🌎 Global Politics: a Bitcoin Rollercoaster Ride

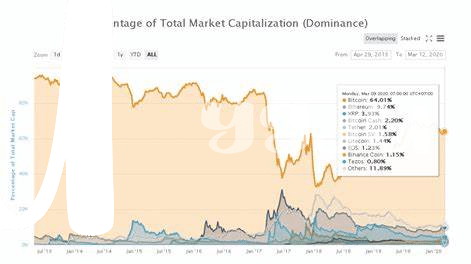

Imagine a rollercoaster soaring high, plunging deep, and sometimes cruising steadily – that’s how Bitcoin behaves amidst international twists and turns. Just like a rollercoaster ride depends on the ups and downs of the track, Bitcoin’s journey is heavily influenced by the decisions made on the world stage. When countries decide to shake hands or turn their backs on each other, it’s like they’re controlling the speed and direction of this digital currency’s ride. Political decisions, such as imposing or lifting sanctions, can send ripples across the globe, nudging Bitcoin’s value in unexpected directions.

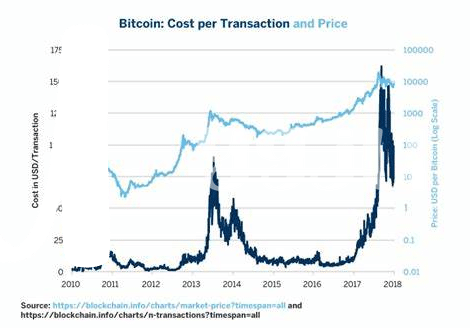

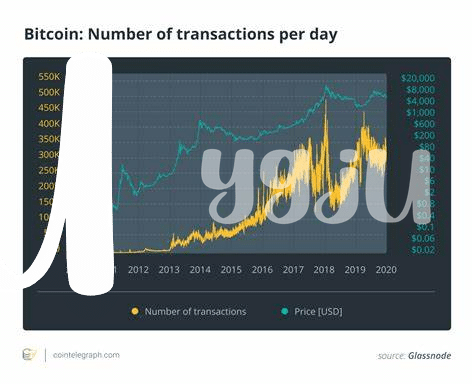

Navigating through this landscape requires understanding not just the highs and lows but the why’s behind them. For instance, when a big economy imposes sanctions on another, it might limit how that country can participate in the global financial system. This is where Bitcoin steps in – as a borderless currency, it offers a way to keep transactions flowing. However, this new role also means its value can swing wildly based on how many people jump on the Bitcoin bandwagon in response to global events. Below is a simple look at how political events have influenced Bitcoin’s value in recent times:

| Event | Impact on Bitcoin |

|---|---|

| Country A imposes sanctions on Country B | Bitcoin value rises as it becomes an alternative financial pathway |

| Peace talks initiate between conflicting nations | Bitcoin value stabilizes as traditional financial systems are favored |

This fascinating interplay between global politics and Bitcoin showcases the ever-changing nature of digital currency, making it a thrilling yet challenging asset to manage.

💲 Understanding Bitcoin’s Value Amidst Economic Shifts

Bitcoin, imagine it like a boat in the ocean of global economy, sometimes riding high waves and other times, dipping low. Its value isn’t just pulled out of thin air but is affected by the winds of economic shifts around the world. When countries impose sanctions on each other, like a game of chess but with real economies, these moves can shake or lift the value of Bitcoin. Sanctions can limit traditional money flow across borders but Bitcoin, with its digital feet, can dance around these restrictions, sometimes becoming more appealing as it isn’t tied down by any country’s rules.

For anyone keen to understand how these global events play with Bitcoin’s value, it’s like learning to read the weather before setting sail. You might find it helpful to look back on how Bitcoin has weathered past storms to better navigate future ones. For deeper insights into Bitcoin’s journey through ups and downs, consider exploring https://wikicrypto.news/expert-insights-professional-advice-for-retrieving-your-lost-cryptocurrency. This knowledge can be your compass, helping you make informed decisions whether you’re weathering a storm or riding a high wave in the Bitcoin sea.

🚀 Navigating Highs and Lows: Practical Tips

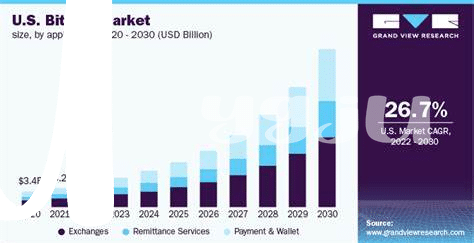

Riding the Bitcoin wave feels like being on a rollercoaster with no end in sight — one minute you’re soaring high, and the next, you’re plunging into the depths. It’s a game of patience and strategy, where understanding when to hold tight and when to take action becomes crucial. Imagine you’re surfing: to ride the wave successfully, you need to know the right moment to stand up on your board. Similarly, in the Bitcoin market, it’s all about timing your moves well. It’s not about making a quick buck but about making informed decisions that align with your long-term financial goals. Keep a cool head and don’t let the fear of missing out push you into hasty decisions.

To safeguard your journey through the cryptocurrency highs and lows, start with setting clear boundaries for yourself. Decide in advance how much you’re willing to invest and at what point you’ll consider selling, both for profit and to cut losses. This is your safety net. 🛡️ Moreover, keep learning. The digital currency landscape is always evolving, and staying informed means you’re better equipped to navigate its changes. Utilize tools and resources available online to track trends and understand market dynamics. 📊 Remember, knowledge is power, especially in a realm as volatile as Bitcoin.

🛡️ Safety First: Securing Your Bitcoin Investments

In the dynamic world of Bitcoin, where values swing like the pendulum of a clock, protecting your digital gold becomes paramount. Think of Bitcoin as a treasure chest on a pirate ship, sailing the rough seas of the financial market; safeguarding it isn’t just wise, it’s necessary. Start by becoming your own sentinel. Employ complex passwords, akin to secret maps filled with riddles, and consider multi-factor authentication as your trusty parrot, always ready to challenge strangers. Dive deeper into the safety net by using hardware wallets. These are like hidden coves, keeping your Bitcoin out of reach from prying eyes. And just as a good captain is ever vigilant, regularly updating your security measures is crucial, ensuring your treasure remains yours and yours alone. For those eager to learn more about weathering these storms, educational resources for learning about bitcoin market trends offer a beacon of knowledge, guiding you through the tumultuous waters of Bitcoin investments with expertise and insight. Remember, in the realm of digital currency, knowledge is not just power—it’s protection. 🌐🔐🧭

🔍 Bitcoin and Sanctions: an Unseen Relationship

When countries decide to give each other the silent treatment or impose restrictions, often called sanctions, it can make things rocky for the world of money, especially the digital kind like Bitcoin. Think of it like a game of musical chairs where suddenly some chairs (or in our case, markets) are pulled away. People start moving their money around, trying to find a safe spot, and this can really shake things up for Bitcoin. It’s like Bitcoin is on a boat in the middle of a storm; when the water gets rough (sanctions happen), the boat rocks more (Bitcoin’s value changes quickly).

It’s kind of like a secret dance between Bitcoin and international sanctions. You might not see it right away, but this dance affects how much Bitcoin is worth. Here’s a little insight into how it works: when sanctions hit, people might run to or away from Bitcoin, changing its value. It’s kind of a hide and seek game, where Bitcoin can either be a really good hiding spot or not so much, depending on how the world is feeling that day.

| Effect | Description |

|---|---|

| Sanctions Introduced | People look for alternative places to keep their money safe, often considering Bitcoin as an option. |

| Bitcoin’s Value Fluctuates | This movement of money can cause Bitcoin’s value to either shoot up or drop quickly, based on global feelings and reactions. |

📈 Making Smart Moves in Turbulent Times

In the whirlwind world of Bitcoin, where every news headline seems like a gust that could either lift it skyward or dash it to the ground, staying anchored isn’t just wise; it’s essential. Think of it like surfing: you need to know when to paddle hard and catch the wave, and when it’s smarter to sit tight and wait for the next one. This isn’t just about keeping an eye on the charts; it’s about understanding the broader picture. For example, in 🌍 countries where Bitcoin is recognized as legal tender, market trends can offer insights that are as precious as the cryptocurrency itself. If you ever find yourself disoriented by a sudden dip, or if you’re just looking to brush up on strategies for digital asset recovery, diving into resources like recovering lost bitcoin: techniques and advice market trends can be incredibly beneficial. Remember, the goal here isn’t just to survive the storm but to sail through it with your treasures secure. So, equip yourself with knowledge, keep a level head, and let’s navigate these choppy waters together. 🚣♂️🔑