Regulatory Landscape 🌍

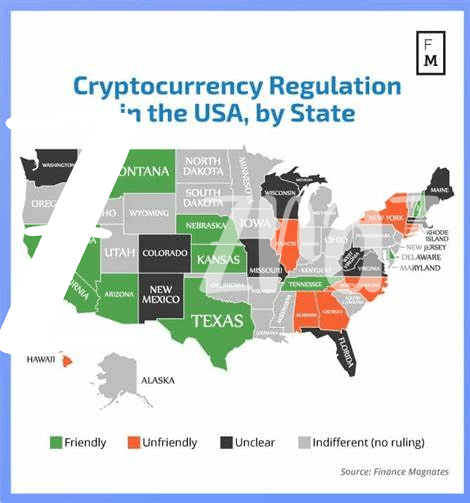

The regulatory landscape surrounding Bitcoin investment funds in the United States is a intricate web of rules and guidelines set forth by various regulatory bodies. Navigating these requirements can be complex, requiring a nuanced understanding of both federal and state regulations to ensure compliance. Additionally, staying abreast of any updates or changes to these regulations is crucial to operating within the boundaries of the law and avoiding potential legal pitfalls.

Compliance Challenges 🕵️♂️

Navigating the intricate web of regulatory requirements in the United States poses a significant challenge for Bitcoin investment funds. Compliance with ever-evolving laws and guidelines demands a meticulous approach and constant vigilance. The landscape is further complicated by the need to balance innovation with adherence to established norms. Developing strategies to address these compliance challenges is essential for the long-term viability and success of investment funds operating in the cryptocurrency space. In an environment where regulatory scrutiny is intensifying, staying ahead of the curve is not just advantageous; it’s imperative.

While the allure of the cryptocurrency market is undeniable, the stringent compliance demands it imposes cannot be overlooked. Each regulatory hurdle represents an opportunity to enhance transparency and build trust with investors, underscoring the importance of proactive compliance management. By navigating these challenges effectively, Bitcoin investment funds can not only mitigate risks but also establish themselves as reliable and compliant players in the evolving financial landscape. Embracing compliance as a strategic priority is key to unlocking the full potential of digital asset investment opportunities and safeguarding investor interests.

Sec Scrutiny 🔍

The Securities and Exchange Commission (SEC) plays a crucial role in scrutinizing the operations of Bitcoin investment funds in the US. With a focus on investor protection and market integrity, the SEC closely examines the activities of these funds to ensure compliance with regulatory requirements. This scrutiny involves thorough assessments of fund structures, operations, disclosures, and adherence to relevant laws. Regulatory transparency and cooperation with the SEC are essential for Bitcoin investment funds to navigate the complex regulatory landscape and establish trust with investors.

Custodial Requirements 🔒

Navigating the landscape of custodial requirements in the realm of Bitcoin investment funds entails fostering a secure environment for storing digital assets. Implementing robust protocols and technologies to safeguard these funds is imperative to instill trust and confidence among investors. By prioritizing stringent custodial measures, investment funds can effectively mitigate risks and reinforce the integrity of their operations. It’s a pivotal aspect that underpins the foundation of investor protection and regulatory compliance in this evolving landscape.

Source: Bitcoin Investment Funds Regulation in United Kingdom

Investor Protection Measures 💰

Investor protection measures ensure that individuals investing in Bitcoin funds are safeguarded against potential risks and fraudulent activities. Regulations such as disclosure requirements, fund valuations, and audits play a crucial role in providing transparency and accountability to investors. Additionally, strict compliance with anti-money laundering (AML) and know your customer (KYC) regulations helps in preventing illegal activities and maintaining the integrity of the investment environment. These measures not only protect investors’ interests but also contribute to building trust and credibility in the market.

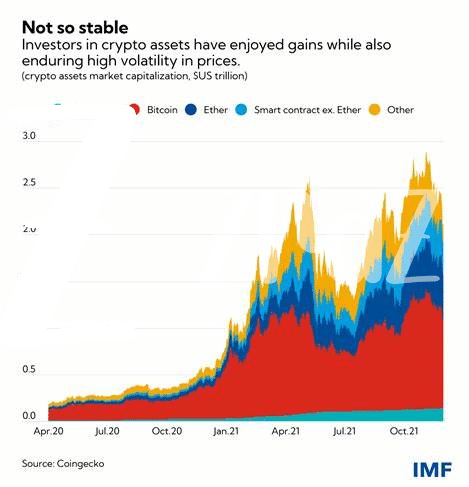

Future Outlook 🚀

The future outlook for Bitcoin investment funds in the United States is filled with both challenges and opportunities. As the regulatory landscape continues to evolve, fund managers must stay nimble and adaptive to navigate the changing landscape. Compliance challenges will remain a key focus, as regulators scrutinize the industry closely. With increased SEC scrutiny and stringent custodial requirements, fund managers will need to prioritize investor protection measures to build trust and credibility. Looking ahead, the future of Bitcoin investment funds in the U.S. appears promising, with potential for growth and innovation in the digital asset space.

Bitcoin investment funds regulation in Venezuela is also a crucial aspect to consider when evaluating international opportunities and compliance standards.