Understanding Bitcoin’s Role in Money Laundering ⚖️

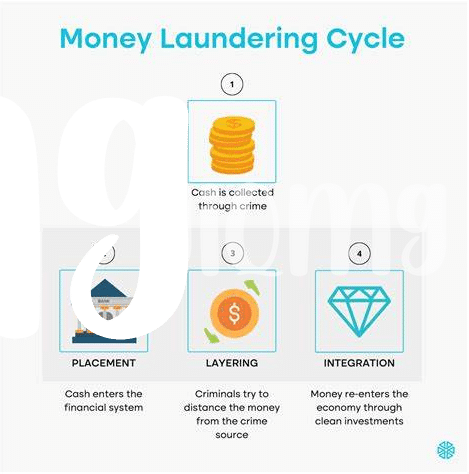

Bitcoin, a digital currency existing outside the traditional banking system, has garnered attention for its potential role in surreptitious financial activities. Its decentralized nature and pseudo-anonymous transactions create opportunities for money laundering schemes to operate under the radar. Understanding how Bitcoin facilitates money laundering is crucial in devising effective regulatory measures to curb illicit financial practices in the digital realm. Delving into the intricacies of Bitcoin’s involvement in money laundering sheds light on the complexities and challenges faced in combatting financial crimes within the cryptocurrency ecosystem.

As authorities grapple with the evolving landscape of financial technologies, staying abreast of Bitcoin’s nuances in money laundering becomes paramount. Enhanced awareness and regulatory oversight are essential to mitigate the risks associated with illicit fund flows utilizing cryptocurrencies. By comprehending the intricacies of Bitcoin’s role in money laundering, policymakers and enforcement agencies can craft tailored strategies to safeguard the integrity of the financial system and uphold anti-money laundering principles in the digital age.

How Bitcoin Aml Regulations Safeguard Against Illicit Activities 🔒

Bitcoin Aml regulations play a crucial role in safeguarding against illicit activities within the cryptocurrency space. By implementing robust compliance measures and monitoring mechanisms, these regulations act as a shield against potential money laundering endeavors. Through stringent identity verification procedures and transaction monitoring, Bitcoin Aml regulations help to mitigate the risks associated with financial crimes, ensuring a more secure ecosystem for all participants. As the digital landscape continues to evolve, staying compliant with these regulations is paramount to maintaining the integrity and trust within the Bitcoin community.

In an ever-changing financial landscape, the importance of Bitcoin Aml regulations cannot be overstated. As regulatory bodies and industry stakeholders work together to enhance compliance standards, the collective effort strengthens the overall resilience of the cryptocurrency market. By embracing technological innovations and international cooperation, the industry is better positioned to detect and deter illicit financial activities. As we look towards the future, the continued evolution of Bitcoin Aml strategies will be crucial in adapting to new challenges and emerging threats, ultimately fostering a more transparent and secure environment for all users.

Challenges in Enforcing Aml Compliance in the Crypto Space 🛡️

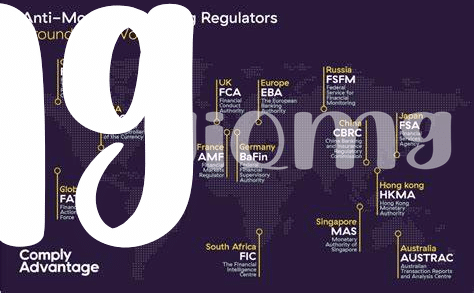

In the rapidly evolving crypto space, enforcing AML compliance poses significant challenges. The decentralized nature of Bitcoin transactions and the pseudonymous identities associated with wallet addresses make it difficult for traditional financial institutions and regulators to monitor and trace illicit activities effectively. Moreover, the global and borderless nature of cryptocurrency transactions further complicates the enforcement of AML regulations across jurisdictions. As the use of cryptocurrencies continues to rise, finding innovative solutions to enhance AML compliance in the crypto space remains a pressing issue for regulators and industry stakeholders alike.

International Cooperation: Strengthening Bitcoin Regulation Efforts 🤝

Achieving effective collaboration on a global scale is paramount in enhancing Bitcoin regulation efforts. By fostering international cooperation 🌍🤝, countries can collectively tackle the challenges posed by money laundering using cryptocurrencies. This unified approach not only strengthens the regulatory framework but also ensures a more robust system to combat illicit activities within the crypto space. To learn more about innovative solutions and compliance challenges in Bitcoin AML regulations, explore the article on bitcoin anti-money laundering (AML) regulations in Turkmenistan available at here.

In an interconnected world where financial transactions transcend borders, building strong partnerships and information-sharing mechanisms is key to staying ahead of money laundering trends. Through coordinated efforts and mutual understanding, countries can proactively address compliance issues and reinforce the integrity of the Bitcoin ecosystem 🤝💡.

Innovations in Aml Technology to Combat Money Laundering 💡

Innovations in Aml Technology to Combat Money Laundering 💡: As the landscape of financial crimes continues to evolve, innovative AML technologies are crucial in staying ahead of money launderers. Advanced analytics and artificial intelligence are being integrated into AML systems to detect suspicious patterns and transactions in real-time, enhancing overall efficacy in combating money laundering. Moreover, blockchain technology itself, the foundation of cryptocurrencies like Bitcoin, is being leveraged to create transparent and immutable transaction records that can aid authorities in tracking illicit financial activities efficiently.

Innovations in AML technology play a pivotal role in the ongoing battle against money laundering, offering a proactive approach to identifying and preventing criminal financial behavior. By harnessing these technological advancements, institutions and regulatory bodies can strengthen their defenses and foster a more secure and compliant financial ecosystem.

The Future Outlook: Evolving Bitcoin Aml Strategies 🌐

In considering the landscape of Bitcoin AML strategies moving forward, it is evident that continuous adaptation and innovation are key to staying ahead of illicit activities. As the cryptocurrency space evolves, so too must regulatory frameworks and compliance practices. Embracing emerging technologies such as blockchain analytics and artificial intelligence will be essential in enhancing the effectiveness of AML efforts. Furthermore, collaboration among international stakeholders is crucial for developing cohesive approaches to combating money laundering through Bitcoin. By fostering a proactive and dynamic approach to AML regulation, the future outlook for Bitcoin strategies appears promising, reflecting a commitment to staying vigilant in the ever-evolving financial landscape.bitcoin anti-money laundering (AML) regulations in Tonga with anchor bitcoin anti-money laundering (AML) regulations in Tunisia.