receiving crypto as payment for goods or services, mining activities, and receiving staking rewards are also considered taxable events. It is important for investors to be aware of these various scenarios and the implications they have for their tax obligations. By understanding the types of taxable events in crypto transactions, investors can ensure they meet their reporting obligations and stay compliant with Singapore’s tax regulations.

Record-keeping Requirements for Accurate Reporting 📚

In the realm of cryptocurrency investments, maintaining accurate records is a pivotal aspect for ensuring compliance with tax regulations. By diligently recording details of transactions, including dates, amounts, and parties involved, crypto investors can streamline the reporting process and minimize the risk of errors. Encapsulating the essence of each transaction in a systematic manner not only aids in fulfilling tax obligations but also provides a comprehensive overview of financial activities for future references and audits.

Fostering a habit of meticulous record-keeping empowers investors to navigate the complexities of tax reporting with confidence and precision. Additionally, organized documentation facilitates the identification of gains, losses, and taxable events, thereby supporting informed decision-making and strategic tax planning. Upholding stringent record-keeping practices not only promotes compliance but also cultivates a culture of transparency and accountability in the dynamic landscape of cryptocurrency investments. Remember, every detail matters when it comes to accurate reporting.

Tax implications of bitcoin trading in Seychelles

Tax Planning Strategies for Crypto Investors 📈

When engaging in tax planning for your crypto investments in Singapore, it’s essential to consider the various strategies that can help you optimize your tax liabilities. Cryptocurrency holdings can be subject to different tax rates based on the duration of ownership, so one key strategy is to plan your transactions strategically to minimize tax burdens. Additionally, staying updated on any changes in tax regulations and seeking professional advice can also be beneficial in structuring your investments efficiently. Remember, proper tax planning can save you both time and money in the long run. 💡

Consequences of Non-compliance with Tax Regulations ⚠️

Non-compliance with tax regulations can have serious repercussions for crypto investors in Singapore. Failure to adhere to reporting obligations and accurately record transactions can result in penalties, fines, and potentially even legal action. The Singaporean authorities are increasingly scrutinizing cryptocurrency activities to ensure compliance with tax laws. It is crucial for investors to stay informed, maintain proper records, and fulfill their tax obligations to avoid facing the consequences of non-compliance. Staying proactive and seeking professional guidance can help mitigate the risks associated with improper tax reporting practices.

Tax implications of bitcoin trading in Sierra Leone