Understanding Portfolio Diversification 📊

Imagine you’re at a buffet, filling your plate with a variety of foods instead of just one dish. That’s pretty much what portfolio diversification is about. It’s the idea of spreading your investments across different types of assets, so if one doesn’t perform well, the others might balance it out, keeping your overall investment in a healthier position. It’s like not putting all your eggs in one basket, because if that basket falls, all your eggs break. Diversifying means you might have some eggs in different baskets, so you’re less likely to lose them all at once.

Here’s a simple way to look at it:

| Investment Type | Reason for Including in Portfolio |

|---|---|

| Stocks | Potential for high returns over time |

| Bonds | Steady income, generally safer than stocks |

| Real Estate | Can provide both income and value appreciation |

| Commodities | Can hedge against inflation |

By mixing different kinds of investments, you can aim for a smoother ride. Some days, your stocks might dip, but your bonds or real estate could be doing just fine, saving your portfolio from taking a big hit. It’s not about avoiding risks entirely, but managing them in a way that works best for you. 🔄🔑

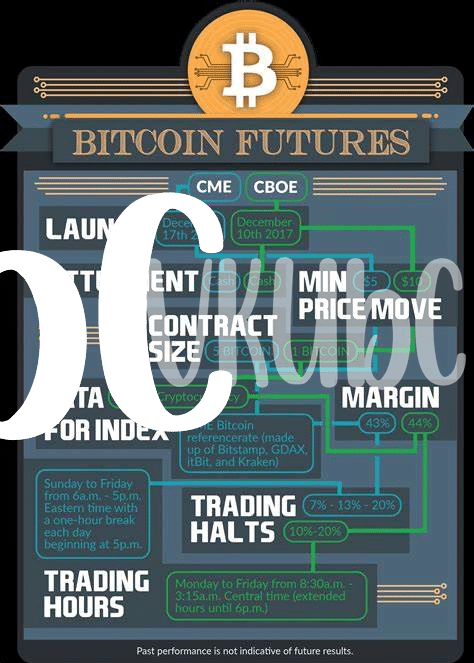

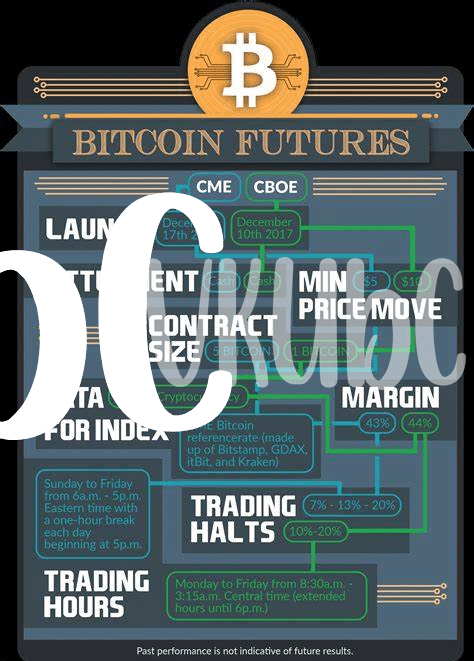

Basics of Bitcoin Futures Explained 📈

Imagine diving into the world of investing with an exciting tool at your fingertips – Bitcoin futures. These aren’t your average investments; think of them as a promise to buy or sell Bitcoin at a future date, at a price that you agree on today. This means if you think Bitcoin’s price will go up, you can set a deal now to buy it later at today’s price, potentially making a profit if the price does go up. It’s a bit like calling dibs on a slice of cake at today’s price, even if you’ll only eat it next week.

This tool isn’t just about making direct profits; it’s also a strategic way to protect your entire investment portfolio. By adding Bitcoin futures, you’re essentially spreading your bets, which can help smooth out the bumps on your investment journey. However, just like any other investment, it’s not without its risks. But don’t let that deter you; with the right strategy, Bitcoin futures can be a powerhouse in your financial arsenal. And to dive deeper into wise investment strategies, check out this valuable resource: https://wikicrypto.news/building-wealth-bitcoin-investment-strategies-for-beginners. Here, you’ll find a treasure trove of information designed to guide beginners on their journey to building wealth through Bitcoin investments.

Risks and Rewards of Bitcoin Futures 🎢

Embarking on the adventure of integrating Bitcoin futures into your portfolio can feel like riding a roller coaster 🎢. On the upside, these futures offer a unique opportunity to hedge against Bitcoin’s price volatility. Essentially, they allow investors to lock in a price for buying or selling Bitcoin in the future, providing a semblance of stability in the turbulent crypto market. This can lead to potentially high rewards as investors might capitalize on price movements to their advantage, without needing to hold the actual digital currency.

However, the journey comes with its set of twists and turns 🔄. The volatile nature of Bitcoin itself poses a significant risk, as the futures are directly linked to its market price. A sudden plunge or spike in Bitcoin’s value could result in substantial losses, making it crucial for investors to approach with caution. Moreover, the complexity of futures contracts requires a good understanding of the market and the ability to anticipate future trends. As thrilling as the potential rewards are, ensuring a well-informed and cautious strategy is paramount for navigating the highs and lows 🛠️.

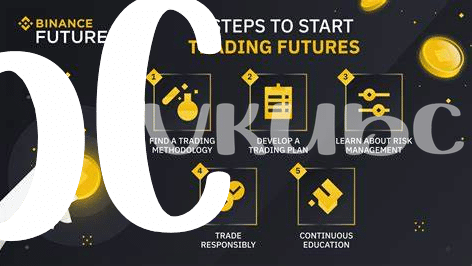

Strategies for Mixing Futures into Your Portfolio 🔄

Mixing in Bitcoin futures into your portfolio can feel like adding a bit of spice to your investment recipe. Imagine your portfolio as a garden. Just as a garden thrives with a variety of plants, your investment can benefit from a mix. Adding Bitcoin futures is like planting a new, exotic seed; it’s exciting but comes with its own care instructions. The key here is balance. You wouldn’t want the new plant to take over the garden, right? Similarly, futures should complement, not dominate, your investment space. It’s like adding a pinch of salt to a dish; too little and you won’t notice it, too much, and it’s all you can taste. Start small, mixing a conservative amount of futures with your traditional investments. This blend allows you to tap into the dynamic world of cryptocurrencies while keeping the stability of standard assets. It’s also pivotal to stay adaptable, just like how weather conditions affect your garden, market trends can shift, and you might need to adjust your strategy. For insights on how Bitcoin investments can play alongside traditional ones and for understanding tax implications, peering into resources provided by the bitcoin community projects investment strategies can equip you with knowledge, helping your investment garden bloom beautifully and sustainably. Remember, patience and continuous learning are your best tools in this journey.

Staying Informed: the Key to Success 🔑

Imagine you’re navigating through a dense, ever-changing jungle; this is akin to venturing into the world of investment, especially with tools like Bitcoin futures. To stay on path and make informed decisions, it’s crucial to keep a keen eye on the ever-evolving landscape. 🌎🔍 The financial markets are like a living, breathing entity, constantly influenced by global events, economic shifts, and technological advancements. To adeptly include Bitcoin futures in your portfolio, immersing yourself in a steady stream of updated knowledge is not just beneficial, it’s essential. Reading up on market trends, understanding how geopolitics affects cryptocurrency prices, and grasping the nuances of technological updates can significantly sway your investment outcomes. 📖💡 Moreover, engaging with a community of like-minded individuals can provide fresh perspectives and insights, which might be the key to unlocking new opportunities or sidestepping potential pitfalls.

Here’s a quick look at why staying informed is pivotal:

| Aspect | Importance |

|---|---|

| Market Trends | Helps in anticipating price movements |

| Economic Indicators | Influences overall market sentiment |

| Technological Advances | Can drastically change the value and usability of cryptocurrencies |

| Community Insights | Provides diverse viewpoints and strategies |

In a world where information is as valuable as currency, arming yourself with the latest insights and trends is the cornerstone of navigating the complex terrain of Bitcoin futures successfully.

Evaluating Your Strategy Periodically 🛠️

Just like taking your car in for a regular check-up to ensure everything is running smoothly, your investment portfolio needs routine evaluations to keep your financial goals on track. This practice is especially important when you’ve mixed in elements like Bitcoin futures, where the market’s ups and downs are more like a roller coaster 🎢. Think of it as a garden 🌱 that you need to tend now and then, pulling out the weeds (underperforming investments) and planting new seeds (promising opportunities) for a bountiful harvest (financial growth).

For more insights into incorporating cryptocurrencies and enhancing your portfolio, make sure to explore bitcoin as a legal tender investment strategies. Keeping yourself updated with the latest trends and shifts in the market is crucial 🔑. Remember, the financial world never sleeps, and staying informed can help you adjust your strategy effectively. Revisiting your investments periodically allows you to stay aligned with your financial goals, adapting to changes in your life or in the market. Remember, a strategy that works today might need tweaking tomorrow, ensuring you’re always steering your financial ship 🚢 towards success.