Unpacking Sanctions: Why Countries Use Them 🌍

Imagine when you and your friends decide on a set of rules for a game and someone decides not to follow them. What do you do? Similarly, on the world stage, when countries don’t play by the agreed rules, sanctions act as the global community’s way of saying, “Hey, that’s not fair!” 🌏✋ By restricting trade, limiting financial transactions, or implementing other barriers, they aim to encourage, or sometimes force, a country to change its behavior. It’s like putting a temporary hold on their ability to buy and sell in the global marketplace, hoping to nudge them back in line with international norms and agreements. But just like any game, the effectiveness of this approach can vary widely, leading to a complex dance of actions and reactions on the global stage.

| Type of Sanction | Purpose | Example |

|---|---|---|

| Economic | To weaken a country’s economy | Trade restrictions |

| Diplomatic | To isolate a country internationally | Expelling diplomats |

| Military | To prevent conflict escalation | Arms embargoes |

Cryptocurrencies 101: Basics Everyone Should Know 💰

Imagine a world where money isn’t just paper and coins in your wallet, but also exists as digital tokens that can zip around the globe with the click of a button. That’s the realm of cryptocurrencies, a dazzling digital currency universe that operates independently of traditional banking systems. At the heart of this universe are Bitcoin and Ethereum, pioneering coins that have revolutionized how we think about money. Cryptos, as they’re affectionately known, harness the power of technology to secure transactions and create new units, moving beyond the reach of central banks and nosy overseers.

Diving a tad deeper, these digital marvels thrive on a technology called blockchain, a super-smart ledger that records all transactions openly and permanently. This means that every send, receive, or trade you do is etched in digital stone, accessible to anyone but alterable by no one. It’s this blend of transparency and security that makes cryptos a beacon for those seeking an alternative to the traditional financial merry-go-round. For a deep dive into how these technologies are shaping the future of money, especially in eco-friendly practices, take a look at https://wikicrypto.news/geothermal-bitcoin-mining-tapping-earths-heat-for-eco-friendly-profits.

How Cryptos Dodge Traditional Financial Barriers 🚀

Imagine you’re sending a letter, but instead of going through the post office, you use a secret tunnel only a few know about. That’s somewhat how cryptocurrencies sneak past the usual financial roadblocks. With regular money, governments and banks watch over transactions like guards, blocking and allowing what goes in and out based on rules. However, cryptocurrencies operate on a web of computers scattered around the globe, making it tough for any single authority to keep an eye on or control them. This is like playing a game of hide and seek on a playground that spans the entire planet. As a result, even when a country faces sanctions, making it hard for it to engage in financial activities with the rest of the world, it can use cryptocurrencies as a workaround. People in these countries turn to digital currencies as a secret passage, enabling them to trade and invest without hitting the barriers built by sanctions. It’s a digital dance, avoiding the traditional financial restrictions with a blend of technology and ingenuity. 🌐💫

Real-life Tales: Sanctions Meet Cryptocurrency 🤝

In the world of global finance, stories of how cryptocurrencies are playing a role in skirting around sanctions are growing. Imagine a country that’s been put in the financial timeout corner by other countries for not playing fair. Now, this country finds a digital backdoor through cryptocurrencies, enabling it to carry out international transactions without the usual checks and balances. It’s like playing a game of financial hide and seek, where cryptos offer a cloak of invisibility. This digital dodgeball is not just limited to countries. Individuals and businesses caught in the crossfire of economic sanctions are also turning to cryptocurrencies as a lifeline, allowing them to continue trading on the global stage. It’s a testament to the power of innovation, providing a workaround when traditional doors are shut.

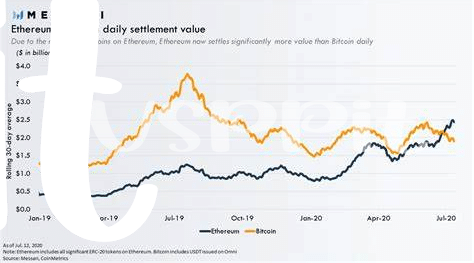

However, this digital dance comes with its own set of tunes. The anonymity and lack of oversight that make cryptocurrencies attractive for evading sanctions also paint a target on their back. This gray area invites not only those looking for financial freedom but also those with less than noble intentions, swinging the spotlight onto the need for responsible innovation and regulation. It’s an ongoing saga of cat and mouse in the digital age, highlighting both the potential and the pitfalls of cryptocurrencies in the realm of international finance. For those interested in the broader implications of this technology, the impact of bitcoin on global remittance flows versus ethereum provides a deeper dive into how these digital assets compare in real-world applications.

The Dark Side: Risks and Challenges 🚨

While cryptocurrencies can zip around the world breaking through traditional financial barriers, they’re not without their shadows. Imagine a playground without rules, where everyone can wear a mask. Sounds thrilling, but also a bit scary, right? That’s the playground of cryptos. Here, bad actors might use these digital coins for naughty stuff like money laundering or funding things we really don’t want funded. Plus, because cryptos operate on this cool but complex technology called blockchain, if you accidentally send your coins to the wrong address, they could be gone forever – like throwing a paper plane into a bonfire. And with the value of these coins jumping up and down like a kangaroo on a trampoline, it’s tough to know when to hold on and when to jump off. But wait, there’s more! Regulatory crackdowns can come out of the blue, making everyone’s heart skip a beat. Here’s a quick view of what we’re dealing with:

| Risk | Challenge |

|---|---|

| Use for illegal activities | Regulating without stifling innovation |

| Loss of funds due to errors | Creating user-friendly safeguards |

| Market volatility | Developing strategies for stabilization |

| Regulatory changes | Adapting to new laws internationally |

Yes, stepping into the cryptocurrency world is like hopping onto a rollercoaster with no seatbelts. Exciting, but you gotta be ready for what comes with the thrill.

Bright Future: Innovations and Solutions ✨

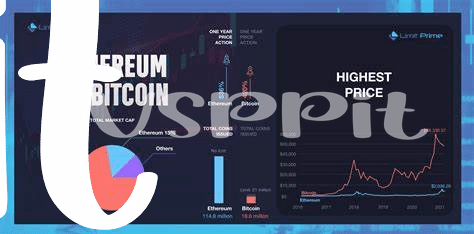

In a world where digital currencies are rapidly evolving, the horizon seems to be glowing with promise. The marriage between cutting-edge technologies and inventive financial strategies is brewing up a storm of revolutionary solutions. Picture a future where blockchain technology not only makes transactions quicker and more secure but also becomes a bastion for privacy and autonomy. Innovations like smart contracts enhance trust and transparency, creating a safer digital ecosystem for everyone. But that’s not all; the push for greener, more sustainable practices is making waves too. For instance, the debate over the energy consumption of various cryptocurrencies has led to a surge in seeking renewable energy solutions to power these digital assets. A notable discussion can be found controversies surrounding Bitcoin explained versus Ethereum, highlighting how each platform is tackling the challenge of becoming more environmentally friendly. Through such efforts, the crypto space is not just navigating around the traditional financial systems but is also setting a precedent for a more sustainable and equitable future. As we venture further, the sky’s the limit for what can be achieved with the synergy of technology, foresight, and ethical considerations. 🌱💡🔗