Understanding the Risks 🌍

Bitcoin investment funds in Uganda face various risks that investors need to understand. From market volatility to regulatory uncertainties, a comprehensive grasp of these risks is crucial for informed decision-making. By analyzing historical data and staying updated on current trends, fund managers can navigate the ever-changing landscape of cryptocurrency investments effectively. This proactive approach is essential in maximizing returns while mitigating potential pitfalls.

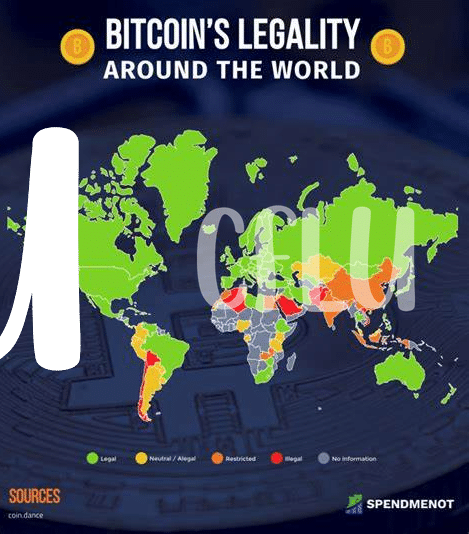

Regulatory Compliance Essentials 📝

Bitcoin investment funds in Uganda must prioritize staying up-to-date with ever-evolving regulatory requirements. This involves implementing robust compliance strategies to ensure adherence to legal frameworks. By integrating a proactive approach towards regulatory compliance, funds can mitigate potential risks and build trust among investors. Understanding and incorporating regulatory essentials is key to navigating the complex landscape of cryptocurrency investments.

Diversification for Stability 🌱

Diversification is like planting a variety of seeds in a garden – it helps spread the risk and ensures that all your eggs aren’t in one basket. By investing in a range of different assets, such as stocks, bonds, and real estate, you can minimize the impact of a single investment going south. This approach not only safeguards your fund against unforeseen market fluctuations but also lays the groundwork for long-term stability and growth. It’s all about creating a balanced portfolio that can weather the storm and thrive in different financial climates.

Technological Security Measures 🔒

For wholesome protection in the digital realm, implementing foolproof technological security measures is paramount. By fortifying firewalls, encrypting data, and conducting regular security audits, Bitcoin investment funds in Uganda can safeguard their assets from potential cyber threats. Embracing cutting-edge security protocols ensures a robust defense against unauthorized access and fraudulent activities, fostering trust among investors and bolstering the integrity of the fund’s operations. Curious to delve deeper into the regulatory landscape of Bitcoin investment funds? Explore more about bitcoin investment funds regulation in Turkmenistan.

Monitoring and Evaluation Systems 📊

Monitoring and evaluation systems play a crucial role in the ongoing success of Bitcoin investment funds. By regularly assessing performance metrics, making data-driven decisions, and adjusting strategies as needed, fund managers can proactively mitigate risks and capitalize on opportunities in the volatile cryptocurrency market. These systems not only provide valuable insights into the fund’s overall health and performance but also enhance transparency and accountability, instilling confidence in both investors and regulatory bodies. With robust monitoring and evaluation mechanisms in place, investment funds can navigate the ever-changing landscape of digital assets with greater resilience and adaptability.

Crisis Response and Recovery Planning 🚨

In times of crisis, having a well-prepared response and recovery plan is crucial for Bitcoin investment funds in Uganda. This includes establishing clear communication channels, designated decision-makers, and predefined steps to mitigate risks and manage unforeseen challenges. By actively identifying potential threats and vulnerabilities, and simulating various scenarios, funds can enhance their resilience and ensure a swift recovery in case of emergencies.

Collaboration with regulatory authorities, implementing robust cybersecurity measures, and regular drills and training sessions can further strengthen the fund’s ability to respond effectively to crises. Additionally, maintaining open communication with stakeholders, having a comprehensive data backup plan, and continuously evaluating and updating the crisis response strategy are essential components for successfully navigating turbulent times in the cryptocurrency investment landscape.bitcoin investment funds regulation in Armenia with anchor bitcoin investment funds regulation in Turkey.