Understanding Bitcoin Basics 💰

Bitcoin operates on a decentralized system called blockchain, where transactions are recorded on a public ledger. This digital currency allows for peer-to-peer transactions without the need for a central authority like a bank. Each transaction is verified by network nodes through cryptography. Unlike traditional currencies issued by governments, Bitcoin is limited to a fixed supply of 21 million coins, making it resistant to inflation. People can buy, sell, or trade Bitcoin on various online exchanges. Understanding the basics of Bitcoin is crucial for navigating its potential benefits and risks in the financial world.

Money Laundering Risks in Digital Transactions 💳

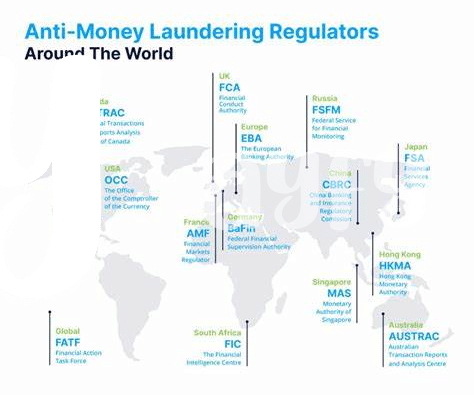

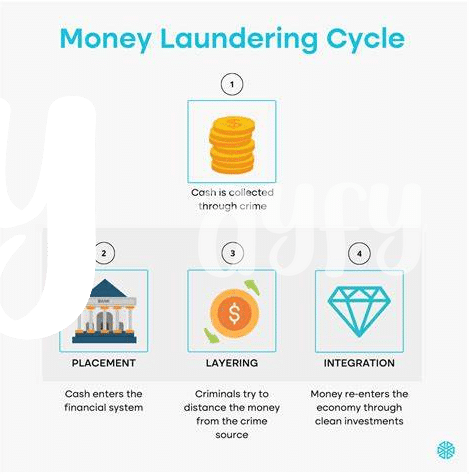

Money laundering risks in digital transactions are a growing concern due to the anonymity and speed of transactions in the digital realm. With the rise of cryptocurrencies like Bitcoin, criminals can easily transfer illicit funds across borders without being traced. The decentralized and pseudo-anonymous nature of digital currencies creates challenges for law enforcement agencies to track and prevent money laundering activities effectively. As a result, countries worldwide are strengthening their regulations and enforcement measures to combat financial crimes in the digital space.

Finland’s Robust Aml Laws and Enforcement 🇫🇮

Finland’s approach towards combating money laundering is exemplified through its rigorous Anti-Money Laundering (AML) laws and proactive enforcement measures. The robust AML framework in Finland is designed to safeguard the financial system from illicit activities, ensuring transparency and accountability within the cryptocurrency space. Authorities in Finland place a strong emphasis on compliance and supervision, actively monitoring and regulating virtual asset service providers to prevent money laundering and terrorist financing risks. This proactive stance highlights Finland’s commitment to upholding integrity in financial transactions and fostering a secure environment for cryptocurrency users and investors.

Challenges and Gaps in Regulating Cryptocurrency 🤔

Challenges and Gaps in Regulating Cryptocurrency 🤔

Cryptocurrency’s decentralized nature presents unique challenges in regulatory oversight. The fast-evolving landscape and anonymity features of some digital assets make it difficult for authorities to monitor and enforce compliance effectively. Additionally, inconsistencies in international regulations create gaps that can be exploited by money launderers and other illicit actors. Bridging these regulatory challenges requires collaboration between governments, financial institutions, and technology providers to establish robust frameworks that safeguard against financial crimes. For further insights on Bitcoin AML regulations, visit [bitcoin anti-money laundering (aml) regulations in Equatorial Guinea](https://wikicrypto.news/ensuring-aml-compliance-best-practices-for-bitcoin-businesses-in-eswatini).

Global Cooperation to Combat Financial Crimes 🌍

In the fight against financial crimes, global cooperation plays a vital role in ensuring a united front against money laundering and illicit transactions. Countries around the world are recognizing the importance of sharing information and working together to combat these threats that transcend borders. By establishing collaborative efforts and frameworks, authorities can more effectively track, investigate, and prosecute individuals or entities involved in such illegal activities. This joint approach enhances the effectiveness of anti-money laundering measures and significantly bolsters the overall integrity of the financial system on a global scale.

Educating the Public on Aml Measures 🧐

Education plays a crucial role in raising awareness about Anti-Money Laundering (AML) measures within the public sphere. By providing accessible information and resources on AML regulations, individuals can better understand the importance of compliance and reporting suspicious activities. Through targeted campaigns, workshops, and online materials, the public can be empowered to recognize potential risks and take proactive steps in safeguarding against money laundering activities.

Curious to explore more about how different countries approach Bitcoin AML regulations? Check out the bitcoin anti-money laundering (AML) regulations in Ethiopia and stay informed on the latest developments in AML policies worldwide by visiting the bitcoin anti-money laundering (AML) regulations in Eswatini.