Understanding Bitcoin’s Role in Global Transactions 🌍

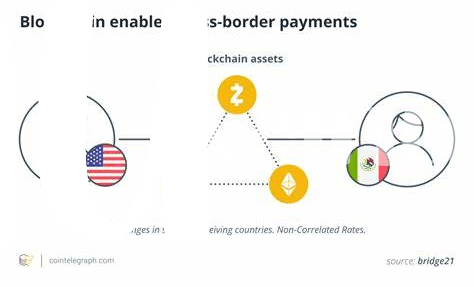

Bitcoin’s role in global transactions is transforming the way money moves across borders, offering a decentralized and transparent alternative to traditional financial systems. As a digital currency, Bitcoin operates independently of central banks or governments, enabling users to send and receive funds securely and efficiently on a global scale. By leveraging blockchain technology, Bitcoin transactions are recorded on a public ledger, ensuring trust and reducing the need for intermediaries in cross-border transfers. This revolutionary approach empowers individuals to navigate the complexities of international money transfers with greater ease and lower costs, opening up new possibilities for financial inclusion and economic empowerment worldwide.

Exploring the Regulatory Environment in Kenya 🇰🇪

Kenya’s regulatory landscape regarding cross-border money transfers is a dynamic ecosystem shaped by evolving financial policies and technological advancements. The Central Bank of Kenya, alongside other regulatory authorities, is continuously evaluating the impact of digital currencies like Bitcoin on cross-border transactions. As Kenya strives to balance innovation with consumer protection, regulatory frameworks aim to mitigate risks associated with cryptocurrency transfers while fostering a conducive environment for financial inclusion and economic growth. Understanding the intricacies of these regulations is crucial for individuals and businesses engaging in cross-border money transfers using Bitcoin in Kenya.

The regulatory environment in Kenya places a strong emphasis on transparency, security, and compliance to prevent illicit activities and protect the interests of consumers. By adhering to regulatory guidelines and staying informed about the evolving landscape of cross-border money transfers, users can navigate the complexities of sending funds internationally with confidence. As technological innovations continue to reshape the financial sector, Kenyan regulators remain vigilant in adapting policies to ensure the stability and integrity of cross-border transactions facilitated by digital assets like Bitcoin.

Challenges Faced by Individuals Sending Money Across Borders 🤔

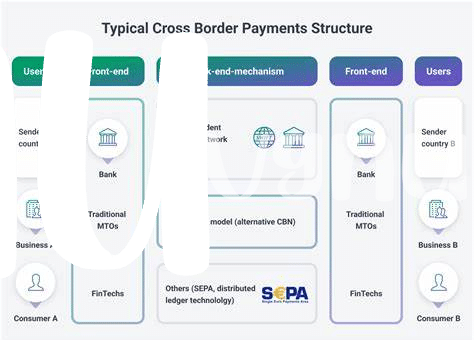

Individuals navigating the complex landscape of cross-border money transfers often encounter a multitude of challenges along the way. One common hurdle is the high fees associated with traditional banking systems, which can significantly reduce the amount of money received by the intended recipient. Additionally, the lengthy processing times involved in international transfers can cause delays in urgent transactions, affecting individuals who rely on timely fund transfers for various purposes. Moreover, strict regulations and compliance requirements imposed by financial institutions and governments can further complicate the process, leading to frustrations and uncertainties for both the sender and the receiver.

Despite these challenges, the emergence of Bitcoin as a viable alternative for cross-border transfers offers a promising solution to many of the obstacles faced by individuals in traditional payment systems. With its decentralized nature and lower transaction fees compared to traditional banking channels, Bitcoin provides a more cost-effective and efficient method for transferring funds across borders. By leveraging blockchain technology, Bitcoin enables faster settlement times and greater transparency in transactions, reducing the reliance on intermediaries and streamlining the transfer process for individuals seeking a hassle-free remittance experience.

Benefits of Using Bitcoin for Cross-border Transfers 💡

When it comes to navigating cross-border money transfers, using Bitcoin can offer several advantages. One key benefit is the potential for quicker transactions compared to traditional banking systems. With Bitcoin, transfers can be processed within minutes or hours, cutting down on the usual delays associated with international transfers. Additionally, Bitcoin transactions often come with lower fees, making it a cost-effective option for sending money across borders. Another advantage is the decentralized nature of Bitcoin, which means that transactions are not subject to traditional banking hours or holidays, allowing for transfers to be made at any time.

If you’re interested in learning more about the legal aspects of cross-border Bitcoin transfers, you can check out this article on bitcoin cross-border money transfer laws in Jordan from WikiCrypto News: bitcoin cross-border money transfer laws in Jordan. This resource can provide valuable insights into the regulatory landscape surrounding Bitcoin transactions in various jurisdictions.

Future Implications of Bitcoin in the Kenyan Financial Landscape 🔮

In the evolving Kenyan financial landscape, Bitcoin is poised to revolutionize cross-border transactions. As the popularity of digital currencies grows, the potential for Bitcoin to streamline international money transfers in Kenya is increasingly promising. With its decentralized nature and lower transaction costs compared to traditional banking systems, Bitcoin offers a feasible alternative for individuals seeking efficient and cost-effective cross-border remittances.

The adoption of Bitcoin in Kenya not only has the potential to simplify transactions but also to empower individuals by providing greater control over their money transfers. By bypassing intermediaries and leveraging blockchain technology, Bitcoin can facilitate smoother cross-border transactions, ultimately reshaping the financial landscape in Kenya. As regulators continue to monitor and adapt to the rise of digital currencies, the future implications of Bitcoin in the Kenyan financial sector are a dynamic space to watch.

Tips for a Safe and Efficient Money Transfer Experience 💸

When it comes to ensuring a safe and efficient money transfer experience using Bitcoin for cross-border transactions, there are some key tips to keep in mind. Firstly, it’s crucial to always double-check the recipient’s wallet address before initiating the transfer to avoid any errors that could result in irreversible transactions. Additionally, staying updated on the latest security measures and best practices in the realm of cryptocurrency transactions can help safeguard your funds from potential cyber threats. Another valuable tip is to consider the timing of your transfers, as Bitcoin transactions can sometimes be subject to fluctuating fees and processing times based on network activity. By being mindful of these factors and staying informed, you can enhance the security and efficiency of your cross-border money transfers using Bitcoin.

For more detailed information on the legal framework surrounding Bitcoin cross-border money transfers, it’s important to understand the specific regulations in different countries. To explore the laws governing such transactions in Kazakhstan, as well as the regulatory landscape in Jamaica, click here: bitcoin-cross-border money transfer laws in Jamaica.