Regulations 📜

Navigating the regulatory landscape surrounding Bitcoin transfers in Sweden requires a keen understanding of the current laws and policies in place. Regulations ensure a secure environment for cryptocurrency transactions, outlining the dos and don’ts that businesses and individuals must adhere to. By staying abreast of the regulatory framework, one can conduct Bitcoin transfers confidently and in compliance with Swedish laws. It’s crucial to familiarize oneself with the specific rules governing digital currency exchanges, wallet providers, and other relevant entities to mitigate the risk of non-compliance. A proactive approach to understanding and following these regulations is key to operating within the legal boundaries set forth by the Swedish authorities.

Reporting Requirements 📊

When it comes to ensuring compliance with Bitcoin transfers in Sweden, keeping up with reporting requirements is crucial. Swedish regulations mandate accurate and timely reporting of all cryptocurrency transactions, highlighting the necessity of transparency in this evolving landscape. By adhering to these reporting guidelines, businesses and individuals can enhance trust and credibility within the market. Institutions must stay vigilant in tracking and documenting their Bitcoin transfers to meet the country’s regulatory standards. Consistent and thorough reporting not only fosters accountability but also aids in identifying and mitigating potential risks associated with cryptocurrency transactions. By integrating comprehensive reporting practices into their operations, stakeholders in Sweden can navigate the complexities of Bitcoin transfers with confidence and integrity. Stay informed, stay compliant, and stay ahead of the curve in the dynamic realm of cryptocurrency compliance. 📈📊🔍

Best Practices 💡

Amid the evolving landscape of Bitcoin transfers in Sweden, incorporating best practices is paramount to ensure compliance and security. Implementing robust customer verification processes, including Know Your Customer (KYC) procedures, can help mitigate risks and uphold regulatory standards. Conducting regular audits and due diligence checks not only safeguards against fraudulent activities but also fosters trust among stakeholders. Leveraging secure payment gateways and encryption technologies can enhance the security and transparency of transactions. Emphasizing educational initiatives for employees and clients on Bitcoin transaction protocols and compliance measures is key to fostering a culture of responsible and informed engagement within the cryptocurrency sphere. Additionally, staying abreast of industry developments and regulatory updates is essential to adapting swiftly to changing compliance requirements and market trends.

Risks to Avoid ⚠️

Bitcoin transfers in Sweden come with risks that you need to be vigilant about. Scammers may attempt to deceive you, leading to financial losses. Additionally, hacking and theft are potential dangers in the digital realm, emphasizing the importance of safeguarding your digital wallets and personal information. Staying informed about the latest security measures and being cautious with your transactions can help mitigate these risks. For a more in-depth look at common risks and protective strategies when sending bitcoins, you can explore the comprehensive guide on bitcoin cross-border money transfer laws in Sudan.

Remember that proactive risk management is crucial in the world of cryptocurrency to ensure a smooth and secure transfer process. By being aware of potential hazards and implementing suitable precautionary measures, you can safeguard your assets and transactions effectively. Stay informed, stay cautious, and stay ahead when it comes to navigating compliance guidelines for Bitcoin transfers in Sweden.

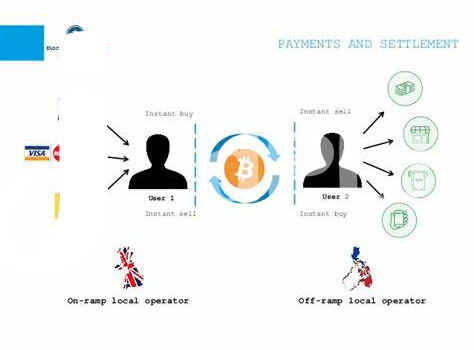

Compliance Tools 🛠️

When it comes to navigating the landscape of cryptocurrency compliance, having the right tools at your disposal is crucial. These tools are designed to streamline the process of adhering to regulatory requirements, making it easier for businesses to stay on top of their compliance obligations. From identity verification solutions to transaction monitoring software, compliance tools come in various forms to address different aspects of compliance. By utilizing these tools effectively, organizations can ensure that their Bitcoin transfers in Sweden are conducted in a compliant manner, reducing the risk of regulatory issues and penalties. Stay ahead of the curve by leveraging these compliance tools, which not only facilitate compliance but also contribute to building trust with regulators and stakeholders. By staying informed about the latest advancements in compliance technology, businesses can proactively address any regulatory challenges that may arise, enabling them to navigate the evolving landscape of cryptocurrency regulations with confidence and ease.

Future Trends 🔮

When looking at future trends in Bitcoin transfer compliance, staying informed and adaptable is key. As technology continues to evolve, so do the regulations and standards surrounding cryptocurrency transactions. It’s crucial to anticipate changes in legislation and ensure that your compliance measures are up to date. Additionally, keeping an eye on emerging technologies like blockchain analytics tools can provide a proactive approach to compliance. By understanding and embracing these advancements, businesses can navigate the evolving landscape of Bitcoin transfers more effectively. Looking ahead, a proactive stance on compliance will be essential for staying ahead of regulatory developments and maintaining a secure and compliant transfer process. Stay informed, stay adaptable, and stay compliant as the future of Bitcoin transfers unfolds.

Bitcoin cross-border money transfer laws in Slovakia