🌎 the Global Bitcoin Ban: Who’s Out and Why?

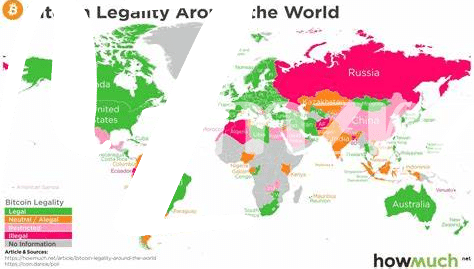

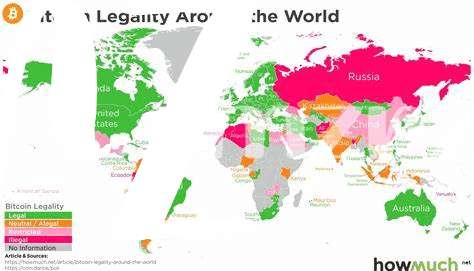

Imagine a world map where certain countries have big, red “No Entry” signs for Bitcoin. This isn’t a game of Monopoly; it’s the real-life stance some nations have taken against this digital currency. The reasons? They range from worries about financial security, protecting citizens from potential scams, to the belief that Bitcoin can disrupt traditional banking systems. Essentially, these countries believe in playing it safe rather than sorry, opting to shut the door on Bitcoin to steer clear of uncertainty and potential economic instability.

| Country | Reason for Ban |

|---|---|

| Algeria | Financial Security Concerns |

| Bangladesh | Prevention of Financial Scams |

| Nepal | Economic Stability |

On the flip side, this cautious approach sparks a vital debate on the balance between innovation and regulation. While some governments see Bitcoin as a hot potato, their stance emphasizes a universal fear of the unknown and a protective instinct towards their financial ecosystems. In navigating these uncharted waters, the question isn’t just about legality; it’s a broader conversation on trust, technology, and the future of money as we know it.

📜 Tracing the Legal Roots: Bitcoin’s Complex Status

Navigating the winding road of Bitcoin’s legal status feels a bit like unraveling a mystery novel where every country writes its own chapter. From its inception, Bitcoin broke the mold as a novel form of money, existing entirely in the digital world without the backing of any government or central bank. This independence is exactly what makes it so appealing to many, yet it’s also the root of its complex legal journey. Different countries have reacted in varied ways, with some embracing its potential to revolutionize finance, while others have slammed the door shut, fearing its implications for financial stability and its ability to bypass regulations. In amidst these diverging paths, understanding Bitcoin’s legal standing becomes crucial for anyone looking to dive into the world of digital currencies. Moreover, concerns around topics like https://wikicrypto.news/the-impact-of-quantum-computing-on-bitcoin-security only add to the intricate tapestry of Bitcoin’s place in the global financial landscape.

🏦 Governments Vs. Bitcoin: Fear or Prudence?

When thinking about Bitcoin, picture two teams playing a game of tug-of-war. On one side, we have governments trying to keep things under control, kind of like parents setting rules for a teenager. They worry about people using Bitcoin for not-so-good things since it’s hard to keep an eye on. Plus, they’re concerned it could shake up the usual money system too much, making things unpredictable. On the other side, there’s Bitcoin, which is like the new kid on the block; it’s exciting and promises a world where everyone can send money around the globe easily, with no big fees or waiting days for a transfer. So, are governments being overly cautious, like when parents worry about every new friend their child makes, or are they wisely stopping to think things through before diving into unknown waters? This push and pull continue to shape Bitcoin’s journey across the world.

🔄 Trading Bitcoin: a Look at the Legal Hurdles

Imagine you’re about to dive into the fascinating world of Bitcoin trading. You’re excited, right? But, just like when you’re learning how to surf, there’s a wave of legal challenges that might catch you off guard. Around the world, governments have set a complex maze of rules that everyone has to navigate. Some of these rules are pretty straightforward, like getting your identity verified, which is a bit like showing your ID at the door of a club. But then, there are trickier parts – for instance, in some places, you’re not allowed to trade Bitcoin at all, which can feel like someone telling you surfing is off-limits at the best beaches. And just when you think you’ve figured it all out, there’s the issue of bitcoin and cybercrime security concerns, reminding us all to stay vigilant in the digital sea. It’s clear that while Bitcoin offers an exciting new frontier of possibilities, the journey isn’t without its hurdles. As governments around the globe wrestle with how to embrace this new technology, the path forward for traders remains a careful balancing act – dodging legal barriers while riding the wave of innovation.

🚀 Adopters Paradise: Countries Embracing Bitcoin’s Potential

In the world of digital currencies, some countries stand out as true pioneers, warmly welcoming Bitcoin into their economies. These nations, often viewed as forward-thinking, have recognized the immense potential Bitcoin holds – not just as a tool for investment, but as a revolutionary way of thinking about money itself. For instance, El Salvador made headlines by becoming the first country to accept Bitcoin as legal tender, a bold step into a future where digital currencies play a central role. Alongside, other countries have been quick to set up regulations that not only protect users but also foster a friendly environment for Bitcoin trading and businesses. This fascinating shift towards acceptance has not only boosted Bitcoin’s reputation but also encouraged innovation and investment within these borders. Below is a table showcasing a few notable nations and their stance on Bitcoin:

| Country | Bitcoin Status |

|---|---|

| El Salvador | Legal Tender |

| Portugal | Tax-Free Trading |

| Japan | Recognized Currency |

Each of these countries not only highlights Bitcoin’s expanding legal acceptance but also points toward a global trend where digital currencies are seen not as threats, but as opportunities to innovate, grow, and evolve the economic landscape.

⚖ Bridging the Divide: Future of Bitcoin’s Legality

Looking ahead, the journey of Bitcoin through the legal frameworks across the globe seems to be taking a brighter turn. The magic lies in the dialogue — nations have started to recognize the need for a shared understanding and approach towards cryptocurrency. Imagine a world where the barriers that currently divide the digital currency realm and regulatory bodies begin to dissolve. This vision isn’t far-fetched; initiatives are underway that seek to harmonize regulations, embracing the benefits of Bitcoin while addressing legitimate concerns around its misuse. This symbiotic relationship promises not only to foster innovation but also to provide a safety net for users and economies alike.

On the other side of things, the security of Bitcoin, especially for smaller businesses, has been a pressing concern amidst its legal voyage. As these entities look to leverage Bitcoin’s potential, understanding and mitigating associated risks is paramount. This is where the conversation around bitcoin and artificial intelligence security concerns becomes crucial. Artificial intelligence offers promising solutions to enhance security, making Bitcoin a more appealing choice for businesses. As legal frameworks evolve, the integration of AI in managing and protecting digital assets could be a significant milestone, bridging the gap between Bitcoin’s widespread adoption and the assurance of safety and compliance in its use.