Current Status of Bitcoin in Gambia 🌍

The adoption of Bitcoin in Gambia has been steadily increasing, with a growing number of individuals and businesses embracing the digital currency for transactions. Despite not having specific regulations in place, the use of Bitcoin is gaining traction as more people recognize its potential benefits for financial inclusion and cross-border transactions. Mobile money platforms are also contributing to the popularity of Bitcoin as a means of transferring value. However, the absence of clear regulatory frameworks poses challenges in ensuring consumer protection and safeguarding against potential risks. With the current status of Bitcoin in Gambia evolving, stakeholders are closely monitoring developments to assess the need for tailored regulations that balance innovation with regulatory oversight.

Potential Impact of Regulation on Bitcoin 💼

The potential impact of regulation on Bitcoin in Gambia holds significant implications for its adoption and use within the country. Establishing clear guidelines and oversight can provide a sense of security and legitimacy to individuals and businesses engaging with Bitcoin. Moreover, regulatory measures can foster trust among users and investors, potentially leading to increased participation in the cryptocurrency market. However, overly restrictive regulations could stifle innovation and hinder the full potential of Bitcoin as a transformative technology. Balancing the need for oversight with fostering growth and innovation poses a crucial challenge for policymakers in shaping the future landscape of Bitcoin in Gambia.

The regulatory framework established in Gambia could serve as a model for other nations navigating the integration of Bitcoin into their economies. By observing and learning from different approaches, countries worldwide can collaboratively refine their regulatory strategies for cryptocurrencies. Understanding the diverse perspectives and experiences of various jurisdictions is essential in developing effective and adaptable regulatory frameworks for the evolving landscape of Bitcoin. This comparative analysis can offer valuable insights into the best practices and pitfalls to avoid in regulating Bitcoin within different geopolitical contexts.

Challenges and Opportunities for Regulation 🚧

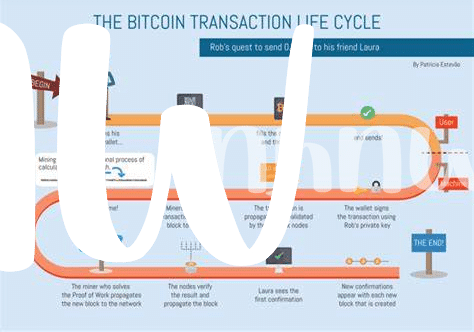

Challenges in regulating Bitcoin in Gambia are as diverse as they are intriguing. On one hand, the decentralized nature of cryptocurrencies presents a hurdle for traditional regulatory frameworks to monitor and enforce compliance. This lack of central authority raises concerns about potential misuse for illegal activities and the need for safeguards to protect consumers. However, these challenges also bring opportunities for innovation in regulatory approaches, fostering a proactive stance towards harnessing the benefits of Bitcoin while mitigating risks. Gaining a deeper understanding of these complexities will be crucial for shaping effective and sustainable regulatory policies in the dynamic landscape of digital currencies.

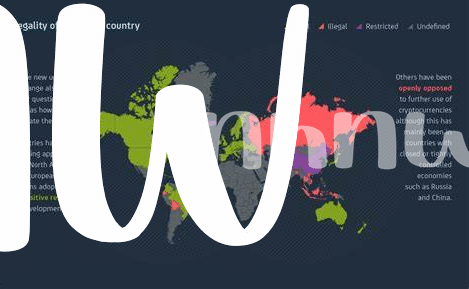

Comparison with Other Countries’ Approaches 🌐

When looking at how other countries approach the regulation of Bitcoin, it becomes evident that there is a wide range of strategies in place. Some nations have embraced cryptocurrencies with open arms, providing clear guidelines for their use and taxation. On the other hand, certain countries have taken a more cautious approach, opting for stringent regulations to mitigate risks such as money laundering and fraud. By examining these various approaches, policymakers in Gambia can gain valuable insights on what has worked well and what pitfalls to avoid when crafting their own regulatory framework for Bitcoin. For further information on legal challenges related to Bitcoin transactions, you can refer to the article on the legal consequences of bitcoin transactions in eswatini.

Public Opinion and Stakeholder Perspectives 🗣️

Public opinion and stakeholder perspectives play a crucial role in shaping the future of Bitcoin regulation in Gambia. Understanding the views and concerns of the general public, businesses, financial institutions, and government agencies is essential for creating effective and sustainable regulatory policies. Stakeholders bring diverse perspectives to the table, raising important questions about consumer protection, financial stability, and innovation in the cryptocurrency space. By actively engaging with these stakeholders, regulators can develop a comprehensive framework that addresses the needs of all parties involved, ultimately fostering a more transparent and inclusive regulatory environment for Bitcoin in the country.

Predictions for the Future of Bitcoin Regulation 🚀

Predicting the future of Bitcoin regulation involves a blend of optimism and uncertainty. As countries navigate the complexities of integrating cryptocurrencies into their legal frameworks, Gambia faces a crucial juncture in shaping its regulatory stance. The evolving landscape of digital currencies poses both challenges and opportunities for policymakers, requiring a delicate balance between fostering innovation and ensuring financial stability. Drawing insights from global approaches can offer valuable lessons for devising effective regulatory measures tailored to Gambia’s unique context.

In the midst of these discussions, public opinion and stakeholder perspectives play a pivotal role in shaping the trajectory of Bitcoin regulation. The voices of various actors, from financial institutions to tech innovators, will influence the strategies adopted by authorities in overseeing cryptocurrency transactions. Looking ahead, the dynamic nature of this emerging asset class suggests that the regulatory environment will continue to evolve, paving the way for a proactive and inclusive approach towards Bitcoin in Gambia.

For more information on the legal consequences of bitcoin transactions in Greece, refer to the legal consequences of bitcoin transactions in Georgia.