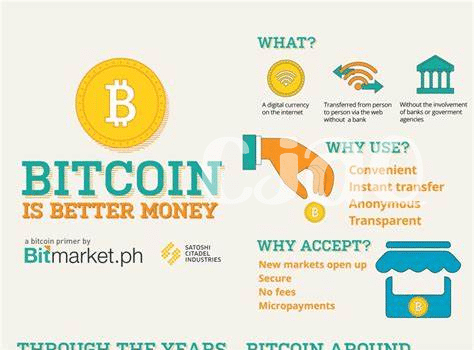

Understand the Tax Rules 📚

Bitcoin traders in the Philippines need to grasp the ins and outs of tax rules to navigate the complexities of filing their returns appropriately. Understanding these regulations is crucial for ensuring compliance with the law and avoiding any potential penalties. By familiarizing themselves with the tax requirements specific to cryptocurrency transactions, traders can effectively manage their tax obligations and plan their financial activities accordingly. This knowledge empowers them to make informed decisions that align with the legal framework surrounding their trading activities.

Keep Detailed Records 📝

Keeping track of your Bitcoin transactions is crucial for tax compliance. Detailed records provide a clear trail of your trading activities, essential for accurately reporting your income. Every buy, sell, and exchange should be documented with dates, amounts, and corresponding values. This level of detail not only ensures compliance with regulations but also simplifies the process in case of audits. With organized records, you can confidently navigate the complexities of tax reporting for your Bitcoin trades.

Consult a Tax Professional 🧑💼

Consulting a tax professional can make navigating the complexities of Bitcoin trading and tax compliance much smoother. These experts have the knowledge and experience to help you understand your obligations, optimize your tax position, and ensure compliance with the relevant laws. By working with a tax professional, you can feel more confident in your reporting and have peace of mind knowing that you are fulfilling your duties accurately. It’s like having a trusted guide by your side in a potentially unfamiliar terrain, guiding you towards the best outcomes for your tax situation.

Stay Updated on Regulations 📰

Staying updated on regulations in the Philippines is crucial for Bitcoin traders to navigate the ever-evolving tax landscape. Being aware of any changes or updates can help traders make informed decisions and ensure compliance with the law. It’s essential to regularly check for any new guidelines or amendments that may impact your tax obligations.

For more insights on the tax implications of Bitcoin trading, especially regarding ICOs and token sales in Portugal, check out this informative article on tax implications of bitcoin trading in Portugal. Keeping abreast of regulations not only helps you avoid any potential penalties but also positions you to adapt proactively to any shifts in the taxation framework.

Prepare for Audits 📊

When it comes to preparing for audits, meticulous record-keeping is key. Organize your transaction history and supporting documents in a systematic manner to easily demonstrate your compliance with tax regulations. This proactive approach not only saves you time and stress during an audit but also showcases your commitment to transparency and adherence to reporting requirements. By regularly reviewing and updating your records, you can confidently navigate any potential audit with ease and accuracy, ensuring a smooth process and minimizing any potential tax liabilities or penalties.

Report Income Accurately 💸

When it comes to reporting income accurately as a Bitcoin trader, attention to detail is key. Keep track of all your trades and transactions to ensure that you are accurately reporting your income to the tax authorities. Be diligent in categorizing your gains and losses, and make sure to include all necessary documentation when filing your taxes. By being meticulous in your record-keeping and transparent in your reporting, you can demonstrate compliance with tax regulations and avoid potential penalties.

For more information on the tax implications of Bitcoin trading in Papua New Guinea, you can refer to the tax implications of bitcoin trading in Papua New Guinea. Understanding the specific guidelines and regulations in your country is essential for maintaining tax compliance and ensuring that you fulfill your obligations as a trader. Stay informed and seek professional advice to navigate the complexities of reporting Bitcoin income accurately.