Understanding Palau’s Regulatory Landscape 🌴

Palau’s regulatory landscape encompasses a unique blend of traditional financial policies and emerging digital trends. As the vibrant palm trees sway in the gentle Pacific breeze, Palau’s approach to regulation reflects a balance between fostering innovation and ensuring stability. Navigating this regulatory terrain requires a deep understanding of the local laws and cultural nuances that shape the financial ecosystem in this tropical paradise. It’s a dynamic environment where fintech and traditional banking converge, creating opportunities for innovation and collaboration within the industry.

Exploring the Rise of Bitcoin in Palau 💰

The emergence of Bitcoin in Palau has sparked a financial revolution, attracting both investors and enthusiasts looking to capitalize on the digital currency trend. With its decentralized nature and potential for lower transaction fees, Bitcoin has gained traction among Palau’s tech-savvy population. As more businesses and individuals adopt Bitcoin as a means of exchange, its presence in Palau’s economy continues to grow, paving the way for new opportunities and challenges in the financial sector.

Benefits and Challenges of Bitcoin Banking 🚀

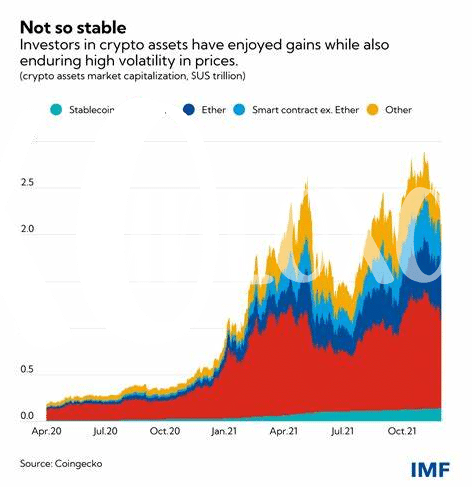

In the dynamic landscape of digital currencies, the incorporation of Bitcoin banking in Palau brings forth a mix of opportunities and obstacles. Embracing Bitcoin offers benefits such as efficient cross-border transactions, financial inclusion for the unbanked population, and potential economic growth. However, challenges lie in regulatory uncertainties, security risks, and volatility in the cryptocurrency market. Striking a balance between harnessing the advantages of Bitcoin banking and mitigating its risks will be crucial for Palau’s financial sector to adapt and innovate in this evolving environment.

Legal Implications for Financial Institutions 🏦

In navigating the regulatory landscape of Palau, financial institutions must carefully consider the legal implications that come with engaging in Bitcoin banking activities. Compliance with relevant laws and regulations is crucial to ensure transparency, security, and accountability in the emerging digital currency space. Understanding and adhering to these legal requirements are essential for safeguarding both the institution and its clients in this rapidly evolving financial ecosystem. To delve deeper into innovative approaches to Bitcoin regulation, particularly in Nigeria, explore the comprehensive insights provided by wikicrypto.news on Bitcoin banking services regulations in Nigeria.

Impact on Palau’s Economic Development 📈

**Output:**

Palau’s increasing adoption of Bitcoin is reshaping its economic landscape, offering new avenues for growth and financial inclusion. The integration of Bitcoin banking services has the potential to attract investment, spur innovation, and enhance financial efficiency across various sectors. This transformative shift not only diversifies Palau’s financial ecosystem but also positions the nation as a progressive player in the global digital economy.

Future Prospects and Opportunities in Bitcoin Banking 🔮

Bitcoin banking in Palau presents exciting future prospects and numerous opportunities for financial institutions to innovate and expand their services. As the adoption of digital currencies continues to grow worldwide, Palau stands at the forefront of embracing this transformative technology within its regulatory framework. By incorporating Bitcoin into its banking sector, Palau not only paves the way for financial inclusion but also fosters a dynamic environment for economic growth and technological advancement. With the support of a robust regulatory framework, Bitcoin banking in Palau has the potential to revolutionize traditional banking practices and drive forward the country’s financial landscape towards a more innovative and secure future.

To explore further regulatory frameworks in different regions, one can refer to the Bitcoin banking services regulations in Oman and the unique approach taken in North Korea. This comparison offers a valuable insight into the diverse strategies countries employ to integrate digital assets into their financial systems, shaping the future of banking on a global scale.