Recognizing Fake Icos: 🕵️♂️

When it comes to recognizing fake ICOs, it’s crucial to delve beyond just the surface of an enticing offer. Understanding the project’s whitepaper, team members’ credentials, and whether there is a viable product in development are key indicators. Additionally, checking for transparency in communication, such as an active and engaged community, can provide insights into legitimacy. Keep an eye out for overly ambitious claims or promises that appear too good to be true. By critically evaluating these aspects, investors can better discern between genuine opportunities and potential scams.

| Common Indicators of Fake ICOs: |

|---|

| Overblown promises with guaranteed high returns |

| Anonymous or unverifiable team members |

| Lack of a clear roadmap or tangible product development |

Due Diligence before Investing: 🧐

Before diving into the world of ICO investments, it’s crucial to conduct thorough research and analysis to safeguard your funds. Conducting due diligence involves scrutinizing the project’s whitepaper, team members, advisory board, and past track record. Verify the credibility of the developers and assess the feasibility and innovation of the product or service being offered. Additionally, delve into the market demand, competition, and token structure to make an informed investment decision. Remember, a well-researched investment is key to avoiding potential scams and fraudulent schemes.

Stay vigilant, stay informed! Protect your investments by staying updated on the latest cryptocurrency news and developments. Utilize reputable sources, forums, and community feedback to gather valuable insights and opinions. By educating yourself and being proactive in your research efforts, you can mitigate risks and enhance the security of your cryptocurrency investments. Remember, investing wisely today can lead to a secure financial future tomorrow.

Red Flags to Watch Out For: 🚩

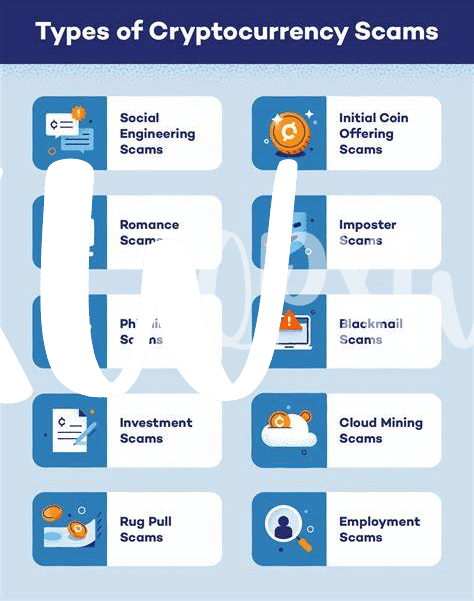

When considering investing in cryptocurrency, it’s crucial to be vigilant for warning signs that may indicate a potential scam. Red flags to be cautious of include unrealistic promises of high returns with little to no risk, lack of transparency regarding project details or team members, and pressure to invest quickly without proper time for research. Additionally, be wary of projects with plagiarized whitepapers, a history of changing project names or goals, or a lack of clear communication channels. By keeping an eye out for these red flags, investors can protect themselves from falling victim to fraudulent ICO schemes and make more informed decisions when navigating the cryptocurrency market. Remember, if something seems too good to be true, it’s essential to investigate further before parting with your hard-earned money.

Educating Yourself on Scams: 📚

Educating Yourself on Scams: 📚

In a world where technology is constantly evolving, staying informed about the latest scams and frauds is crucial to protect your cryptocurrency investments. By educating yourself on common tactics used by scammers, you can arm yourself with the knowledge needed to spot potential red flags and avoid falling victim to fraudulent schemes. Whether it’s understanding the basics of blockchain technology or keeping up to date with the latest security measures, being proactive in your education can go a long way in safeguarding your hard-earned assets.

To delve deeper into the realm of cryptocurrency scams and fraud prevention, check out this insightful article on bitcoin fraud and scam reporting in Haiti. Explore valuable insights and practical tips to enhance your awareness and protect yourself against potential threats in the digital currency space.

Securing Your Cryptocurrency Investments: 🔒

When it comes to safeguarding your cryptocurrency investments, staying vigilant is key. Consider using hardware wallets, which store your digital assets offline and out of reach from potential hackers. Additionally, enable two-factor authentication on your exchange accounts and create strong, unique passwords to add an extra layer of security. Regularly update your antivirus software and be cautious of unsolicited emails or messages asking for personal information. Remember, protecting your investments is a proactive task that requires ongoing attention and care.

| Tip 1 | Use hardware wallets |

|---|---|

| Tip 2 | Enable two-factor authentication |

| Tip 3 | Create strong, unique passwords |

| Tip 4 | Update antivirus software regularly |

| Tip 5 | Be cautious of unsolicited communication |

Reporting Fraudulent Activities: 🚨

If you come across any suspicious activities or potential fraud in the world of cryptocurrency, it is crucial to take action and report it promptly. By reporting fraudulent activities, you not only protect yourself but also contribute to a safer community for all investors. It’s important to stay vigilant and speak up if you see anything that doesn’t seem right. If you encounter any Bitcoin fraud or scams in Guinea-Bissau, you can report them using the resources available for bitcoin fraud and scam reporting in Hungary.