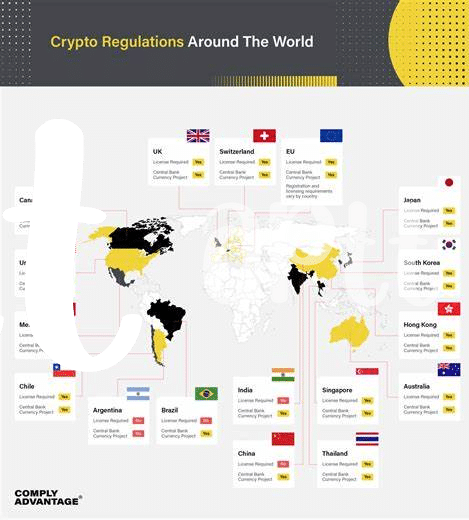

Understanding the Regulatory Landscape 🌍

In today’s ever-evolving landscape, the world of cryptocurrency exchange licensing can seem like a maze of regulations and requirements. Navigating this terrain requires a keen understanding of the regulatory framework that governs the industry. From identifying the key players to staying abreast of rapidly changing laws, grasping the nuances of the regulatory landscape is crucial for any exchange looking to operate successfully in the market. By unpacking the complexities and shedding light on the various regulatory bodies involved, aspiring exchanges can better position themselves to navigate the twists and turns of compliance with confidence and clarity.

Key Requirements for Licensing 📝

Understanding the Regulatory Landscape is crucial for navigating the complex world of cryptocurrency exchange licensing. It is essential to be aware of the various laws and guidelines set forth by regulatory bodies to ensure compliance and legitimacy in the market.

When diving into the realm of licensing, there are several key requirements that must be met. From detailed documentation to financial stability, these requirements serve as the foundation for obtaining a license to operate a cryptocurrency exchange. Understanding and fulfilling these requirements are essential steps in the journey towards becoming a licensed and reputable exchange platform.

Navigating the Application Process 🗺️

Navigating the application process for cryptocurrency exchange licensing can be a daunting journey for many. With various forms to fill out, documents to compile, and regulations to adhere to, the path may seem intricate 🌍. However, breaking down the process step by step can simplify the journey. Start by familiarizing yourself with the specific requirements set by the regulatory authorities. Gather all necessary information and ensure that your application is complete and accurate. Communicate openly with the licensing authorities to address any questions or concerns promptly. By staying organized and proactive, you can navigate the application process with confidence and efficiency 🗺️.

Ensuring Compliance with Anti-money Laundering Regulations 💰

Ensuring compliance with anti-money laundering regulations is a crucial aspect of operating a cryptocurrency exchange. By implementing robust monitoring and reporting mechanisms, exchanges can detect and prevent suspicious transactions, thereby safeguarding the integrity of the financial system. It is essential for exchange operators to stay abreast of the evolving regulatory landscape and continuously improve their AML processes to mitigate risks effectively. Partnering with reputable financial institutions and leveraging advanced technological solutions can enhance the efficacy of AML compliance efforts. By fostering a culture of transparency and accountability, exchanges can build trust with regulators and customers alike, ensuring long-term sustainability in the dynamic cryptocurrency market. For further insights on cryptocurrency exchange licensing requirements in Saint Vincent and the Grenadines, visit cryptocurrency exchange licensing requirements in Saint Vincent and the Grenadines.

Handling Local Legal Challenges 🛡️

Local legal challenges can often present hurdles for cryptocurrency exchanges operating in Russia. Navigating varying interpretations of laws and regulations, as well as potential uncertainties in enforcement, requires a strategic approach. Engaging with local legal experts who understand the nuances of the Russian legal system can be crucial. By proactively addressing these challenges and staying informed about shifting legal landscapes, cryptocurrency exchanges can better position themselves to operate compliantly and mitigate potential risks that may arise. In a complex regulatory environment, staying adaptable and responsive to legal challenges is key to long-term success.

Maintaining Transparency and Accountability 🕵️♂️

Maintaining transparency and accountability in the realm of cryptocurrency exchange licensing is paramount to fostering trust and credibility within the market. By adhering to stringent reporting standards and implementing robust auditing mechanisms, cryptocurrency exchanges can reassure both users and regulators of their commitment to ethical practices. Embracing transparency not only enhances regulatory compliance but also contributes to the overall integrity of the digital asset ecosystem.

For more information on cryptocurrency exchange licensing requirements in Rwanda, visit cryptocurrency exchange licensing requirements in Rwanda. It is essential to stay informed about global regulations, such as the cryptocurrency exchange licensing requirements in Portugal, to ensure a comprehensive understanding of the evolving landscape.