Tax Obligations for Bitcoin Transactions 💰

When engaging in Bitcoin transactions, it is essential to be aware of the associated tax obligations to ensure compliance with Irish government guidelines. Understanding how your Bitcoin activities may be subject to taxation is crucial in managing your financial responsibilities. By staying informed about the tax implications of your transactions, you can navigate the regulatory landscape more effectively and avoid potential penalties. Being proactive in meeting your tax obligations will contribute to a smoother financial journey in the realm of cryptocurrencies.

Understanding Capital Gains and Losses 💸

Capital gains and losses are a key aspect to consider when dealing with Bitcoin transactions. Essentially, capital gains occur when you sell your Bitcoin for a price higher than what you paid, resulting in a profit. On the other hand, capital losses happen if you sell your Bitcoin for less than your initial investment. Understanding how to calculate and report these gains and losses is essential for accurate tax filing. It’s crucial to keep detailed records of your transactions and seek guidance from tax professionals to ensure compliance with Irish government guidelines. By staying informed and proactive, you can navigate the tax implications of Bitcoin transactions effectively.

Calculating the Taxable Value of Bitcoin 📊

When it comes to calculating the taxable value of Bitcoin for tax purposes, it’s essential to consider the market price at the time of the transaction. The Irish Revenue typically values Bitcoin transactions in euros based on the exchange rate at the time of the transaction. This value is then used to determine any potential capital gains or losses that may need to be reported. Keeping accurate records of your Bitcoin transactions and their respective values is crucial for ensuring compliance with tax regulations and accurately reporting your taxable income.

Reporting Requirements to the Irish Revenue 💼

When it comes to fulfilling your reporting requirements to the Irish Revenue, it’s crucial to ensure compliance with the guidelines set forth by the authorities. Submitting accurate and timely reports about your Bitcoin transactions is essential to avoid any potential issues with taxation. By staying informed and adhering to the reporting obligations, you can demonstrate transparency and a commitment to meeting your tax responsibilities. Remember, seeking professional advice for any uncertainties or complex situations can provide you with the necessary support to navigate through the process smoothly. Stay informed and compliant to ensure a hassle-free tax season.

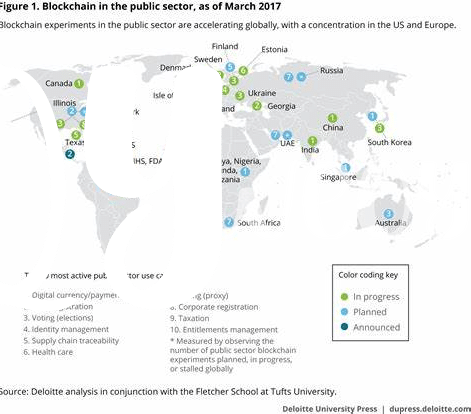

Government initiatives on bitcoin and blockchain in Indonesia

Potential Tax Risks and Compliance Tips ⚖️

In the world of Bitcoin transactions, there are some potential tax risks that individuals need to be aware of. One of the key risks is non-compliance with reporting requirements, which can lead to penalties or audits from the Irish Revenue. To stay on the right side of the law, it’s essential to keep meticulous records of all your Bitcoin transactions and ensure that you accurately calculate and report your taxable income. Seeking professional advice from a tax expert can help navigate these complexities and ensure compliance with Irish tax laws.

Seeking Professional Advice for Tax Matters 🧑💼

Seeking professional advice for tax matters is crucial when dealing with Bitcoin transactions. Tax laws can be complex, especially in the digital currency space, and having a knowledgeable tax professional on your side can help navigate potential pitfalls and ensure compliance with regulations. Consulting with a tax expert can provide valuable insights into tax implications specific to your situation and help minimize any risks associated with incorrect reporting or misinterpretation of tax guidelines.

For government initiatives on Bitcoin and blockchain, it’s worth exploring the strides made by countries such as Iceland and Honduras in embracing and regulating this emerging technology.