Understanding Bitcoin Regulations 📜

Bitcoin regulations in New Zealand provide a framework for the legal operation of cryptocurrency transactions within the country. Understanding these regulations is crucial for individuals and businesses engaging in Bitcoin transactions. The regulations set out guidelines for the buying, selling, and trading of Bitcoin, ensuring transparency and accountability in the digital currency market. By navigating these regulations effectively, stakeholders can operate within the legal boundaries and contribute to the growth of the cryptocurrency ecosystem in New Zealand.

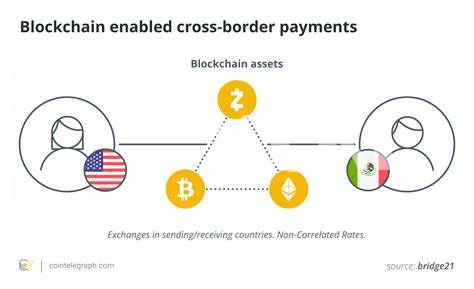

Impact of Cross-border Transactions 💸

The global nature of Bitcoin transactions presents a dynamic landscape where financial borders become blurred. The decentralized nature of cryptocurrencies allows for swift and secure cross-border transactions, challenging traditional banking systems. These transactions can have both positive and negative impacts, offering opportunities for financial inclusivity while also posing risks of regulatory non-compliance and fraud. As the volume of cross-border Bitcoin transactions continues to rise, the need for clear regulatory frameworks becomes increasingly crucial to ensure transparency and security in the digital financial ecosystem.

In navigating the complexities of cross-border Bitcoin transactions, it is essential for businesses and individuals to stay informed about regulatory requirements and compliance protocols. Understanding the legal obligations and implications of engaging in cross-border transactions is paramount to mitigating risks and fostering trust in the evolving landscape of digital finance. By adopting best practices and embracing regulatory guidelines, stakeholders in the Bitcoin ecosystem can contribute to the sustainable growth and integrity of cross-border transactions within the legal frameworks of respective jurisdictions.

Compliance Requirements for Businesses 📋

For businesses engaging in cross-border Bitcoin transactions, adhering to compliance requirements is crucial. By implementing robust KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures, businesses can ensure they are operating within the legal frameworks set out by regulatory authorities. It is essential for businesses to stay updated on any changes or additions to these requirements to mitigate the risk of non-compliance. Additionally, maintaining detailed records of transactions and reporting any suspicious activities are key aspects of regulatory compliance. Collaborating with legal experts or consultants specializing in blockchain and cryptocurrency laws can provide valuable insights and guidance for businesses navigating the complex landscape of cross-border Bitcoin transactions. By prioritizing compliance, businesses can not only build trust with their customers but also safeguard their operations from potential legal implications.

Risks Associated with Legal Ambiguities ⚖️

Navigating the realm of Bitcoin cross-border transactions in New Zealand can be fraught with risks due to the legal ambiguities that surround this innovative form of currency exchange. The lack of clear regulatory frameworks and oversight opens the door to potential pitfalls for both businesses and individual users engaging in international transactions. Uncertainties in legal interpretations can lead to inadvertent violations and expose transacting parties to legal challenges and financial losses. It is crucial for stakeholders to stay informed and vigilant in navigating these murky waters to mitigate the risks associated with legal uncertainties.

For more insights on best practices for sending money abroad with Bitcoin, check out this resource on bitcoin cross-border money transfer laws in the Netherlands: bitcoin cross-border money transfer laws in Netherlands.

Case Studies of Successful Transactions 📊

Bitcoin has successfully facilitated cross-border transactions for businesses in New Zealand, showcasing the potential of digital currencies to streamline international trade and transactions. These case studies highlight instances where businesses have leveraged Bitcoin to overcome traditional payment barriers, such as high fees and lengthy processing times. For example, a local e-commerce company was able to expand its customer base globally by accepting Bitcoin, enabling seamless and secure transactions with customers from different countries. Additionally, a tech startup utilized Bitcoin to receive funding from overseas investors, demonstrating the efficiency and accessibility of cross-border investments through cryptocurrency. These successful transactions not only illustrate the practical applications of Bitcoin in a global context but also emphasize the importance of adapting to digital financial innovations to thrive in an increasingly interconnected business landscape.

Future Outlook on Regulatory Developments 🚀

In the ever-evolving landscape of Bitcoin cross-border transactions, regulatory developments play a crucial role in shaping the future trajectory of this digital currency. As countries around the world grapple with the challenges and opportunities presented by the rise of cryptocurrencies, New Zealand stands at a pivotal juncture in defining its stance on Bitcoin transactions. The future outlook on regulatory developments is marked by a delicate balance between promoting innovation and ensuring consumer protection. As policymakers continue to navigate this complex terrain, the regulatory framework is expected to undergo significant refinements to adapt to the dynamic nature of the crypto market. Stay tuned for the latest updates on Bitcoin cross-border money transfer laws in Nauru, and explore the framework in Namibia for a comprehensive understanding of global regulatory trends.