Understanding Aml Regulations and Their Importance 🌍

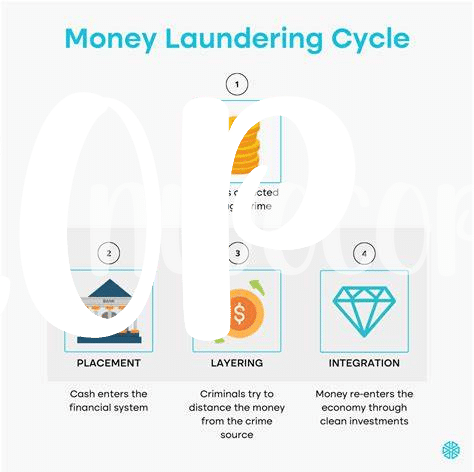

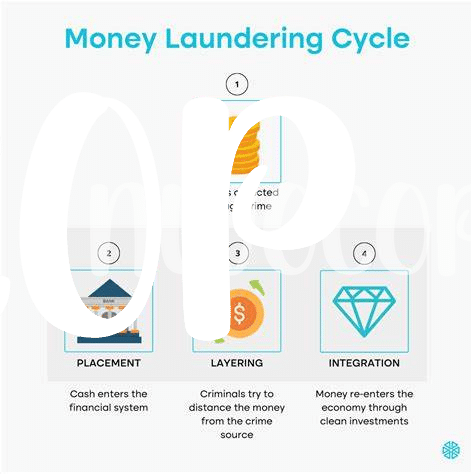

In the modern digital landscape, Anti-Money Laundering (AML) regulations stand as crucial pillars for maintaining the integrity and security of financial transactions worldwide. Understanding these regulations goes beyond mere compliance; it is about safeguarding the financial system from illicit activities and fostering a transparent environment for economic transactions. This understanding is especially pertinent in the realm of Bitcoin and cryptocurrencies, where the decentralized nature of transactions can pose unique challenges for regulatory oversight. By delving into the nuances of AML regulations, individuals and businesses can not only comply with legal requirements but also contribute to the legitimacy and sustainability of the financial ecosystem.

Overview of Bitcoin Regulations in Switzerland ⛓️

Switzerland has emerged as a key player in the regulation of Bitcoin, implementing a comprehensive framework that governs the use of cryptocurrencies within its borders. The country has adopted a progressive stance towards digital assets, aiming to strike a balance between fostering innovation and safeguarding against potential risks. With a clear legal framework in place, Switzerland has become a hub for blockchain and cryptocurrency-related businesses, attracting a growing number of companies seeking a stable and supportive regulatory environment.

As one of the most cryptocurrency-friendly nations in the world, Switzerland has established itself as a leader in shaping the future of digital finance. Through its forward-thinking approach and commitment to regulatory clarity, the country has positioned itself at the forefront of the global blockchain revolution. The Swiss regulatory landscape continues to evolve, offering a dynamic and welcoming environment for Bitcoin enthusiasts and businesses alike.

Compliance Challenges and Common Pitfalls 💼

Navigating through the world of cryptocurrency regulations can be a tricky path, with various compliance challenges and common pitfalls along the way. From ensuring adequate customer due diligence to implementing robust transaction monitoring systems, businesses operating in the Bitcoin industry must stay vigilant to stay ahead of regulatory requirements. Common pitfalls include lack of clarity in regulatory guidelines, inadequate resources for compliance, and the evolving nature of AML regulations. By addressing these challenges head-on and adopting best practices, companies can navigate the legal landscape effectively and build a solid foundation for sustainable growth.

Best Practices for Navigating Legal Requirements 💡

When navigating the legal landscape of AML regulations for Bitcoin in Switzerland, it is essential to adopt proactive measures. Engaging with relevant authorities, staying abreast of regulatory updates, and implementing robust compliance protocols are key. Conducting regular audits, training employees, and utilizing technology solutions can streamline compliance efforts. Emphasizing a culture of compliance within the organization and fostering a transparent approach can enhance regulatory adherence. By prioritizing compliance as a central tenet of operations, businesses can navigate the legal requirements effectively. For further insights on challenges and opportunities in AML regulations, refer to the informative article on bitcoin anti-money laundering (AML) regulations in Syria.

Impact of Aml Regulations on the Bitcoin Industry 💰

Amid the evolving landscape of digital currencies, the implementation of Anti-Money Laundering (AML) regulations has brought about significant repercussions for the Bitcoin industry in Switzerland. These regulations have not only increased transparency and accountability but have also set a higher standard for compliance within the sector. The impact of AML regulations on the Bitcoin industry extends beyond mere regulatory requirements; it has fostered a culture of legitimacy and trust among stakeholders, paving the way for broader acceptance and integration within the traditional financial system. As the industry continues to mature, the symbiotic relationship between AML regulations and Bitcoin will undoubtedly shape its future trajectory and adoption on a global scale.

Future Outlook and Potential Regulatory Changes 🚀

Considering the ever-evolving nature of regulatory frameworks, the future outlook for Bitcoin compliance in Switzerland is poised for potential changes. As the industry continues to mature and garner more attention from regulators, it is crucial for businesses to stay abreast of any upcoming regulatory updates. These changes could impact operational practices, compliance requirements, and reporting obligations. Staying proactive and remaining informed about potential regulatory shifts will be key in navigating the legal landscape effectively. Adhering to best practices and maintaining a flexible approach will be essential in adapting to any forthcoming regulatory changes in the Bitcoin sector. For more insights on Bitcoin anti-money laundering (AML) regulations in Switzerland, check out the detailed guidelines on bitcoin anti-money laundering (AML) regulations in Sri Lanka.