Qatar’s Regulatory Changes Affecting Cryptocurrency ⚖️

– The shifting regulatory landscape in Qatar has sparked significant changes in the realm of cryptocurrency. These evolving laws have set the stage for a dynamic interaction between traditional financial regulations and the decentralized nature of digital currencies. With a keen focus on compliance and oversight, Qatar’s interventions seek to balance innovation and accountability within the burgeoning cryptocurrency market.

– As the regulatory climate continues to evolve, stakeholders in the cryptocurrency space must navigate these new frameworks strategically. Understanding the nuances of Qatar’s regulatory changes is crucial for individuals and businesses involved in the ever-expanding world of digital assets. Adapting to these shifts will not only support the growth of the cryptocurrency sector but also foster greater transparency and trust within the ecosystem.

Rise of Bitcoin Usage Amidst Evolving Laws 📈

The evolving regulatory landscape in Qatar is reshaping the way Bitcoin is being embraced and utilized within the country. As laws adapt to address the growing presence of cryptocurrencies, the rise of Bitcoin as a preferred digital asset is becoming more pronounced. Amidst these changes, individuals and businesses are navigating the evolving legal framework to harness the opportunities presented by Bitcoin while ensuring compliance with regulatory requirements. This dynamic environment is fueling the growth of Bitcoin usage in Qatar, reflecting a shift towards digital currencies influenced by changing laws and regulations.

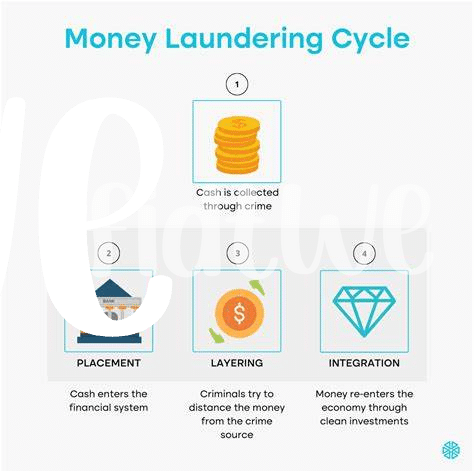

Challenges of Implementing Aml Regulations 🛑

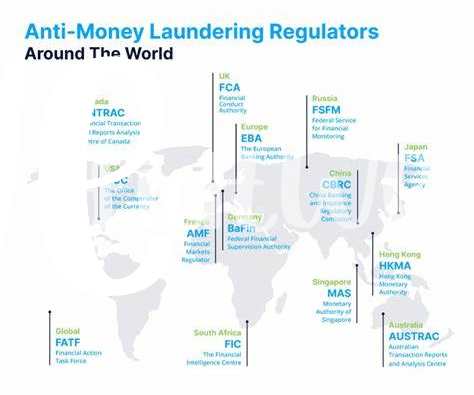

Challenges arise in implementing Anti-Money Laundering (AML) regulations due to the complex nature of ensuring compliance while maintaining the privacy and security of individuals using Bitcoin within Qatar. This involves striking a balance between upholding regulatory requirements and enabling the continued growth of cryptocurrency usage in a rapidly evolving environment. The intricacies of monitoring transactions, conducting customer due diligence, and identifying suspicious activities present significant hurdles for both regulatory authorities and cryptocurrency users alike. As the regulatory landscape continues to shift, the challenge lies in effectively enforcing AML measures without stifling innovation and adoption of digital assets in Qatar.

Impact on Local Bitcoin Trading Platforms 📊

The evolving regulatory landscape in Qatar is significantly impacting local Bitcoin trading platforms. These platforms are facing increased scrutiny and pressure to adhere to stringent anti-money laundering (AML) regulations. Compliance challenges are on the rise, forcing these platforms to adapt their operations to meet the new requirements. As a result, the dynamics of Bitcoin trading within Qatar are shifting, with traders and platforms alike navigating a complex regulatory environment. To learn more about the specific challenges related to Bitcoin AML regulations, you can check out this insightful article on bitcoin anti-money laundering (AML) regulations in Panama.

Future Outlook for Cryptocurrency in Qatar 🔮

The cryptocurrency landscape in Qatar is set to undergo significant changes in the coming years. With evolving regulations and increasing interest in digital currencies, the future outlook for cryptocurrency in Qatar is both promising and challenging. As the regulatory framework continues to develop, it will be crucial for businesses and investors to stay informed and adapt to the changing environment. This shift presents opportunities for innovation and growth within the cryptocurrency sector, paving the way for new developments and advancements in Qatar’s digital economy.

Recommendations for Navigating the Changing Landscape 📝

Navigating the evolving regulatory landscape in Qatar requires adaptability and proactive engagement with legal developments. Understanding the shifting dynamics of cryptocurrency regulations is crucial for individuals and businesses involved in Bitcoin trading. Staying informed about compliance requirements and actively participating in consultations with regulatory authorities can help mitigate risks and ensure a smooth transition. It is essential to establish robust internal AML procedures and regularly update them in line with regulatory changes. Collaborating with legal experts and industry peers can provide valuable insights and best practices for navigating the changing landscape effectively. By taking a proactive approach and embracing regulatory developments, stakeholders can position themselves for success in the dynamic cryptocurrency market.

Please find more information on Bitcoin anti-money laundering (AML) regulations in Peru by visiting the link: bitcoin anti-money laundering (AML) regulations in Peru.