Accessibility 🌍

Bitcoin’s global reach revolutionizes accessibility to financial transactions in Mozambique and beyond. With just an internet connection, individuals can participate in the digital currency economy, overcoming traditional banking barriers. This accessibility empowers unbanked populations and facilitates cross-border transactions seamlessly. Whether connecting urban centers or remote villages, Bitcoin’s decentralized nature allows anyone to engage in transactions, fostering financial inclusion and economic empowerment. The potential to transact with anyone, anywhere in the world, sets Bitcoin apart as a game-changer in the realm of financial accessibility.

Security 🔒

When it comes to using Bitcoin for transactions, it’s vital to consider the aspect of security. Ensuring that your digital assets are protected from potential threats is a top priority for users across the globe. The decentralized nature of blockchain technology provides a layer of security that traditional payment methods lack. By incorporating robust cryptographic measures, Bitcoin transactions offer a level of protection that can give users peace of mind when sending or receiving funds. Understanding how to safeguard your digital assets is key to maximizing the benefits of using Bitcoin in your transactions.

Volatility 💸

Bitcoin’s value can fluctuate rapidly, which may result in significant gains or losses for individuals using it for transactions. This volatility is a double-edged sword – while it presents opportunities for quick profits, it also poses a risk of sudden drops in value. Users in Mozambique should be aware of these price swings and carefully consider their implications before relying solely on Bitcoin for transactions. Strategies such as setting clear price targets, diversifying investments, and staying informed about market trends can help mitigate the impact of volatility and make the most out of this aspect of using Bitcoin.

Cost-effectiveness 💰

Using Bitcoin can often provide a more cost-effective solution compared to traditional payment methods due to lower transaction fees and the potential for lower exchange rates. This cost efficiency is particularly beneficial for individuals and businesses looking to save on international transactions or avoid high banking fees. Moreover, the decentralized nature of Bitcoin means that users have more control over their funds and can avoid intermediaries that may charge additional costs. As a result, utilizing Bitcoin for transactions can lead to significant savings over time.

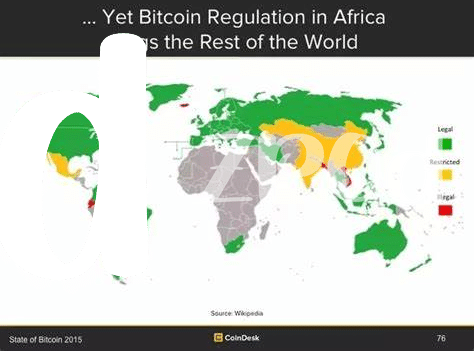

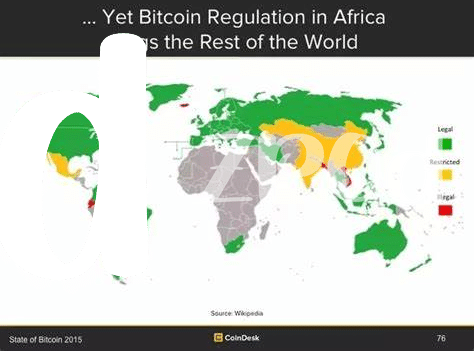

It’s important to consider the legal aspects when using Bitcoin for transactions in Mozambique. Regulations surrounding cryptocurrencies continue to evolve, impacting the way Bitcoin is used and perceived in the country. To delve deeper into the legal consequences of Bitcoin transactions in Mozambique, you can explore insights on the future of Bitcoin regulation and legal changes in the region [here](legal consequences of bitcoin transactions in morocco).

Legal Considerations ⚖️

Navigating the legal landscape when using Bitcoin in Mozambique is crucial for individuals and businesses alike. Understanding the regulatory environment and compliance requirements is essential to prevent any legal repercussions. As the digital currency space evolves, policymakers in Mozambique are also adapting their frameworks to address the unique challenges posed by cryptocurrencies. Ensuring full compliance with these regulations not only safeguards against potential legal issues but also fosters a more secure and stable environment for Bitcoin transactions in the country.

Adoption and Future Potential 🚀

Bitcoin adoption in Mozambique is steadily increasing, driven by a growing awareness of its potential benefits. As more businesses and individuals embrace this digital currency, its future potential for revolutionizing the financial landscape in the country is becoming more apparent. The innovative technology behind Bitcoin offers opportunities for financial inclusion and empowerment, especially in regions where traditional banking systems are limited. With the right infrastructure and support, Bitcoin has the potential to become a transformative force in Mozambique’s economy, paving the way for greater financial accessibility and opportunities for its citizens. The future outlook for Bitcoin adoption in Mozambique is promising, with the potential to drive economic growth and financial empowerment for its people. For more insights on the legal consequences of Bitcoin transactions in Mozambique, visit legal consequences of bitcoin transactions in Mongolia.