🚀 Riding the Bitcoin Wave: Basic Strategies Unpacked

Diving into the world of Bitcoin trading might seem like surfing a giant wave – it’s thrilling but can seem a bit scary at first glance. However, with a few simple strategies, you can ride this digital currency’s ups and downs like a pro. First off, it’s all about knowing when to hop on and off the board. Think of it as buying Bitcoin when prices are lower than usual (that’s your cue to get on the wave) and selling when they peak (that’s when you ride the wave all the way to the shore). But, how do you spot these moments? Keeping a close eye on market trends and news can give you clues. Another golden tip is to start small. You wouldn’t attempt a giant wave on your first day of surfing, right? In Bitcoin trading, this means not putting all your money in at once. It reduces the risk and gives you the chance to learn as you go. Ready for an adventure? Here’s a simple table to help you remember these tips:

| Strategy | Description |

|---|---|

| Timing the market | Buy low, sell high based on market trends |

| Keep informed | Follow news and developments closely |

| Start small | Minimize risk by investing smaller amounts |

By embracing these strategies, you’re setting sail on an exciting journey. Remember, every expert was once a beginner, and with patience and practice, you’ll find your footing and maybe even enjoy the ride.

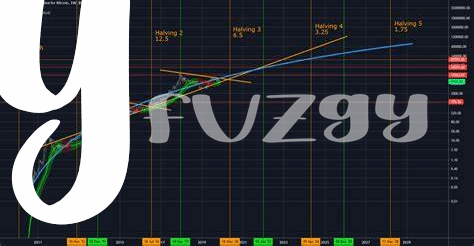

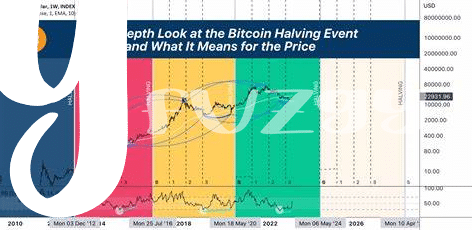

📊 Charting Success: Technical Analysis Simplified

Imagine playing detective but instead of looking for clues in a mystery novel, you’re diving into the world of Bitcoin. This is where technical analysis comes in, acting as our magnifying glass to spot opportunities and avoid traps. By studying past charts and patterns, we can get a sense of where Bitcoin might head next. It’s like trying to predict the weather by looking at the clouds and wind direction; not always 100% accurate, but definitely helpful. Drawing lines and identifying trends might sound complex, but it’s really about getting to know the market’s mood swings. Plus, with practice, anyone can start to see these patterns. Think of it as learning a new language, where each chart tells its own story about what traders think and how they act. For those curious about how this fits into the broader picture of Bitcoin’s journey and its interaction with tech innovations, https://wikicrypto.news/decoding-smart-contracts-bitcoins-future-landscape-in-2024 offers a peek into how countries are pioneering in 2024, enriching your trading playbook.

🚦 Green Light for Altcoins: Diversifying the Portfolio

Imagine you’re at a buffet with all sorts of tasty food. You wouldn’t want to fill your plate with just one dish, right? That’s pretty much the idea when it comes to spreading your investments across different digital coins, including the ones that might not be as famous as Bitcoin but have potential: we call these altcoins. 🍽️ It’s like giving a green light to variety in your investment world. By doing this, you’re not putting all your eggs in one basket (or in this case, all your money in one coin), which can be a smart move. The world of cryptocurrencies is like a rollercoaster 🎢, full of ups and downs, and by investing in a mix of coins, you could smooth out the ride a bit. This strategy can help protect your investment from the big swings that can hit a single currency, making your journey into the future of trading a bit more stable and potentially more profitable. Remember, it’s all about balancing the risks and rewards.

🤖bots and Automatons: Embracing Ai in Trading

Imagine a world where your trading buddy never sleeps, constantly analyzes the markets, and makes decisions faster than any human can blink. Welcome to the era of smart trading partners – AI bots. These clever algorithms dive deep into the sea of market data, spotting trends and opportunities that might escape even the keenest of human eyes. By learning from past patterns, they’re always ready to act, day or night, ensuring no golden chance slips through.

As the future of Bitcoin 💰💹 looms with possibilities, exploring the bitcoin as a legal tender in 2024 opens doors to understanding how AI-driven strategies might redefine success. With these digital geniuses, diversifying your portfolio becomes less about guesswork and more about informed decision-making. Embracing this tech doesn’t just mean staying ahead; it’s about creating a trading fortress that’s agile, informed, and ready for anything the market throws your way. 🚀📊

✨ the Psychic Edge: Leveraging Sentiment Analysis

Imagine having a kind of superpower, a way to peek into what investors around the world are feeling about Bitcoin without asking each one personally. That’s where understanding the mood of the market, or “sentiment analysis,” comes into play. It’s like reading the room before making your move. You don’t need to be a mind reader, though; you just need to know where to look. Social media platforms, news headlines, and even market forums buzz with opinions and emotions that can give you clues. By keeping an eye on these, you can gauge whether the wind is blowing in favor of or against Bitcoin. It’s like catching a wave perfectly with your surfboard, using the collective mood to guide your timing.

| Strategy | Tools | Benefit |

|---|---|---|

| Sentiment Analysis | Social Media, News Aggregators, Forums | Understanding Market Mood |

But it’s not just about following the herd. It’s about understanding the underlying emotions driving market movements. Are people scared, optimistic, or indifferent? By combining this emotional intelligence with your other trading strategies, you can navigate the waters of Bitcoin trading with a more holistic view. It’s like having a compass that tells you more than just the direction—it tells you why the wind blows that way. And in the unpredictable world of Bitcoin, this psychic-like edge could make all the difference, helping you to ride the peaks and avoid the troughs with a bit more grace.

🛡️ Risky Business: Managing the Unpredictables

When it comes to trading, especially with something as unpredictable as Bitcoin, it’s a bit like riding a roller coaster blindfolded. You know there are going to be ups and downs, twists and turns, but you’re not quite sure when they’ll happen. This is where the art of managing the unpredictable comes into play. 🛡️ Think of it as having a safety net while walking a tightrope. It’s all about setting up strategies that help you stay balanced, even if the market swings unexpectedly. One key approach is setting “stop-loss” orders – a way to automatically sell off your investment if it falls to a certain price, helping you avoid a potential bigger loss. Another strategy is to keep a cool head; it’s easy to get swayed by sudden market changes, but patience and not reacting impulsively can often be your best ally.

Diving deeper, another crucial part of dealing with uncertainties is to stay informed. Knowledge is power, and in the crypto world, being up-to-date with the latest trends can make a significant difference. For anyone wanting to get a grasp on the current state of Bitcoin and how it could shape your trading strategies, take a look at bitcoin and smart contracts in 2024. This provides an insightful glimpse into past performances and possible future directions. Furthermore, diversifying your investment portfolio can spread out the risks. Instead of putting all your eggs in one basket, consider splitting your investments across different assets. This way, a downturn in one investment might be balanced out by stability or gains in another. 📈💹 Remember, the goal isn’t just to survive the roller coaster but to emerge on solid ground, ready for the next ride.