Understanding Rwanda’s Crypto Regulations 🌍

Rwanda has emerged as a notable player in the realm of cryptocurrency regulations, with a proactive stance toward fostering innovation while ensuring compliance with legal frameworks. The country’s approach reflects a nuanced understanding of the evolving crypto landscape, incorporating measures to mitigate risks associated with digital assets. By delving into the specifics of Rwanda’s crypto regulations, one gains insight into the potential impact on the local economy and the broader implications for the global financial ecosystem. This emphasis on regulatory clarity sets the stage for a conducive environment that encourages responsible adoption of blockchain technologies, positioning Rwanda at the forefront of the digital transformation sweeping across the African continent and beyond.

Implications of Aml Laws on Bitcoin 📉

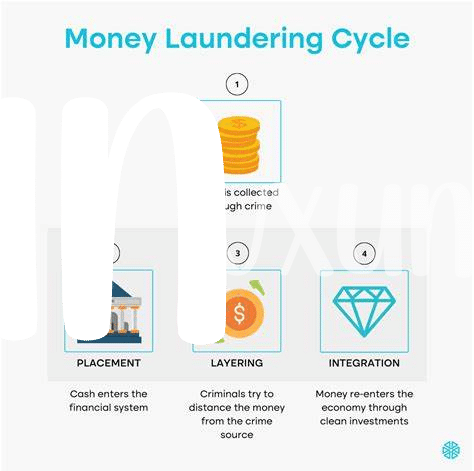

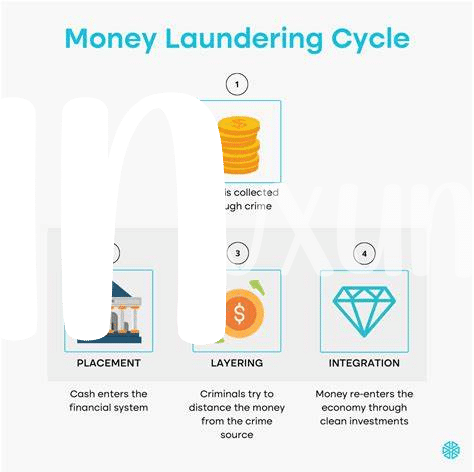

Bitcoin has emerged as a revolutionary digital currency, but the landscape changes significantly when Anti Money Laundering (AML) regulations come into play. These laws are crucial for combating illicit financial activities and ensuring a transparent and secure crypto market. However, for Bitcoin investors and users, AML regulations can lead to increased scrutiny, mandatory identity verification, and reporting requirements. The implications of AML laws on Bitcoin 📉 add a layer of complexity to transactions, as anonymity gives way to transparency, influencing how individuals interact with the cryptocurrency.

In navigating the realm of AML compliance, Bitcoin exchanges in various countries face unique challenges and opportunities. While these regulations aim to safeguard against money laundering and terrorism financing, they also require innovative solutions to streamline compliance processes without stifling innovation. Adopting robust compliance measures not only strengthens the credibility of the crypto industry but also fosters trust among investors and regulatory bodies. Embracing technological advancements and global best practices is essential in striking a balance between effective AML compliance and promoting the growth of Bitcoin ecosystems.

Challenges and Innovations in Compliance 💡

In navigating the landscape of compliance in the realm of cryptocurrencies, Rwanda faces a host of challenges that require innovative solutions. One such obstacle is the decentralized nature of Bitcoin, which poses difficulties in tracking transactions and ensuring regulatory adherence. Additionally, the fast-paced evolution of the crypto market demands continuous updates to compliance measures to stay ahead of potential risks and vulnerabilities. In this dynamic environment, balancing effective enforcement with technological advancements is crucial for Rwanda to foster a robust and secure crypto ecosystem.

Rwanda’s response to these challenges includes exploring new compliance tools and methodologies to address the intricacies of regulating a digital asset like Bitcoin. Leveraging blockchain technology and collaboration with industry experts, the country aims to implement agile compliance frameworks that can adapt to the evolving nature of cryptocurrencies. By embracing innovation and staying abreast of global best practices, Rwanda is positioning itself at the forefront of regulatory compliance in the digital currency space.

Global Perspectives on Rwanda’s Approach 🌐

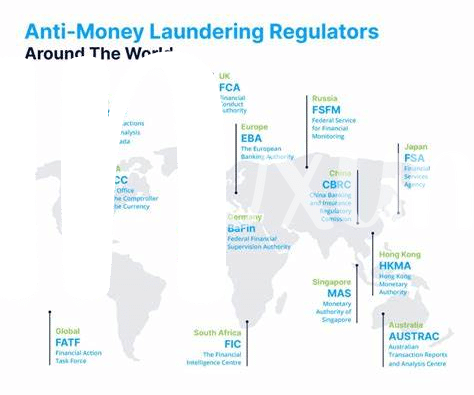

Rwanda’s approach to Bitcoin AML regulations has garnered attention on a global scale, with experts praising its innovative stance in the ever-evolving landscape of cryptocurrency compliance. International observers view Rwanda’s regulatory framework as a forward-thinking model that strikes a delicate balance between fostering crypto innovation and ensuring robust AML measures are in place. The unique perspectives offered by Rwanda in this realm have sparked discussions among policymakers and industry players worldwide, shaping the way countries approach digital asset regulations.

To delve deeper into the global context of Rwanda’s approach to Bitcoin AML regulations, visit [bitcoin anti-money laundering (aml) regulations in portugal](https://wikicrypto.news/qatars-evolving-regulatory-landscape-impact-on-bitcoin-aml).

Balancing Privacy and Security Concerns 🔒

Privacy and security are crucial aspects to consider when it comes to the adoption of Bitcoin in Rwanda. Striking a balance between safeguarding personal data and preventing illicit activities poses a significant challenge for regulators. The country’s approach must prioritize protecting user privacy while implementing robust security measures to combat money laundering and other financial crimes effectively. Finding the right equilibrium is essential to foster trust in the digital currency ecosystem and ensure a safe environment for both investors and users.

As Rwanda navigates the complexities of regulating Bitcoin, it must continuously reassess and refine its strategies to adapt to evolving threats and technological advancements. Enhancing collaboration between the government, financial institutions, and crypto businesses is key to developing sustainable frameworks that prioritize both privacy and security. By fostering a cooperative ecosystem focused on innovation and compliance, Rwanda can leverage the benefits of Bitcoin while mitigating potential risks, ultimately paving the way for a more secure and transparent financial landscape in the digital age.

Future Outlook for Bitcoin in Rwanda 🚀

The future outlook for Bitcoin in Rwanda is optimistic, with the country’s approach to crypto regulations paving the way for potential growth and innovation in the sector. As Rwanda continues to navigate the complexities of AML laws and compliance challenges, there also exists an opportunity for fostering new ideas and solutions in safeguarding financial systems. With a keen focus on balancing privacy and security concerns, Rwanda’s evolving stance on Bitcoin sets a promising trajectory for its adoption and integration within the nation’s financial landscape.