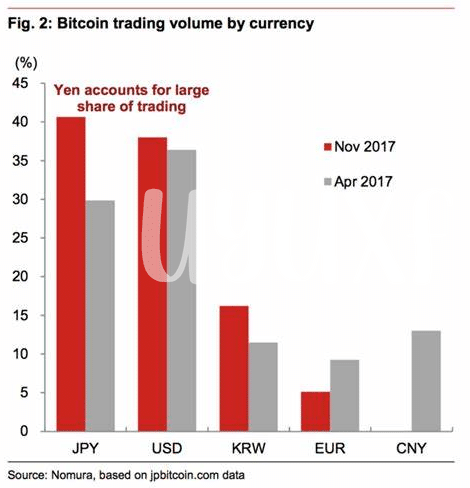

🌟 Understanding Tax Deductions for Bitcoin Traders in Japan

Bitcoin traders in Japan are eligible for various tax deductions, presenting both opportunities and challenges. Understanding the intricacies of tax deductions in this context involves navigating a complex regulatory landscape. By delving into the specifics of permissible deductions and exclusions, traders can optimize their tax liabilities. It’s crucial for traders to grasp the nuances of tax laws to leverage deductions effectively, enhancing their financial outcomes while staying compliant with regulations.

💰 Allowable Expenses That Can Be Claimed

When it comes to trading Bitcoin in Japan, there are various allowable expenses that traders can claim to maximize their tax benefits. These expenses can include costs related to trading platforms, transaction fees, software subscriptions, hardware wallets, and other necessary tools for efficient trading. By keeping track of these expenses and ensuring they are accurately documented, Bitcoin traders can potentially reduce their tax liability and optimize their overall financial strategy. It is important for traders to consult with a tax professional to fully understand the deductions available to them and to ensure compliance with tax regulations.

📝 Keeping Accurate Records for Tax Purposes

Maintaining meticulous records of cryptocurrency transactions is essential for ensuring accurate tax reporting. By recording details such as the date of each trade, the amount of Bitcoin involved, the corresponding market value at the time of the transaction, and any fees incurred, traders can provide a clear overview of their trading activities. Organizing these records systematically not only simplifies the process of calculating gains or losses but also demonstrates transparency and compliance to tax authorities. Utilizing digital tools or specialized software can streamline this record-keeping process and help traders stay organized throughout the tax year.

🌍 International Implications and Considerations

In the realm of cryptocurrency trading, understanding the international implications and considerations is crucial for navigating tax obligations across borders. As a Bitcoin trader in Japan, being aware of how different countries view and regulate cryptocurrencies can impact your tax liabilities. It’s essential to stay informed about the evolving global landscape of cryptocurrency taxation to ensure compliance and make well-informed decisions. For example, the tax implications of bitcoin trading in Ireland can provide valuable insights into how other jurisdictions approach taxing cryptocurrency transactions. By staying abreast of international developments, you can strategically plan your trading activities and optimize your tax position effectively. Learn more about tax rates for cryptocurrency businesses operating in Iraq [tax implications of bitcoin trading in Ireland](https://wikicrypto.news/tax-rates-for-cryptocurrency-businesses-operating-in-iraq).

🧾 Consultation with a Tax Professional Recommendation

Consultation with a tax professional can provide valuable insights into navigating the complex world of tax deductions and allowable expenses for Bitcoin traders in Japan. By seeking expert advice, traders can ensure they are maximizing their tax benefits and minimizing potential liabilities. Tax professionals can offer personalized guidance tailored to individual trading activities and financial situations, helping traders make informed decisions that align with current tax regulations and requirements. Their expertise can also be instrumental in identifying overlooked deductions or expenses that could significantly impact overall tax obligations.

📊 Maximizing Tax Benefits While Trading Cryptocurrencies

When navigating the world of tax obligations as a Bitcoin trader, there is a valuable opportunity to strategically optimize your tax benefits through astute planning. By keeping a keen eye on tax regulations and staying informed about potential deductions and allowances, traders can maximize their tax benefits. Additionally, actively seeking out ways to structure trades and transactions in a tax-efficient manner can significantly impact one’s overall tax liability. Engaging with tax professionals who specialize in cryptocurrency taxation can provide valuable insights and personalized strategies to enhance tax efficiency. Ultimately, by proactively considering and implementing tax-saving techniques, traders can effectively maximize their tax benefits and retain more of their hard-earned profits.

Insert the link to tax implications of bitcoin trading in Indonesia with anchor “tax implications of bitcoin trading in Iraq” tax implications of bitcoin trading in Iraq.