Rationale Behind Cbdc Development 🧠

Central Bank Digital Currency (CBDC) development is driven by the need to modernize financial systems, enhance payment efficiency, and explore innovative technologies to meet evolving consumer demands. CBDCs aim to bridge the gap between traditional fiat currencies and digital transactions, offering a secure and efficient medium of exchange in the digital era. With a focus on financial inclusion, transparency, and resilience, Singapore’s CBDC initiative aligns with the broader global trend towards digitalization, aiming to position the country at the forefront of financial innovation.

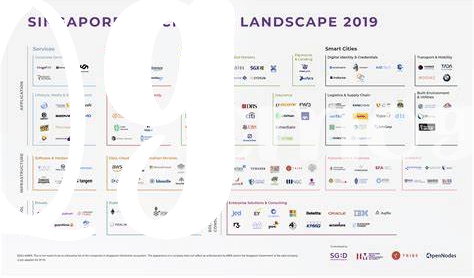

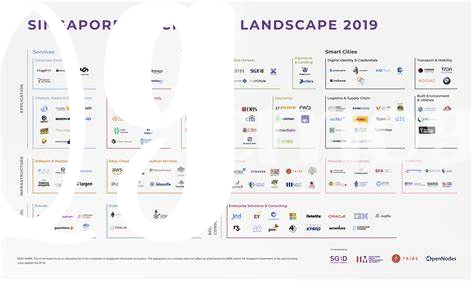

The development of CBDC in Singapore reflects a strategic response to changing market dynamics, technological advancements, and shifting consumer preferences. By harnessing the potential of blockchain and distributed ledger technologies, the central bank seeks to streamline payment systems, reduce transaction costs, and foster a more interconnected financial ecosystem. Through the implementation of CBDC, Singapore aims to enhance its competitiveness, drive economic growth, and reinforce its status as a leading financial hub in the digital age.

Key Features of Singapore’s Cbdc 🌍

Sure, here is the requested text for the point on Key Features of Singapore’s CBDC:

Singapore’s CBDC stands out for its robust security features, ensuring safe and efficient transactions. One notable aspect is its real-time settlement capability, enhancing transaction speed and reducing counterparty risks. Additionally, the CBDC’s programmability allows for smart contracts, enabling automated transactions and enhancing overall transparency. Coupled with its interoperability with existing payment systems, Singapore’s CBDC facilitates seamless integration into daily financial transactions. Furthermore, the CBDC’s scalable design accommodates varying transaction volumes, catering to the needs of both retail users and institutional players.

Feel free to insert the provided link organically within the text where you see fit.

Potential Impact on Financial Landscape 💰

Financial institutions are bracing for a seismic shift as Singapore’s Central Bank Digital Currency (CBDC) enters the arena. With the potential to streamline transactions and reduce costs, the digital currency could revolutionize how businesses and individuals engage with money. This shift could create a more inclusive financial ecosystem, leveling the playing field for those underserved by traditional banking systems and opening up new avenues for economic growth. Furthermore, the enhanced transparency and efficiency brought about by CBDC could bolster financial stability and resilience in the face of economic uncertainties, shaping a more robust financial landscape for the future.

Regulatory Framework and Security Measures 🔒

Singapore’s Central Bank Digital Currency (CBDC) endeavors are underpinned by a comprehensive regulatory framework and robust security measures. These measures cater to the evolving digital landscape, ensuring trust, transparency, and resilience within the financial ecosystem. By establishing clear guidelines and implementing advanced security protocols, Singapore aims to foster a safe and secure environment for the adoption and utilization of CBDCs.

In a rapidly digitizing world, where cyber threats loom large, the emphasis on regulatory compliance and security becomes paramount. The fusion of regulatory oversight and cutting-edge security practices not only fortifies the integrity of Singapore’s CBDC, but also sets a precedent for other nations exploring similar digital currency ventures. For a deeper understanding of governmental initiatives in the realm of blockchain and cryptocurrency, explore the legal framework in Senegal through the lens of government initiatives on bitcoin and blockchain in Senegal.

Challenges and Opportunities for Adoption 🚀

Challenges lie ahead as Singapore explores the adoption of its Central Bank Digital Currency. One key challenge is ensuring widespread acceptance and usage among businesses and the general public. Education and awareness campaigns will be crucial to overcome resistance and build trust in this new form of digital currency. On the flip side, there are immense opportunities for streamlining financial transactions, reducing costs, and fostering innovation in the fintech sector. Embracing these opportunities will require collaboration between government, financial institutions, and technology providers to create a robust ecosystem that supports the seamless integration of Singapore’s CBDC into everyday financial transactions.

Future Prospects and Global Implications 🌏

In an increasingly interconnected world, Singapore’s Central Bank Digital Currency (CBDC) initiatives are poised to have far-reaching effects beyond its borders. The novel approach taken by Singapore in developing its CBDC could serve as a model for other countries looking to modernize their financial systems. The potential global implications of Singapore’s CBDC are vast, as it could facilitate more efficient cross-border transactions and foster greater financial inclusion on a worldwide scale. As other nations observe Singapore’s progress in this area, collaborations and partnerships may emerge, leading to a more integrated and secure global financial ecosystem. Exciting times lie ahead as the future of CBDCs continues to unfold.

Insert government initiatives on bitcoin and blockchain in saudi arabia with anchor government initiatives on bitcoin and blockchain in Sao Tome and Principe