🌐 What Are Smart Contracts? a Simple Guide

Imagine going to a vending machine, where instead of getting a snack, you drop in a coin and out pops a digital contract that automatically takes care of a task for you, like renting a car, buying a house, or paying for a service, no paperwork or middlemen needed. This is the magic of smart contracts! These are nifty pieces of code living on the blockchain, a technology far beyond a simple database, it’s a ledger that’s secure and shared among many. What makes them special is that they automatically execute, control, or document legally relevant events according to the terms written into them. Think of them as self-operating digital agreements that churn out the expected outcome without any hiccups or need for a trusty handshake.

Here’s a simple table to understand better:

| Feature | Description |

|———|————-|

| **Self-executing** | Automatically performs the contract terms |

| **Blockchain-based** | Lives on a secure and shared ledger |

| **Transparent** | Terms are visible to all parties involved |

| **Trustless system** | Operates without the need for intermediaries |

Smart contracts are like your trustworthy buddy who makes sure everything goes as planned, except they’re bits of code ensuring that a deal goes through only when all conditions are met, painting a future where agreements are as easy as a click, and everyone’s on the same page.

💡 Ethereum’s Special Sauce for Smart Contracts

Ethereum, often seen as the leading platform for smart contracts, offers a unique blend of flexibility and security that’s hard to find elsewhere. At the heart of Ethereum’s appeal is its programming language, which allows anyone to write more complex and tailored smart contracts compared to Bitcoin’s relatively simple script. This customization makes Ethereum an ideal playground for developers dreaming up everything from decentralized finance (DeFi) applications to non-fungible tokens (NFTs). Beyond just creating contracts, Ethereum’s upcoming shift to a proof-of-stake model promises enhanced security and scalability, addressing some of the most pressing concerns in the crypto world. For a deeper dive into how Ethereum is reshaping the future of finance and giving Bitcoin a run for its money, check out this comprehensive comparison here.

🔐 Putting Safety First: How Ethereum Stands Out

Ethereum is a bit like a big, bustling marketplace, not just for buying and selling, but for making deals that are smart, secure, and can take care of themselves. Think of it as a place where promises are locked in safe boxes that only open when certain conditions are met, ensuring everyone sticks to their end of the bargain. This safety-first approach sets Ethereum apart from Bitcoin, which is more like a vast, secure vault for storing and moving money. While Bitcoin’s simplicity makes it incredibly secure, Ethereum adds layers of sophistication by allowing these smart contracts to interact in complex ways, all while keeping a tight lock on security. This blend of flexibility and safety makes Ethereum a standout, offering a playground for innovations that can potentially reshape everything from finance to the internet itself. However, it’s not just about keeping things safe in theory but also about constantly improving and testing the boundaries of what’s possible, thereby fostering a safer and more dynamic ecosystem for users and developers alike. 🛠️✨

📉 Comparing Ethereum and Bitcoin: the Safety Angle

When it comes to ensuring the safety of digital contracts and transactions, Ethereum and Bitcoin take quite different approaches. Imagine Ethereum as a highly skilled artist, capable of creating intricate and detailed masterpieces (smart contracts) that do more than just exchange money; they can automate processes, manage agreements, and even run autonomous organizations without human intervention. This flexibility is not just for show; it significantly enhances safety because Ethereum can tailor security measures to the specific needs of each contract. On the other hand, Bitcoin operates more like a master craftsman who specializes in creating one thing exceptionally well: secure, straightforward financial transactions. However, its simplicity does have a drawback. It lacks the versatility to build in the complex safety checks and balances that Ethereum’s smart contracts allow. For a deeper dive into how these differences affect their respective abilities to adapt and improve, including safety protocols, check out understanding bitcoin software updates and forks versus ethereum. This comparison sheds light on why Ethereum might offer an edge in safety through its innovative use of smart contracts, inviting us to explore how technology can create not just a safer financial world but a more adaptable and intricate one.

🚀 Real-world Examples: Ethereum’s Smart Contracts in Action

Imagine you’re at a fair, but instead of buying tickets for rides, you’re exchanging digital tokens that represent real value, like money, but in a digital form. This is a bit like how Ethereum’s smart contracts work in the real-world. Think of a vending machine: you select a snack, pay the right amount, and the machine gives you what you chose. Ethereum does something similar, but with digital agreements that automatically execute when conditions are met. For example, artists are now selling their music directly to fans, and once a fan pays, they automatically receive the digital album. No middleman, no waiting. Similarly, companies are using these contracts for things like insurance. If a flight is delayed, the contract automatically processes refunds to passengers. Here’s a sneak peek at how Ethereum is being applied across different sectors:

| Sector | Application Example |

|——–|———————|

| Art and Music | Direct sales from artists to fans with automatic payment distribution. |

| Insurance | Automatic refunds for flight delays without manual claims processing. |

| Real Estate | Instant property transfers with automatic contract execution upon payment. |

The magic of Ethereum’s smart contracts lies in how they open doors to creative solutions, ensuring that transactions are not just secure but also immediate and without the need for a third-party to intervene. The digital world is evolving, and Ethereum is at the forefront, redefining how we think about and execute agreements in our daily lives.

💣 Potential Risks and How to Stay Safe

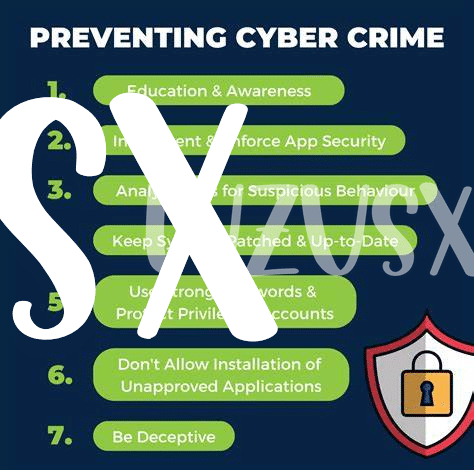

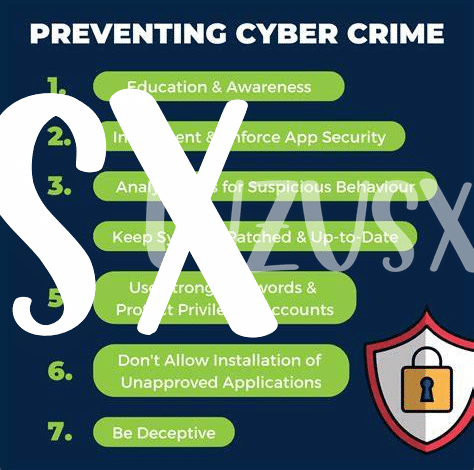

In the world of blockchain and cryptocurrencies, smart contracts on platforms like Ethereum have opened up new possibilities for automation and efficiency. However, as with any technology, there are risks to be mindful of. One of the main concerns is the code itself. Since smart contracts operate based on pre-set rules, any mistake in the code can lead to unintended consequences, including the loss of funds. Moreover, the irreversible nature of blockchain means once a contract is deployed, it is very challenging to correct these mistakes.

Another risk revolves around the security of the platforms these contracts run on. Despite the advanced security features of Ethereum, the platform and its smart contracts have been targets for hackers. Therefore, it’s crucial for both developers and users to rigorously test contracts and stay informed on best practices for security. Staying educated about potential vulnerabilities and being cautious can substantially reduce the risk of falling prey to exploits. For those interested in understanding the broader context of blockchain’s influence, especially in terms of how different cryptocurrencies like Bitcoin and Ethereum are viewed by major financial institutions, it could be enlightening to explore the philanthropic initiatives funded by bitcoin donations versus ethereum. This comparison sheds light not only on the technological differences but also on the perception and adoption of these digital currencies in more traditional sectors.