Understanding Aml Regulations in Sweden 🇸🇪

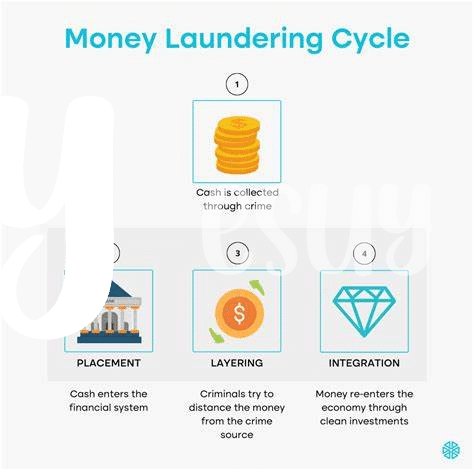

Navigating through the intricate landscape of AML regulations in Sweden requires a keen understanding of the legal frameworks governing virtual currencies. Compliance obligations are shaped by the country’s evolving regulatory environment, necessitating a proactive approach to ensure adherence to established guidelines. In Sweden, AML regulations for Bitcoin businesses are designed to mitigate the risks of financial crimes, including money laundering and terrorist financing, emphasizing the importance of robust compliance measures tailored to the cryptocurrency sector. Stakeholders must navigate these regulatory requirements with diligence and vigilance to uphold the integrity of their operations within the Swedish market.

As the regulatory landscape continues to evolve, staying abreast of updates and amendments to AML guidelines is essential for Bitcoin businesses seeking to maintain compliance. Implementing a comprehensive understanding of the specific AML requirements in Sweden is pivotal for businesses operating within the cryptocurrency space, fostering transparency and accountability in their financial activities. Adhering to these regulations not only ensures legal compliance but also fosters trust and credibility among stakeholders, reinforcing the reputation of Bitcoin businesses as responsible and law-abiding entities in Sweden’s financial ecosystem.

Key Challenges Faced by Bitcoin Businesses 💼

Bitcoin businesses in Sweden encounter a multifaceted landscape of challenges, ranging from regulatory uncertainties to evolving compliance standards. Navigating the intricacies of AML requirements can be particularly daunting, as ensuring transparency and accountability becomes paramount. The dynamic nature of the cryptocurrency industry adds an extra layer of complexity, with the need to stay ahead of emerging risks and regulatory expectations. Maintaining robust AML procedures while balancing operational efficiency is a delicate tightrope that businesses must walk to uphold integrity and trust within the ecosystem. Implementing comprehensive risk management strategies and fostering a culture of compliance are essential pillars in overcoming these hurdles and thriving in the evolving regulatory environment.

Importance of Compliance Procedures 📝

Compliance procedures play a crucial role in ensuring the integrity and legitimacy of Bitcoin transactions in Sweden. By adhering to robust compliance measures, businesses can mitigate the risks associated with money laundering and illicit activities. These procedures not only protect the reputation of the industry but also instill trust among customers and regulatory bodies. Implementing effective compliance protocols is essential for the long-term sustainability of Bitcoin businesses, fostering a secure and transparent ecosystem for all participants involved in the crypto industry.

Best Practices for Aml in the Crypto Industry 💡

In the ever-evolving landscape of the crypto industry, implementing robust Anti-Money Laundering (AML) practices is crucial for maintaining trust and security. One key best practice is conducting thorough customer due diligence to ensure compliance with regulations and prevent illicit activities. Additionally, having a system in place for monitoring transactions and reporting any suspicious behavior is essential in safeguarding the integrity of the cryptocurrency market. By proactively staying informed about regulatory changes and industry developments, companies can stay ahead of potential risks and demonstrate a commitment to upholding AML standards.

To dive deeper into the complexities of navigating AML compliance for Bitcoin, check out this informative resource on bitcoin anti-money laundering (AML) regulations in Sri Lanka: bitcoin anti-money laundering (AML) regulations in Sri Lanka.

Resources for Staying Updated on Regulations 📚

Staying ahead of regulatory changes is crucial for Bitcoin businesses in Sweden. Keeping abreast of updates can be challenging due to the rapidly evolving nature of the crypto industry. To navigate this, utilizing a variety of reliable resources is essential. Engaging with regulatory bodies, attending industry conferences, and joining relevant forums can provide valuable insights into the latest developments in AML compliance. Additionally, partnering with legal experts specializing in cryptocurrency regulations can offer tailored guidance to ensure ongoing adherence to the changing landscape. By leveraging these resources, businesses can proactively adapt their compliance procedures, safeguarding their operations in the dynamic regulatory environment.

Future Trends in Aml Compliance for Bitcoin 🚀

As the landscape of AML compliance for Bitcoin continues to evolve, several future trends are emerging. One key trend is the increased focus on transaction monitoring tools and technologies to enhance detection capabilities and streamline compliance processes. Moreover, regulatory authorities are anticipated to introduce more stringent guidelines and regulations to address emerging risks and vulnerabilities in the cryptocurrency space. Collaboration between industry players and regulatory bodies is also expected to strengthen, fostering a more unified approach towards AML compliance in the Bitcoin sector.

For more information on Bitcoin anti-money laundering (AML) regulations in Sudan, please refer to the official guidelines provided by the regulatory authorities. [Bitcoin anti-money laundering (AML) regulations in South Sudan](). Stay informed and proactive in adapting to these evolving AML frameworks to ensure compliance and integrity in your Bitcoin operations.