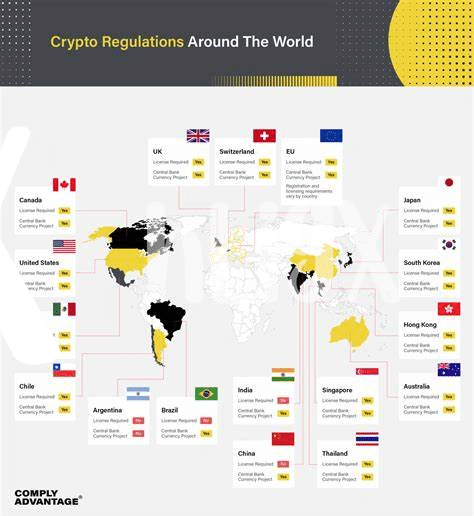

Overview of Cryptocurrency Regulations 🌐

Cryptocurrency regulations play a crucial role in shaping the landscape of digital assets in Hungary. The framework governing these regulations aims to provide clarity and security for investors and users alike. By understanding and adhering to these guidelines, cryptocurrency exchanges can operate within the boundaries set by the authorities, ensuring a safe and compliant environment for all stakeholders involved. This overview delves into the essential aspects of cryptocurrency regulations in Hungary, shedding light on the key components that govern the industry and influence market dynamics.

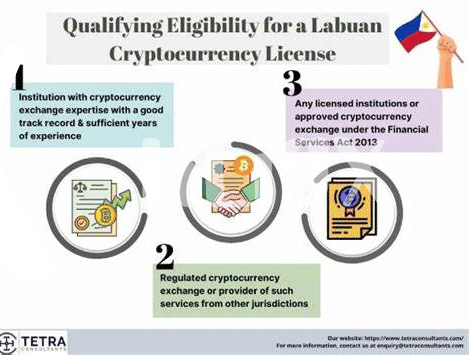

Licensing Requirements for Exchanges 💼

Navigating the world of cryptocurrency exchanges can be a complex journey, especially when it comes to licensing requirements. Understanding the specific regulations set in place is crucial for exchanges looking to operate within the legal framework. This involves obtaining the necessary licenses from the relevant authorities, which may vary depending on the nature and scale of the exchange’s operations. Compliance with these licensing requirements not only ensures legality but also helps build trust with users and stakeholders.

For cryptocurrency exchanges in Hungary, adhering to licensing requirements is essential for establishing credibility and longevity in the market. By obtaining the required licenses, exchanges demonstrate their commitment to transparency and accountability, which are vital in the fast-evolving landscape of digital currencies. Moreover, meeting these obligations paves the way for a more secure and regulated environment where both operators and users can engage with confidence and peace of mind.

Compliance with Anti-money Laundering Laws 💰

Cryptocurrency exchanges operating in Hungary must adhere to stringent Anti-money Laundering (AML) laws to prevent illicit financial activities. Implementing effective AML measures entails thorough customer due diligence, ongoing transaction monitoring, and reporting suspicious activities to relevant authorities. By conducting KYC (Know Your Customer) checks and adopting robust AML policies, exchanges can safeguard against potential risks and ensure compliance with regulatory requirements. Staying vigilant and proactive in detecting and combating money laundering activities is crucial for maintaining a secure and trusted cryptocurrency trading environment in Hungary.

As part of their AML efforts, cryptocurrency exchanges in Hungary are required to uphold strict regulatory standards to mitigate the risks associated with money laundering and terrorist financing. By following AML guidelines and implementing appropriate controls, exchanges can contribute to the overall integrity of the financial system and protect both their customers and the broader market from illicit activities. Emphasizing transparency, accountability, and cooperation with law enforcement agencies is essential for cryptocurrency exchanges to uphold the principles of AML compliance and foster a culture of regulatory compliance within the industry.

Tax Implications for Cryptocurrency Transactions 💸

Cryptocurrency transactions can have tax implications that vary based on the jurisdiction and the nature of the transaction. Understanding how cryptocurrency is classified for tax purposes, whether as property, currency, or commodity, is crucial for ensuring compliance with tax laws. In Hungary, individuals and businesses involved in cryptocurrency transactions may be subject to income tax, capital gains tax, or value-added tax, depending on the specific circumstances. Keeping accurate records of transactions and seeking professional advice can help navigate the complex landscape of taxation in the cryptocurrency space. For more detailed information on tax implications for cryptocurrency transactions in Hungary, you can refer to this comprehensive guide on legal compliance for cryptocurrency exchanges.

The tax treatment of cryptocurrency transactions continues to evolve globally, with regulatory bodies adapting their approaches to address the challenges posed by decentralized digital assets. It is essential for cryptocurrency exchanges and market participants to stay informed about tax laws and reporting requirements to mitigate risks and ensure compliance. Collaborating with tax professionals and engaging with regulatory authorities can help clarify any uncertainties and establish a framework for transparent tax practices in the cryptocurrency ecosystem. As the regulatory environment around cryptocurrency taxation matures, proactive engagement and adherence to best practices will be key to navigating the evolving landscape effectively.

Handling Customer Data and Privacy Concerns 🔒

When it comes to safeguarding customer data and privacy within the realm of cryptocurrency exchanges, stringent measures must be in place. Ensuring encrypted communications and secure storage systems are just the starting points. With cyber threats on the rise, implementing robust identity verification processes and adhering to data protection regulations is crucial. Transparency and clarity regarding how customer information is handled not only promotes trust but also mitigates potential risks of data breaches and privacy violations.

Future Outlook and Upcoming Regulatory Changes 🚀

As the cryptocurrency landscape continues to evolve, the future outlook for regulatory changes in Hungary is poised to shape the operations of exchanges. The government is actively considering updates to existing laws to adapt to the rapid advancements in digital assets. This forward momentum signals a commitment to establishing a robust regulatory framework that balances innovation with investor protection.

For more information on cryptocurrency exchange licensing requirements in Guyana, visit the official guidelines provided by the government cryptocurrency exchange licensing requirements in Guyana. Stay informed about the latest developments as the regulatory landscape in Hungary evolves to meet the needs of the growing cryptocurrency market.