Understanding the Risks 🛡️

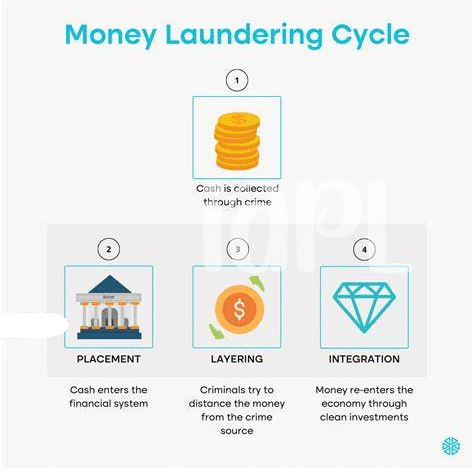

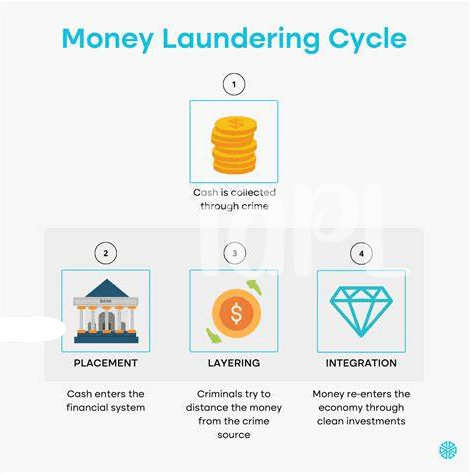

With the rapid growth of the Bitcoin sector in Liechtenstein, it is crucial to have a deep understanding of the potential risks involved. This involves identifying and assessing the various risks associated with Anti-Money Laundering (AML) practices within the sector. By recognizing these risks, businesses can proactively implement strategies to mitigate them, ultimately enhancing their overall compliance and security. Understanding the risks not only helps in safeguarding the integrity of operations but also contributes to building trust with stakeholders and regulatory bodies. This comprehensive awareness serves as the foundation for developing robust risk assessment strategies tailored to the unique landscape of the Bitcoin sector in Liechtenstein.

Regulatory Compliance Measures 📝

Regulatory compliance in the Bitcoin sector is a vital aspect that demands meticulous attention and adherence to established protocols. To ensure a seamless compliance process, companies must stay abreast of the latest regulatory developments and integrate them into their operational frameworks. Implementing robust internal controls, conducting regular audits, and fostering a culture of compliance are key steps in mitigating risks and upholding regulatory standards. By fostering transparency and accountability within their organizations, businesses can navigate the complex landscape of AML regulations with confidence and integrity. Additionally, fostering partnerships with regulatory authorities can provide valuable insights and guidance for achieving and maintaining compliance effectively.

Technology Integration for Monitoring 🖥️

Technology Integration for Monitoring in the bitcoin sector is crucial for detecting and preventing potential risks. By utilizing advanced monitoring systems, companies can track transactions in real-time and identify any suspicious activities promptly. Integrating cutting-edge technology allows for more efficient monitoring, ensuring compliance with regulations and enhancing overall security measures. Automated tools can analyze large amounts of data quickly, providing valuable insights and alerts for unusual patterns. Implementing robust monitoring technology not only strengthens AML practices but also demonstrates a proactive approach in safeguarding against illicit activities in the digital currency realm.

Training and Awareness Programs 🧠

Using a combination of interactive workshops, online modules, and ongoing communication, employees in the Bitcoin sector in Liechtenstein engage in continuous learning about AML best practices. Through detailed case studies and real-world simulations, participants gain a deeper understanding of how to identify and mitigate potential risks within their operations. These programs not only enhance individual expertise but also foster a culture of vigilance and accountability across the organization. By emphasizing the importance of AML compliance in a dynamic industry landscape, these initiatives empower staff to actively contribute to a safer and more secure financial ecosystem. As the regulatory landscape evolves, ongoing training and awareness programs ensure that employees remain equipped to navigate emerging challenges effectively. To learn more about Bitcoin anti-money laundering (AML) regulations in Madagascar, visit bitcoin anti-money laundering (AML) regulations in Madagascar.

Collaboration with Authorities 🤝

Collaboration with authorities is crucial in ensuring a robust AML framework. By working hand in hand with relevant agencies, Bitcoin businesses in Liechtenstein can stay ahead of emerging risks and regulatory requirements. This partnership fosters a culture of transparency and accountability, ultimately enhancing the overall integrity of the sector. Through ongoing dialogue and information sharing, companies can proactively address potential threats and contribute to a safer and more resilient ecosystem. Such collaboration not only benefits individual entities but also strengthens the collective efforts towards combating illicit activities within the digital currency space.

Continued Evaluation and Adaptation 🔄

In the ever-evolving landscape of AML in Liechtenstein’s Bitcoin sector, continual assessment and adaptation are essential for effectively mitigating risks. By regularly evaluating existing strategies and adapting them to meet the changing regulatory environment and technological advancements, businesses can stay ahead of potential threats. This proactive approach ensures that compliance measures remain effective and aligned with the latest industry standards, ultimately safeguarding the integrity of the sector and fostering trust among stakeholders.

bitcoin anti-money laundering (AML) regulations in Lesotho