Understanding Tax Deductions for Bitcoin Investments 🧾

When it comes to understanding tax deductions for Bitcoin investments, it’s essential to grasp the nuances of how this digital asset is treated by tax authorities. Bitcoin investments can offer tax benefits, but navigating the complexities requires a clear understanding of the rules and regulations in place. Factors such as holding periods, capital gains, and allowable deductions play a crucial role in determining the tax implications of your Bitcoin transactions. By staying informed and seeking guidance when needed, investors can maximize their tax savings while staying compliant with the law.

Criteria for Qualifying for Tax Deductions 💼

When it comes to qualifying for tax deductions for your Bitcoin investments, certain criteria must be met to ensure eligibility. These criteria typically involve the duration for which you have held your Bitcoin assets, the purpose of your investments, and compliance with relevant tax regulations. By keeping detailed records of your transactions and holdings, you can substantiate your claims for deductions effectively. Additionally, understanding the optimal timing for selling your Bitcoin can maximize the deductions you can claim. Exploring potential additional tax benefits specific to Bitcoin investors can further enhance your overall tax strategy. Consulting with a tax professional knowledgeable in cryptocurrency taxation can provide valuable guidance tailored to your individual circumstances.

Keeping Records of Your Bitcoin Transactions 📊

Ensuring you maintain detailed records of all your Bitcoin transactions is crucial for proper tax reporting. By diligently documenting each buy, sell, or exchange, you not only demonstrate transparency but also pave the way for potential deductions. Your records should include dates, amounts, transaction fees, and the purpose of each transaction. Using digital wallets or specialized software can streamline this process. Additionally, keeping track of the fair market value of your Bitcoin at the time of each transaction is essential for accurate tax calculations. Remember, organized record-keeping not only simplifies your tax filing but also provides a clear overview of your investment journey.

Timing Your Bitcoin Sales for Maximum Deductions ⏰

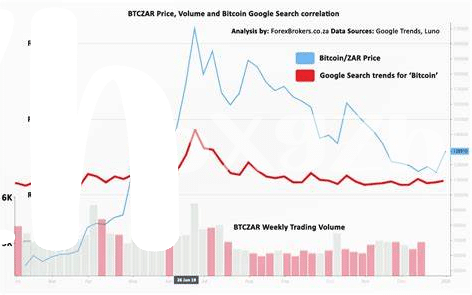

When it comes to maximizing your tax deductions from Bitcoin sales, timing is crucial. The key is to strategically plan when to sell your Bitcoin to take advantage of any potential tax benefits. By understanding the tax implications of different sale times and rates, you can optimize your deductions and potentially reduce your overall tax liability. It’s essential to stay informed about market trends, tax regulations, and any potential changes that could impact the timing of your Bitcoin sales. By staying proactive and knowledgeable, you can position yourself to achieve maximum deductions while complying with tax laws.

For more insights on tax implications related to Bitcoin investments, you can refer to the tax implications of bitcoin trading in Syria. Explore the detailed checklist to ensure compliance and maximize your tax benefits as a Bitcoin investor.

Exploring Additional Tax Benefits for Bitcoin Investors 💰

Are you curious about ways to further maximize your tax benefits as a Bitcoin investor? Discover potential strategies that can help you legally optimize your tax situation while engaging in cryptocurrency investments. By unlocking additional tax benefits tailored for Bitcoin investors, you may uncover opportunities to enhance your financial position and minimize tax liabilities. Explore various avenues that could potentially save you money and increase your overall investment returns in the dynamic world of cryptocurrency.

Consulting with a Tax Professional for Guidance 🤝

Consulting with a tax professional can be a valuable step in navigating the complexities of tax deductions for Bitcoin investments. A tax professional can provide tailored advice based on your individual circumstances, ensuring you maximize available deductions while remaining compliant with tax regulations. Their expertise can help you accurately assess your eligibility for deductions, strategize the timing of Bitcoin sales, and explore additional benefits you may not be aware of. Moreover, seeking guidance from a tax professional can offer peace of mind and reassurance that you are approaching your tax obligations in the most efficient and effective manner possible. For further insights on tax implications of Bitcoin trading, check out the details on tax implications of Bitcoin trading in Slovenia.