Overview of Bitcoin Remittances in Saudi Arabia 🌍

The adoption of Bitcoin for remittances in Saudi Arabia has been steadily increasing, offering a modern and efficient way for individuals to transfer money both domestically and internationally. This digital currency provides users with a decentralized and secure platform to conduct financial transactions, including remittances, without the need for intermediaries like traditional banks. As Saudi Arabia continues to embrace the digital economy, Bitcoin remittances have the potential to revolutionize the way individuals send and receive money across borders, opening up new possibilities for financial inclusion and accessibility.

Current Regulatory Landscape 📜

The regulatory landscape surrounding Bitcoin remittances in Saudi Arabia is evolving rapidly. Authorities are closely monitoring and adapting to the growing trend of digital currency transactions. The current regulations aim to strike a balance between fostering innovation and ensuring financial stability. With a focus on consumer protection and anti-money laundering measures, Saudi Arabia is paving the way for a more transparent and secure environment for Bitcoin remittances. Financial institutions are actively engaging with these regulations to navigate the complexities of compliance while exploring the potential benefits of this emerging technology. As the regulatory framework continues to develop, both challenges and opportunities arise for consumers, prompting a need for increased awareness and understanding in the dynamic landscape of Bitcoin transactions.

Impact on Financial Institutions 🏦

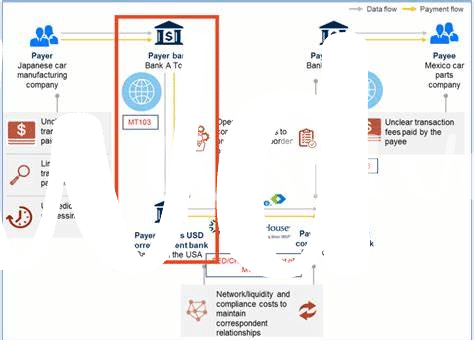

Financial institutions in Saudi Arabia are facing a significant impact with the rise of Bitcoin remittances and transfers. The adoption of this digital currency has forced traditional banks to reassess their strategies and services, as they now need to compete with alternative and more efficient remittance methods. This shift in the financial landscape has pushed institutions to invest in new technologies and explore innovative solutions to stay relevant in the market. Additionally, the decentralized nature of Bitcoin poses a challenge for banks in terms of monitoring and regulating transactions, leading to a heightened focus on compliance and security measures. Despite the challenges, the emergence of Bitcoin remittances also presents opportunities for financial institutions to expand their reach and attract a new generation of tech-savvy consumers. By embracing this change and leveraging the potential of digital currencies, banks have the chance to enhance their services and drive future growth in the financial industry.

Challenges and Opportunities for Consumers 💡

Consumers in Saudi Arabia face a mix of challenges and opportunities when it comes to using Bitcoin for remittances and transfers. On one hand, the volatility of Bitcoin prices can make transactions unpredictable, impacting the value received by the receiver. Additionally, since Bitcoin operates independently of traditional financial systems, there may be concerns about security and fraud protection for consumers who are unfamiliar with this digital currency landscape. However, on the bright side, using Bitcoin for remittances can offer lower transaction fees and faster transfer times compared to conventional methods, presenting a cost-effective and efficient alternative for tech-savvy individuals looking to send money across borders.

For a deeper dive into how Bitcoin regulations impact cross-border money transfers in St. Kitts and Nevis, check out this insightful article on bitcoin cross-border money transfer laws in Senegal.

Future Prospects and Trends 🚀

In Saudi Arabia, the future of Bitcoin remittances and transfers holds exciting possibilities. As technology continues to evolve, we can expect to see increased adoption and integration of cryptocurrencies in the financial ecosystem. From peer-to-peer transfers to cross-border transactions, Bitcoin offers a decentralized and efficient alternative to traditional banking methods. This shift towards digital currencies is not just a trend, but a glimpse into the future of how money will be moved and managed globally.

Furthermore, emerging trends point towards a more seamless and secure remittance experience for individuals and businesses alike. With blockchain technology at the forefront, the potential for faster, cheaper, and more transparent transactions is on the horizon. As regulatory frameworks adapt to accommodate these innovations, Saudi Arabia is poised to become a key player in shaping the future landscape of Bitcoin remittances. Embracing these trends will not only enhance financial inclusivity but also drive further economic growth and stability in the region.

Importance of Compliance and Innovation 🔒

Bitcoin innovation in the remittance sector necessitates a delicate balance between compliance and forward-thinking practices. As the regulatory framework evolves in Saudi Arabia, the need for adherence to established guidelines becomes paramount. Ensuring compliance not only fosters trust within the financial ecosystem but also mitigates potential risks associated with unauthorized transactions. Additionally, innovative solutions can streamline processes, enhance security, and revolutionize cross-border money transfers. Embracing technological advancements while upholding regulatory standards is essential for the sustainable growth of Bitcoin remittances in the region. 💼

Incorporating compliance measures also paves the way for greater transparency and accountability, instilling confidence among both providers and consumers. By harmonizing regulatory requirements with innovative strategies, the financial landscape can adapt to the changing dynamics of digital asset transactions. This synergy between compliance and innovation sets the stage for a robust and resilient Bitcoin remittance market, poised for sustainable expansion. Moreover, embracing compliance standards can bolster the overall credibility of the sector, attracting new opportunities for growth and development. 📈

For more information on bitcoin cross-border money transfer laws in San Marino, visit here.