Understanding Bitcoin’s Roller Coaster Ride 🎢

Imagine hopping on a roller coaster; the excitement, the nervous anticipation, and that adrenaline rush as you climb steep hills and plunge into sudden valleys. That’s a bit like diving into the world of Bitcoin. Originally introduced in 2009, Bitcoin quickly became the face of cryptocurrency, known for its rapid climbs in value and sudden, stomach-churning drops. It’s thrilling yet unpredictable, going from being every investor’s dream to their biggest test of patience. This digital currency operates in an online universe, away from traditional banks, making its journey full of surprises.

| Year | High | Low |

|---|---|---|

| 2020 | $29,000 | $5,000 |

| 2021 | $64,000 | $29,000 |

| 2022 | $69,000 | $17,000 |

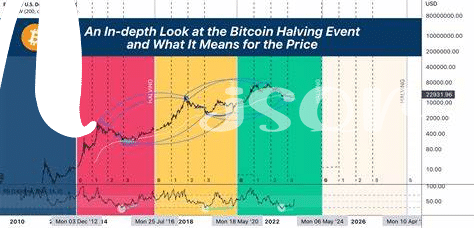

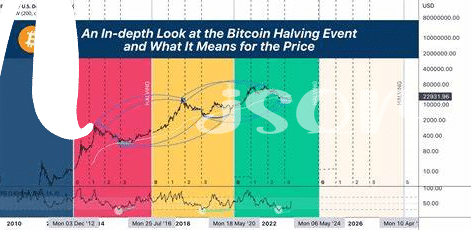

Spotting the patterns in Bitcoin’s history 📈🔍 is crucial for anyone looking to invest. While past performance isn’t always a perfect predictor of future results, it does provide valuable insights. The key to navigating this electrifying ride is not just in holding tight but in understanding the ebbs and flows of the market, preparing yourself for the unexpected turns, and learning to enjoy the journey. Think of it as a thrilling adventure where caution and excitement go hand in hand.

Spotting Signals in the Bitcoin Frenzy 🚦

In the midst of Bitcoin’s wild ups and downs, learning to read the market’s language is like finding a hidden map. Imagine being at a busy intersection; the market signals serve as traffic lights guiding your next move. While it’s tempting to follow the crowd, the secret lies in observing patterns that hint at what might happen next. Just like weather forecasts help plan your day, understanding these clues can protect you from getting caught in a storm. It’s about looking beyond the immediate excitement, identifying trends, and making informed decisions.

To dive deeper into this, consider the broader picture of digital currency’s impact on traditional money, navigating the waters of Bitcoin transaction fees in 2024 provides a comprehensive angle, enriching your strategy. By demystifying the complexities of transaction fees, you equip yourself with knowledge, ensuring your investment journey is not only adventurous but also secure. Remember, the goal is not just to survive the frenzy but to emerge with wisdom, enabling you to spot opportunities where others see chaos.

Creating a Safe Space for Your Investment 🛡️

Imagine you’re building a cozy home for your finances in the middle of the wild world of Bitcoin, where the winds of change can blow fiercely. 🌬️ Just like putting sturdy locks on your doors and windows, you’ll want to construct a fortress around your investment to shield it from the unexpected. Think of it as laying down a solid foundation, brick by brick, with the wisdom of keeping your passwords safe, not putting all your eggs in one basket, and staying informed through reliable sources. 🏰 It’s like nurturing a garden, where you regularly check on your plants, but in this case, you’re keeping an eye on your investment, making small adjustments as needed, ensuring it grows strong even when the weather is tough. By doing so, you’re not just protecting your hard-earned money; you’re also creating a calm space in the midst of the storm, where you can make thoughtful decisions without being swayed by every gust of wind. This sanctuary isn’t just a shelter; it’s your command center, from where you can watch the horizon with confidence, ready to adapt and thrive. 🛠️

The Golden Rules of Trading Bitcoin Wisely 📏

Imagine stepping into the world of Bitcoin trading, where the tide can turn at a moment’s notice. It’s a place when navigated with care, can lead to exciting opportunities. A fundamental approach to tread wisely in these digital waters involves understanding the bigger picture, especially how Bitcoin stacks up against traditional money. For those digging deeper into this comparison, the bitcoin versus fiat currency in 2024 offers fresh perspectives on the evolving landscape. Firstly, it’s crucial never to invest more than you can afford to lose 📉. The value of Bitcoin can swing wildly, so putting all your eggs in one basket is risky. Setting clear goals and limits before you dive in is like having a map in uncharted territory. Secondly, do your homework 📚. The internet is a treasure trove of information, from market trends to bitcoin’s historical performance. Armed with knowledge, you’re better equipped to make informed decisions. Lastly, remember the power of patience 🕰️. In a world that moves at lightning speed, sometimes the wisest move is to wait. Observing the market from the sidelines can provide valuable insights, ensuring when you do make a move, it’s calculated and not just a shot in the dark.

Harnessing the Power of Diverse Portfolios 🌈

In the world of investing, putting all your eggs in one basket can be pretty risky, especially with something as unpredictable as Bitcoin. Think of your investments like a garden 🌻; you wouldn’t want just one type of plant. The same goes for your money. Mixing it up with different investments – stocks, bonds, maybe some real estate, alongside your Bitcoin – can help keep things steady when the crypto market decides to take a wild ride. 🎠 This approach, known as building a diverse portfolio, acts like a safety net. It means when Bitcoin’s price takes a nosedive, your entire investment doesn’t have to crash with it. Keeping a cool head and spreading your investments around 🌍 makes for a smoother journey, offering less stress and potentially better outcomes. Here’s a little table to show why diversity can be your best friend in the investment world:

| Investment Type | Risk Level | Potential for Growth |

|---|---|---|

| Stocks | Medium | High |

| Bonds | Low | Medium |

| Real Estate | Medium | Medium |

| Bitcoin/Crypto | High | Very High |

Diving into different pools helps ensure that even if one market isn’t performing well, your financial health isn’t solely dependent on its success.

Staying Cool When Bitcoin Heats up ❄️

When the Bitcoin world gets a little too hot 🌡️, remember, keeping your cool 🧊 can make all the difference. It’s like when you’re baking cookies and the oven gets too hot; if you don’t adjust the temperature, you’ll end up with burnt cookies. In the same way, when Bitcoin’s prices start jumping up and down like a hopscotch game, that’s your cue to take a deep breath and stick to your plan. Having a clear strategy and not letting the heat of the moment dictate your decisions is key. It’s also a good idea to keep learning and stay informed. Think of it as adding ingredients to your investment recipe. A great place to sprinkle in some extra knowledge is by understanding how transaction fees work, which can impact your trading decisions. Discover more about this by checking out bitcoin trading strategies in 2024. So, when the crypto kitchen gets hot, stay cool, and your investments might just come out golden brown and delicious 🍪.