Understanding 🧐 Aml Regulations in Nicaragua

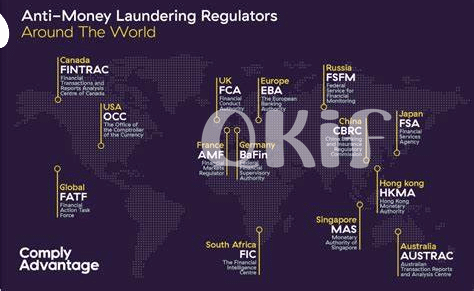

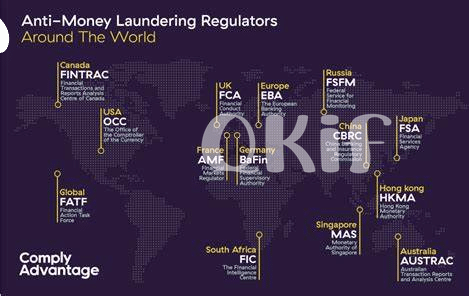

Nicaragua has specific regulations in place to combat money laundering, an essential aspect of financial security. Understanding these AML laws is crucial for anyone involved in Bitcoin transactions within the country. By familiarizing oneself with the intricacies of these regulations, individuals and businesses can ensure compliance and operate within the legal framework. Being aware of the requirements and restrictions set forth by Nicaraguan AML laws is the first step towards navigating the intersection of cryptocurrency and regulatory compliance effectively.

Impact of 📉 Aml Laws on Bitcoin Transactions

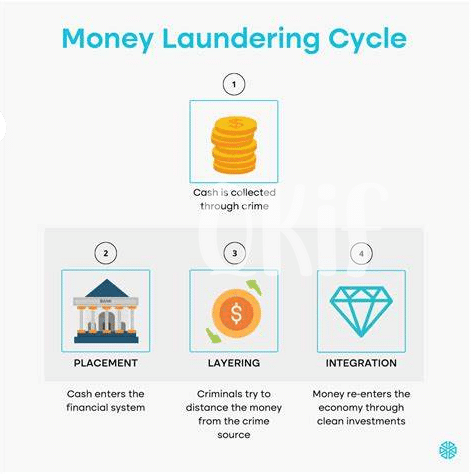

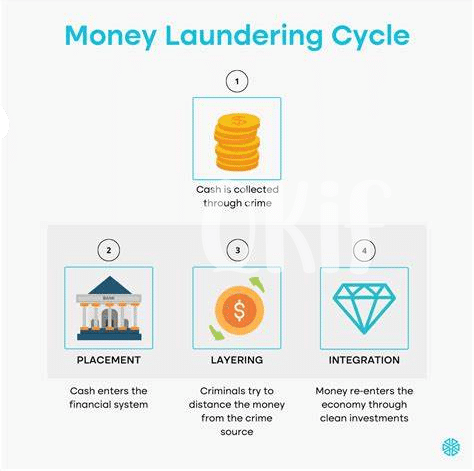

The regulations around Anti-Money Laundering (AML) laws can have a significant impact on Bitcoin transactions in Nicaragua, influencing how individuals and businesses can engage with this digital currency. These laws are designed to prevent illicit activities, such as money laundering and terrorist financing, within the cryptocurrency space. Compliance with AML regulations may require additional verification steps for users, affecting the speed and ease of Bitcoin transactions. Moreover, the implementation of AML laws can lead to increased scrutiny and oversight, potentially influencing the overall user experience and adoption of Bitcoin in Nicaragua.

As individuals and businesses navigate these complexities, understanding the implications of AML laws on Bitcoin transactions becomes crucial. Compliance with these regulations not only ensures legality but also fosters trust and credibility in the cryptocurrency ecosystem. By staying informed and implementing appropriate strategies, stakeholders can adapt to the changing landscape of AML laws and optimize their use of Bitcoin in Nicaragua.

Challenges in 🔄 Complying with Aml Requirements

Navigating the AML requirements in Nicaragua can present numerous challenges for individuals and businesses operating in the Bitcoin space. The complexities lie in the ever-evolving nature of these regulations, making it difficult to stay compliant amidst changing frameworks and guidelines. Furthermore, the decentralized and pseudonymous nature of Bitcoin transactions adds another layer of complexity, as it can be challenging to trace and verify the source of funds, which is a crucial aspect of AML compliance.

To successfully navigate these challenges, businesses must implement robust monitoring and reporting mechanisms to ensure transparency and accountability in their Bitcoin transactions. Additionally, staying informed about the latest developments in AML laws and collaborating with legal experts can help navigate the intricate landscape of regulatory compliance effectively.

Strategies for 🛡️ Navigating Aml Complexities

For navigating the complexities of AML laws in Nicaragua concerning Bitcoin, it is essential to develop comprehensive strategies that balance regulatory compliance with operational efficiency. One effective approach is to implement robust identity verification protocols for all cryptocurrency transactions to ensure transparency and traceability. Additionally, utilizing advanced blockchain analytics tools can help detect and investigate suspicious activities in real-time, enhancing overall compliance efforts. Collaborating with industry peers and participating in information-sharing networks can provide valuable insights and best practices for navigating the evolving AML landscape effectively.

Incorporating automated monitoring systems can streamline compliance processes and enable prompt responses to regulatory updates or emerging threats. By fostering a culture of compliance within the organization and investing in continuous training for staff, companies can proactively address AML challenges while staying ahead of evolving regulatory expectations. Engaging with legal experts specializing in AML compliance can offer tailored guidance and support in developing and implementing effective strategies to navigate the intricacies of AML regulations in the Bitcoin space confidently. [Insert the provided link to gain further insights on Bitcoin anti-money laundering (AML) regulations in Myanmar.]

Importance of ⚖️ Legal Counsel in Aml Compliance

Navigating the complexities of Anti-Money Laundering (AML) laws in the cryptocurrency realm requires a keen understanding of the legal landscape. Legal counsel specialized in AML compliance serves as a crucial guide in ensuring adherence to the ever-evolving regulations. Their expertise not only helps in deciphering the intricate legal jargon but also in devising tailored strategies to maneuver through the compliance requirements effectively. By enlisting the support of legal professionals well-versed in AML laws, businesses dealing with Bitcoin transactions can proactively address potential compliance pitfalls and safeguard their operations from regulatory violations. In the dynamic environment of AML regulations, legal counsel emerges as a valuable asset in steering enterprises towards sustainable compliance practices that align with the regulatory framework.

Future Outlook 🌟 for Aml and Bitcoin in Nicaragua

As Nicaragua continues to navigate the evolving landscape of AML regulations in the realm of Bitcoin, the future outlook appears promising yet challenging. The intersection of digital currencies and financial compliance is expected to witness further regulatory developments and enhancements. With increased scrutiny and enforcement measures, the onus lies on businesses and individuals to adapt and adhere to these evolving AML requirements. Collaboration between authorities, industry players, and legal counsel will play a pivotal role in shaping the future dynamics of AML and Bitcoin interactions in Nicaragua. Embracing technological advancements and proactive compliance strategies will be key in fostering a secure and compliant environment for cryptocurrency transactions.