Understanding the Bitcoin Transfer Laws in Denmark 🇩🇰

In Denmark, the regulations surrounding Bitcoin transfers are carefully outlined to ensure transparency and security for both users and the financial system. Understanding these laws is crucial for anyone looking to engage in cross-border transactions involving Bitcoin. With a clear grasp of the legal framework in place, individuals can navigate the complexities of international transfers confidently and in compliance with Danish regulations. By staying informed about the specific requirements and restrictions related to Bitcoin transfers, users can minimize the risk of running into legal issues and ensure a smooth transaction process.

In addition to the legal aspects, being aware of the evolving regulatory landscape in Denmark can help individuals adapt their transfer strategies accordingly. Regulatory changes can have a significant impact on how Bitcoin transfers are conducted, making it essential to keep abreast of any updates or amendments to existing laws. By staying proactive and responsive to these changes, users can maintain compliance and continue to engage in cross-border Bitcoin transfers effectively.

Compliance Requirements for Cross-border Transactions 💼

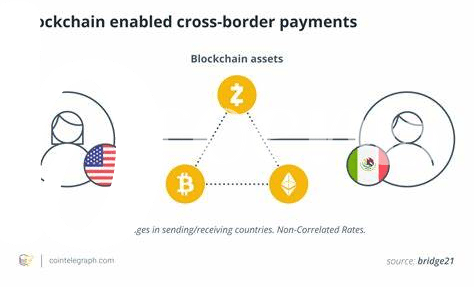

When engaging in cross-border Bitcoin transactions, understanding and adhering to compliance requirements is paramount. Various regulations govern these transactions, requiring individuals to ensure they meet the necessary standards when transferring Bitcoin internationally. This includes verifying the identities of both senders and recipients, monitoring transactions for signs of money laundering or fraudulent activity, and reporting large transactions to regulatory bodies. Failure to comply with these requirements can result in legal repercussions and financial penalties, making it essential for individuals to stay informed and follow the necessary protocols when conducting cross-border Bitcoin transfers.

To navigate these compliance requirements effectively, individuals and businesses can implement clear internal policies and procedures for cross-border transactions, conduct regular audits to ensure ongoing compliance, and seek guidance from legal experts or regulatory authorities when needed. By proactively addressing compliance challenges and staying abreast of regulatory changes, individuals can streamline their cross-border Bitcoin transfers and mitigate potential risks associated with non-compliance.

Impact of Regulatory Changes on Bitcoin Transfers 📉

Regulatory changes in the Bitcoin transfer landscape have introduced a wave of uncertainties for individuals navigating cross-border transactions. As laws evolve, so do the frameworks that govern the movement of digital currencies. These shifts not only impact the ease of transferring Bitcoin but also introduce new compliance considerations that demand swift adaptation. The fluctuating regulatory environment emphasizes the need for a proactive approach to stay in compliance and operate effectively. Understanding the nuances of these changes is crucial for individuals seeking to engage in cross-border Bitcoin transfers securely and profitably. By staying informed and agile in response to evolving regulations, users can navigate the complexities of cross-border transactions with confidence.

Strategies for Navigating Legal Challenges Efficiently 🛂

When faced with legal challenges in cross-border Bitcoin transfers, it is essential to employ a proactive approach. An effective strategy involves staying updated on the evolving regulatory landscape and seeking expert advice when needed. Building strong relationships with legal counsel and compliance experts can provide valuable insights and guidance in navigating complex legal hurdles. Embracing a culture of compliance within your organization and implementing robust internal controls can help mitigate risks associated with regulatory uncertainties. Additionally, fostering open communication channels with regulatory authorities and actively participating in industry discussions can enhance your understanding of the legal framework governing Bitcoin transfers.

For further insights into navigating legal challenges in Bitcoin transfers, you can refer to the compliance guide on bitcoin cross-border money transfer laws in the Democratic Republic of the Congo. This comprehensive resource offers detailed information and practical tips to ensure compliance with the regulatory requirements of cross-border Bitcoin transactions.

Addressing Tax Implications When Transferring Bitcoin 💰

Navigating the tax implications of transferring Bitcoin across borders requires careful consideration and adherence to relevant regulations. It is essential to stay informed about the tax laws in both the sending and receiving countries to ensure compliance and avoid any potential legal issues. Factors such as the nature of the transfer, the amount of Bitcoin involved, and the duration of ownership can impact the tax treatment. Seeking guidance from tax professionals or legal advisors with expertise in cryptocurrency transactions can help navigate this complex landscape successfully. By proactively addressing tax implications when transferring Bitcoin, individuals and businesses can minimize their tax liabilities and operate within the bounds of the law, promoting a more transparent and sustainable cross-border transfer process.

Best Practices for Secure and Transparent Cross-border Transfers 🔒

When engaging in cross-border Bitcoin transfers, prioritizing security and transparency is crucial. Implementing best practices ensures smooth transactions while safeguarding your assets. Firstly, conducting thorough due diligence on the receiving party and utilizing secure channels are fundamental steps. Verifying the legitimacy and credibility of the recipient helps prevent potential fraud or unauthorized transactions. Secondly, employing encryption tools and secure wallets adds an extra layer of protection. Utilizing reputable platforms and staying informed about the latest security measures further enhances the safety of your cross-border transactions. By adhering to these best practices, you can navigate the complexities of international Bitcoin transfers with confidence.

For more information on cross-border money transfer laws for Bitcoin, including specific regulations in Cuba, please refer to the detailed guidelines provided on Bitcoin cross-border money transfer laws in the Czech Republic. These resources offer valuable insights into legal requirements and compliance standards to ensure smooth and legal transactions in these regions.