Overview of Bitcoin Banking Services in Belgium 🏦

In Belgium, Bitcoin banking services are gaining momentum, providing individuals and businesses with innovative financial solutions. These services offer a bridge between traditional banking systems and the decentralized world of cryptocurrency. Through user-friendly interfaces and secure platforms, customers can easily manage their digital assets and engage in transactions seamlessly. The emergence of Bitcoin banking services reflects the growing acceptance and integration of cryptocurrencies into the mainstream financial landscape in Belgium.

Evolution of Regulatory Frameworks 📜

The regulatory landscape governing Bitcoin banking services in Belgium has undergone significant transformations over time. As authorities strived to comprehend and address the challenges posed by this innovative sector, regulatory frameworks have evolved to provide a clearer framework for operations. These changes reflect the dynamic nature of the cryptocurrency ecosystem, with regulators adapting their approaches to foster growth while safeguarding against potential risks. The evolution of these regulatory frameworks not only showcases the maturation of the Bitcoin banking sector but also highlights the ongoing dialogue between policymakers and industry stakeholders to shape a robust and sustainable framework for the future.

Impact of Regulations on Banking Sector 💼

Regulatory frameworks play a crucial role in shaping the landscape for banking services in Belgium. These regulations not only influence the operations and services offered by traditional banks but also have a significant impact on bitcoin banks. By navigating through the regulatory requirements, bitcoin banks face unique challenges in compliance and operational efficiency. The evolving nature of regulations in Belgium’s banking sector means that bitcoin banks must constantly adapt to ensure compliance while also striving for innovation and growth.

Challenges Faced by Bitcoin Banks 🤔

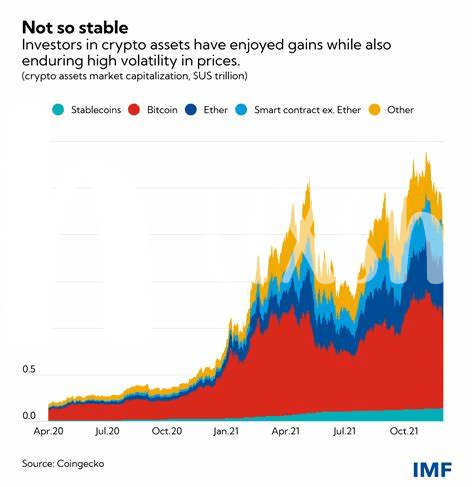

Bitcoin banks in Belgium encounter a myriad of challenges that test their resilience and adaptability. From navigating complex regulatory requirements to managing cybersecurity risks, these institutions must constantly stay ahead of the curve. Additionally, the volatile nature of the cryptocurrency market poses a significant challenge for Bitcoin banks, necessitating robust risk management strategies and continuous monitoring of market trends and developments. To delve deeper into the intricacies of challenges faced by Bitcoin banks, one can explore further insights in this detailed article on the future of Bitcoin banking in Bangladesh. [Find more information here](bitcoin banking services regulations in Barbados).

Future Prospects in Belgium’s Crypto Landscape 🌐

Belgium’s dynamic crypto landscape paints a promising future for investors and businesses looking to capitalize on emerging opportunities. With evolving regulatory frameworks in place, the country is poised to establish itself as a key player in the global cryptocurrency market. As traditional banking services adapt to incorporate Bitcoin, the potential for increased adoption and innovation in Belgium’s financial sector is on the horizon. The growing acceptance of cryptocurrencies by mainstream institutions indicates a shift towards a more integrated crypto ecosystem, offering exciting possibilities for those keen on exploring this evolving landscape.

Recommendations for Investors and Businesses 💡

For investors and businesses looking to navigate the evolving regulatory landscape of Bitcoin banking services in Belgium, it is crucial to stay informed and proactive. Investing in thorough research and due diligence before entering the market can mitigate risks and maximize opportunities. Establishing strong partnerships with compliant service providers and maintaining strict compliance with regulations will be key to long-term success. Additionally, staying abreast of developments in other jurisdictions, such as the bitcoin banking services regulations in Australia, may provide valuable insights for business strategies. Implementing robust security measures and continuously educating oneself on industry trends and best practices are essential for sustainable growth.