🌍 the Global Landscape of Money Transfers

Sending money across borders used to be a game of wait-and-see. You’d hand over your cash, and it would embark on a mysterious journey, hopping from one bank to another, accruing fees, and finally landing in your recipient’s pocket—hopefully. But that’s old news. Today, we’re part of a thrilling transformation, where sending money feels almost like magic. With just a few clicks, you can beam your hard-earned cash halfway around the world. Whether you’re paying for a craftsman’s beautiful work in another country or sending a little help home, the digital revolution has opened up a treasure chest of methods. But as we stand at the crossroads of traditional banking avenues and the digital frontier, it’s like choosing between a well-worn map and an adventurous leap into the unknown. Here’s a simple glance at how these methods stack up:

| Method | Speed | Cost | Global Reach |

|---|---|---|---|

| Traditional Banks | 1-5 days | $$ | Wide |

| Bitcoin and Other Cryptocurrencies | Minutes to hours | $ | Expanding |

Embracing this change not only means faster and cheaper transactions but also stepping into a world where boundaries blur, and your money moves freely, just as it should.

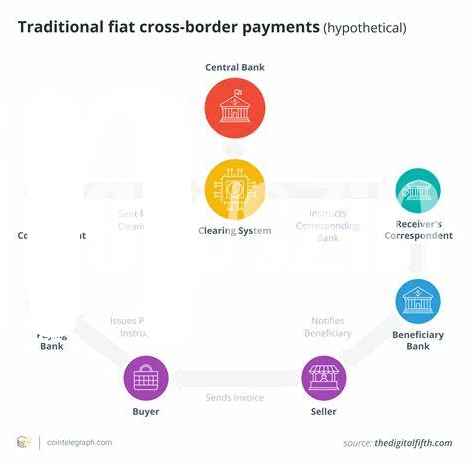

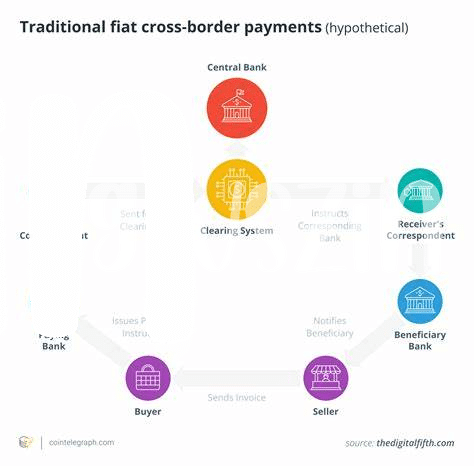

🏦 How Traditional Banks Handle International Payments

When it comes to moving money across borders, traditional banks have been the go-to for years. They operate like massive global clubs, with each branch working together to make sure your money gets from point A to point B. It’s a bit like sending a letter through the post office; you drop it off at one end, and through a network of connections, it arrives at its destination. These transactions can navigate through various banks and countries, each adding their own bit to the process. This method is familiar to many, offering a sense of security knowing it’s backed by large, established institutions.

However, this journey isn’t always as straightforward as you might hope. Every bank along the way wants a piece of the pie, which means additional costs for you. Plus, the time it takes for your money to reach its destination can vary greatly – sometimes it’s quick, other times it could take days. This is because banks operate within their own regular working hours and have to adhere to various regulations and checks, making international payments a bit of a waiting game. For those looking for more information on how to safely manage their digital assets, such as Bitcoin, in light of these issues, the following link offers valuable insights: https://wikicrypto.news/bitcoin-investment-strategies-for-inflationary-economies.

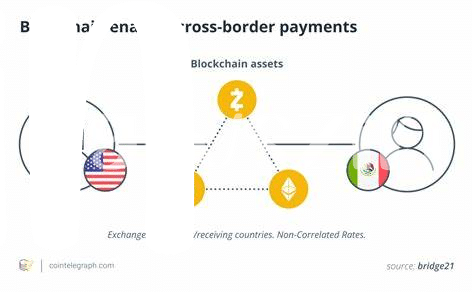

💸 Bitcoin: a New Frontier in Money Exchange

Imagine a world where sending money across the globe is as easy as sending a text message. That’s the reality with Bitcoin, a digital form of currency that operates independently of traditional banking systems. Unlike banks that can take days to process international transfers, Bitcoin transactions can zip around the world in minutes, regardless of borders or time zones. It’s a bit like having a magic wallet: if you want to send money to a friend in another country, you simply transfer Bitcoin from your wallet to theirs, using a computer or smartphone. There’s no need for an intermediary, like a bank, which makes the whole process smoother and more direct. This innovative approach is shaking up the way we think about money exchange, offering a glimpse into a future where financial transactions are faster, easier, and accessible to everyone, everywhere. With its growing acceptance and increasing user base, Bitcoin is not just an alternative; it’s carving out a new pathway in the landscape of global finance.

🕒 Speed Comparison: Bitcoin Vs. Traditional Banks

When we look at moving money across borders, a big part of the conversation comes down to how fast the funds can get from point A to point B. Traditional banks, with their established systems, have been the long-standing champions of international payments. A transaction here might take a few days, as the money dances through various banks and countries, each step adding a bit of time to the journey. On the flip side, enter Bitcoin, a sprightly contender in the realm of global money exchange. With its digital prowess, Bitcoin can zip money across the world, often in a matter of minutes or, at most, a few hours, regardless of where you are or the time of day. This stark difference in speed isn’t just about convenience; it can be a game-changer in emergencies or business operations needing fast liquidity. For those interested in the nuances of Bitcoin and perhaps looking into bitcoin cold storage methods investment strategies, understanding these differences in transaction speeds becomes crucial in making informed decisions about managing and transferring wealth.

💰 Comparing Costs: Fees in Banks and Bitcoin

When it comes to sending money across the globe, you might wonder whether to stick with the old school banks or to jump on the digital currency train with Bitcoin. Now, banks have been around forever, right? They charge you for sending money internationally through fees that can sometimes make you raise an eyebrow. These fees cover the service cost, and let’s not forget the exchange rates which might not always be in your favor. On the flip side, enter Bitcoin – the digital player in the field. It’s like sending an email; easy, fast, and direct. The cost? Usually lower than banks because it skips the traditional banking system and its layers of fees. However, it’s not all sunshine; the transaction fee in the Bitcoin network can vary based on how busy it is. So, while sometimes it might be cheaper, other times, it could get pricey. Now, let’s throw some numbers into a simple table to compare:

| Traditional Banks | Bitcoin | |

|---|---|---|

| Service Fees | Varies widely, can be high | Usually lower, but varies |

| Exchange Rates | Often not in your favor | N/A (Direct exchange) |

| Transaction Speed | Can be slow | Generally faster |

Choosing the best route depends on factors like how quickly you need the money to arrive and how much you’re willing to pay. Each method has its pros and cons, so consider what matters most for your wallet and peace of mind.

🔒 Safety and Security: Trusting Your Transaction Method

When we think about sending money from one country to another, we often worry about whether our money is safe and if we can trust the process. Traditional banks have been around for a long time, and they offer a certain level of security because they follow strict rules that are meant to protect our money. They use various systems to make sure that the money reaches the right person and that it isn’t stolen or lost along the way. On the other hand, we have bitcoin, a newer way to send money that works a bit differently. Bitcoin operates on a technology called blockchain, which is kind of like a digital ledger that keeps a secure record of every transaction. This technology is designed to make bitcoin transactions safe and tough to tamper with. So, when we compare the two, it’s a bit like choosing between a tried-and-tested method and a new, tech-savvy approach. Both have their ways of keeping your money safe, but they do it differently. If you’re interested in digging deeper into how bitcoin is shaking things up in the world of finance, you might enjoy reading about bitcoin in popular culture investment strategies, which explores how this digital currency is becoming a part of our economic landscape. In the end, choosing the right method depends on what makes you feel more comfortable and what meets your needs for speed, cost, and safety.