Overview of Cryptocurrency Laws in Colombia 🇨🇴

Colombia has embraced digital currencies, with a regulatory environment that acknowledges the existence of cryptocurrencies. While not formally recognized as legal tender, cryptocurrencies are not explicitly prohibited either. The country’s approach to crypto laws is evolving, with a focus on consumer protection and preventing money laundering. As such, individuals and businesses operating in the cryptocurrency space in Colombia should stay informed about regulatory updates and compliance requirements to navigate the legal landscape effectively.

Regulatory Framework and Compliance Requirements 📜

A solid understanding of Colombia’s cryptocurrency regulations is vital for businesses and investors to navigate the evolving landscape. Complying with the regulatory framework ensures legitimacy and fosters trust within the sector. The compliance requirements set by authorities aim to uphold transparency and security, safeguarding stakeholders from fraudulent activities. By aligning with these guidelines, cryptocurrency entities can operate ethically and contribute to the market’s overall stability and growth.

Legal Challenges and Emerging Trends ⚖️

Colombia’s evolving landscape of cryptocurrency laws presents a dynamic arena fraught with legal challenges and promising emerging trends. The interplay of existing regulations and the need to adapt to the fast-paced nature of digital currencies poses unique hurdles for both authorities and industry stakeholders. Regulatory clarity, enforcement mechanisms, and the balancing act between innovation and consumer protection stand out as prominent issues shaping the legal framework surrounding cryptocurrencies in Colombia. Additionally, the emergence of new technologies and financial instruments in the crypto space heralds a shifting landscape where traditional legal paradigms may need to be reexamined and adapted.

As the legal challenges continue to unfold, the cryptocurrency sector in Colombia is witnessing a confluence of emerging trends that highlight the industry’s potential for growth and disruption. From the rise of decentralized finance (DeFi) platforms to the increasing prevalence of non-fungible tokens (NFTs), innovative solutions and novel business models are reshaping the traditional notions of finance and investment. These trends not only reflect the adaptability of the digital asset ecosystem but also underscore the need for proactive legal frameworks that can accommodate and regulate the changing dynamics of the cryptocurrency landscape.

Impact on Cryptocurrency Businesses and Investors 💼

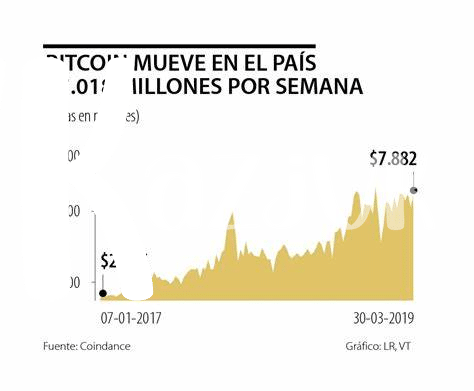

The evolving landscape of cryptocurrency laws in Colombia has significant implications for businesses and investors navigating this space. With regulatory clarity and compliance measures shaping the operating environment, stakeholders must stay abreast of legal requirements to mitigate risks and foster growth. The impact on cryptocurrency businesses and investors is multifaceted, influencing operational strategies, investment decisions, and market dynamics. As Colombia refines its approach to regulating cryptocurrencies, businesses and investors must adapt to ensure long-term sustainability and competitiveness in this dynamic sector. Stay informed about the latest developments to proactively address challenges and seize opportunities in this rapidly evolving ecosystem. For more insight into legal obligations surrounding bitcoin transactions in different jurisdictions, explore the legal consequences of bitcoin transactions in the Democratic Republic of the Congo.

Taxation Guidelines for Cryptocurrency Transactions 💸

Cryptocurrency transactions pose unique challenges when it comes to taxation in Colombia. The regulatory landscape is still evolving, and tax authorities are working to establish clear guidelines for reporting and paying taxes on cryptocurrency gains. Investors and businesses in the crypto space must navigate these complex rules to ensure compliance with tax laws. Understanding the tax implications of cryptocurrency transactions is crucial to avoid potential penalties and legal issues. Effective tax planning and staying updated on the evolving regulations are key strategies for individuals and entities involved in the cryptocurrency market.

Future Outlook and Potential Developments 🔮

In Colombia, the future of cryptocurrency regulations holds a mix of challenges and opportunities. As the digital asset space continues to evolve globally, Colombian authorities are actively exploring ways to adapt their legal frameworks to this emerging asset class. Potential developments may include more clarity on compliance standards, heightened consumer protection measures, and increased scrutiny on anti-money laundering practices within the cryptocurrency industry. Collaborative efforts between regulators, businesses, and investors will be key in shaping a conducive environment for sustainable growth in the cryptocurrency sector.

For further insights on legal consequences of bitcoin transactions in the Dominican Republic, you can refer to the legal consequences of bitcoin transactions in Czech Republic. This comparison can provide valuable perspectives on the regulatory landscape of cryptocurrency transactions in different jurisdictions.