Regulatory Warnings: ⚠️

In the ever-evolving landscape of Bitcoin investments in Nigeria, it is crucial for investors to heed regulatory warnings from official authorities. These warnings serve as guiding beacons, alerting individuals to potential risks and pitfalls that may lurk in the uncharted waters of the cryptocurrency market. By staying informed and compliant with these regulatory guidelines, investors can navigate the turbulent seas of digital currencies with more confidence and awareness. It is essential to pay heed to these warnings, as they often encompass valuable insights and precautions that could safeguard investors from falling victim to fraud or legal ramifications. In essence, regulatory warnings act as a shield, helping to fortify investors against unforeseen challenges and ensuring a smoother sailing experience in the realm of Bitcoin investments.

| Regulatory Warnings | ⚠️ |

|---|

Potential Legal Consequences: ⚖️

Potential Legal Consequences: Being aware of the potential legal consequences when investing in Bitcoin in Nigeria is crucial. Failure to comply with regulatory requirements can lead to penalties or even legal action. It’s important to understand the laws surrounding cryptocurrency investments to avoid any legal pitfalls. By staying informed and following the guidelines set by the regulatory authorities, investors can navigate the legal landscape with confidence. Seeking legal advice when in doubt can also help in ensuring compliance and avoiding any legal repercussions. It is essential to acknowledge and respect the legal framework governing Bitcoin investments in Nigeria to protect both investments and individuals involved.

Reporting Requirements and Obligations: 📝

When it comes to engaging in Bitcoin investments in Nigeria, understanding the reporting requirements and obligations is crucial. Not only does this ensure compliance with relevant regulations, but it also helps in maintaining transparency with the authorities. Whether it involves disclosing transaction details or providing regular reports, being aware of the reporting procedures is essential for investors. By fulfilling these obligations diligently, investors can demonstrate their commitment to operating within the legal framework and contribute to a more robust regulatory environment in the cryptocurrency space.

Staying informed about the reporting requirements and obligations can empower investors to navigate the crypto landscape responsibly. While it may seem like a formality, adherence to these protocols fosters trust and credibility, both for individual investors and the broader cryptocurrency community. By treating reporting obligations seriously and proactively, investors not only protect themselves but also contribute to the legitimacy and long-term sustainability of Bitcoin investments in Nigeria.

Safeguarding Against Fraudulent Schemes: 🔒

When it comes to safeguarding against fraudulent schemes in the realm of Bitcoin investments, it is crucial to be vigilant and informed. In a landscape where digital currencies can be susceptible to various scams and hacks, investors must exercise caution and adopt proactive measures to protect their assets. This includes conducting thorough research on potential investment opportunities, verifying the legitimacy of platforms and services, and being cautious of offers that seem too good to be true. Additionally, implementing robust security measures such as using reputable wallets, enabling two-factor authentication, and staying updated on cybersecurity best practices can help mitigate the risk of falling victim to fraudulent activities. By remaining vigilant and informed, investors can navigate the Bitcoin market with a greater sense of security and confidence.

To read more about regulatory guidance on bitcoin investments, check out this resource: regulatory guidance on bitcoin investments in north korea.

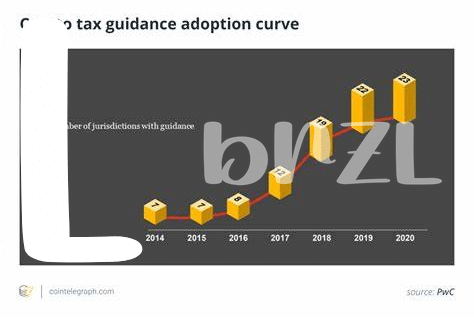

Tax Implications and Obligations: 💸

When it comes to investing in Bitcoin in Nigeria, understanding the tax implications and obligations is crucial. As a Bitcoin investor, you need to be aware that any profits you make from trading or selling Bitcoin may be subject to taxation by the government. It’s essential to keep detailed records of your transactions and ensure that you comply with all tax reporting requirements. Failing to do so could result in penalties or legal consequences down the line. Seeking advice from a tax professional can help you navigate the complexities of cryptocurrency taxation and ensure that you meet your obligations while maximizing your returns. Stay informed and proactive when it comes to the tax implications of your Bitcoin investments in Nigeria to avoid any unexpected surprises.

| Tax Tips | Importance |

| ——— | ———- |

| Keep records of transactions | High |

| Seek advice from professionals | High |

| Stay informed on tax regulations | High |

Seeking Professional Advice: 🤝

Seeking professional advice when navigating the complexities of Bitcoin investments is crucial for making informed decisions and safeguarding your financial interests. Consulting with experts who understand the regulatory landscape and can provide tailored guidance based on your specific circumstances can help you avoid potential pitfalls and ensure compliance with relevant laws. By seeking professional advice, you can gain clarity on the intricacies of Bitcoin investments in Nigeria and make informed choices that align with your investment goals.

Don’t forget to consult the regulatory guidance on Bitcoin investments in Namibia for further insights and best practices. For more information, refer to the regulatory guidance on Bitcoin investments in Nepal provided by financial authorities in the region.