Understanding Bitcoin’s Wild Ride 🎢

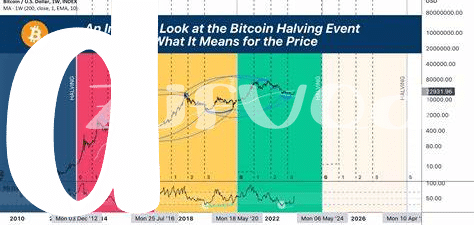

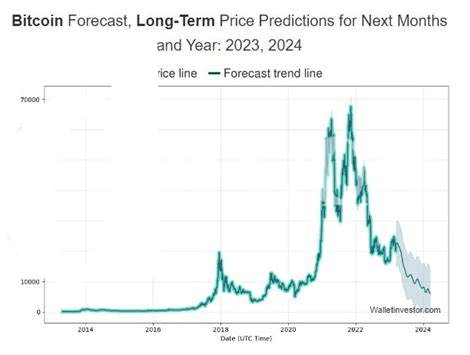

Imagine hopping on the most unpredictable roller coaster at the amusement park, where ups and downs come at you without warning. That’s a bit what it’s like to dive into Bitcoin – a digital currency that can see its value shoot up like a rocket 🚀 and then plummet just as quickly, all in the blink of an eye. This wild ride is driven by a mix of factors, from global economic shifts, governmental regulations, to even social media buzz, making it quite the adventure for those daring enough to partake. To grasp the complexity, check out this snapshot:

| Year | High | Low |

|---|---|---|

| 2020 | $29,000 | $5,000 |

| 2021 | $65,000 | $30,000 |

| 2022 | $45,000 | $20,000 |

Getting familiar with Bitcoin’s peaks and valleys not only arms investors with valuable insights but also helps prepare for the exhilarating journey ahead, where every turn can lead to newfound opportunities or challenges.

Setting Sail: Strategies to Weather the Storm 🚢

As we dive deeper into the unpredictable waters of Bitcoin in 2024, it’s crucial for investors to equip themselves with a suite of strategies to navigate the volatility. Think of it like heading into a storm; you need a solid plan. One key tactic is knowing exactly when to hold your digital assets tight and when it might be wise to let them sail away. This decision shouldn’t be based on gut feelings but informed by thorough research. To help with that, considering resources like https://wikicrypto.news/exploring-lightning-networks-evolution-for-bitcoin-in-2024 can provide essential insights for your investment journey. Additionally, spreading your investments across various cryptocurrencies can act as a lifeline, preventing a total shipwreck should one asset underperform. And through it all, maintaining a cool head, as difficult as it may be amidst the market’s heat, is paramount. This combination of strategies, rooted in knowledge and diversification, can help investors weather the storm, steering them towards a potentially prosperous horizon even in the face of Bitcoin’s volatility.

When to Hold on or Let Go 🤲

Deciding whether to keep your bitcoins or sell them might feel like trying to catch a falling knife or letting go of a potential golden goose. Imagine you’re on a boat; sometimes, it’s wise to hold onto the railing as the waves get rough, signaling keeping your bitcoins through the market’s ups and downs. Other times, when the weather clears and the sea is calm, it might be the perfect moment to sail to new adventures, or in our case, take profit or reallocate resources. It’s a dance between patience, watching for signs like big market shifts or changes in how businesses use bitcoin, and readiness to act, always informed by your own goals and what you’re comfortable risking. 🚢🧭 Remember, it’s not about trying to time the market perfectly but making thoughtful decisions that align with your financial journey. 🗺️

The Role of Research in Your Journey 🔍

Imagine you’re embarking on a treasure hunt, where maps aren’t just drawn in ink but crafted from information you gather along the way. Each piece of data is like a clue, guiding you closer to making informed decisions on your investment journey. This quest is particularly crucial in the unpredictable world of Bitcoin, where the landscape changes with the wind. By digging into the histories and patterns, you’re not just a spectator but a savvy explorer, capable of interpreting the signals that the market sends your way.

Knowledge is your compass, and in this digital age, resources are plentiful. A profound understanding of bitcoin security practices in 2024 can safeguard your voyage against the unseen icebergs lurking in the market’s depths. Engaging with up-to-date analyses and expert insights, while keeping an eye on technological and regulatory shifts, allows you to adjust your sails as conditions change. Remember, the seas of Bitcoin are fraught with volatility, but with the right research as your north star, you’re well-equipped to navigate through the storm towards your investment goals.

Diversify: Not All Eggs in One Basket 🧺

Imagine you’re at a buffet with all kinds of delicious food. You wouldn’t just fill your plate with one dish, right? You’d probably want to try a bit of everything. That’s how smart investing works, particularly when it comes to Bitcoin and its unpredictable swings. Putting all your money into just Bitcoin is like betting on a single horse in a race. Diversification is your ticket to enjoying a stable meal, so to speak. By spreading your investments across different assets—not just cryptocurrencies, but perhaps stocks, bonds, or real estate—you reduce the risk of a total loss. This approach can help stabilize your investment journey, even when Bitcoin decides to take you on a rollercoaster ride.

Research shows that investors who diversify their portfolio often experience less volatility and better returns over time. Consider how having investments in different baskets can act as a safety net. When one market dips, another might rise, balancing out your overall risk. This method won’t eliminate risk completely, but it can offer a smoother sail through the choppy waters of the investment world.

| Investment Type | Pros | Cons |

|---|---|---|

| Bitcoin/Cryptocurrencies | High potential returns | High volatility |

| Stocks | Potential for growth | Susceptible to market fluctuations |

| Bonds | Stable income source | Lower returns |

| Real Estate | Tangible asset, potential for passive income | Requires large initial investment |

This chart shows a quick glance at different assets you might consider for your balanced investment feast. Remember, a well-diversified portfolio can help you ride out the highs and lows with greater confidence.

Staying Cool Amidst the Heat 🧊

When the heat turns up in the Bitcoin market, it’s like being in a kitchen where the stove is always on. You might feel the sweat on your brow as prices swing high and low 📈📉. But remember, the key to not getting burnt is staying calm. Picture yourself as a chef who knows exactly when to add the ingredients, regardless of the heat. Just like in cooking, timing in investing is crucial. When things get too hot, having a level head can help you make smart decisions, rather than rash moves driven by the heat of the moment.

On this unpredictable journey, it’s smart to keep an eye on the bigger picture. Imagine sailing on a vast ocean 🚤💨, where the weather changes rapidly. In one moment, the sea is calm, and in the next, a storm could be brewing on the horizon. This is where doing your homework pays off. Checking out how is bitcoin regulated market trends in 2024 can give you insights into navigating through these choppy waters. By arming yourself with knowledge and maintaining a cool demeanor, you’ll be better equipped to face whatever the Bitcoin market throws your way.