Overview of Money Laundering Laws in Singapore 🌏

Singapore boasts a robust framework of anti-money laundering laws which play a vital role in safeguarding the integrity of its financial system. With a comprehensive set of regulations in place, Singapore remains vigilant in combating illicit activities that attempt to exploit its financial infrastructure. These laws are designed to detect, prevent, and deter money laundering activities effectively.

Proactively evolving to address emerging challenges, Singapore regularly reviews and enhances its anti-money laundering laws to ensure they remain effective in combating evolving threats. The collaborative efforts between regulatory authorities, financial institutions, and law enforcement agencies underscore Singapore’s commitment to maintaining a secure and trusted financial ecosystem.

Impact of Bitcoin Transactions on Financial Regulations 💰

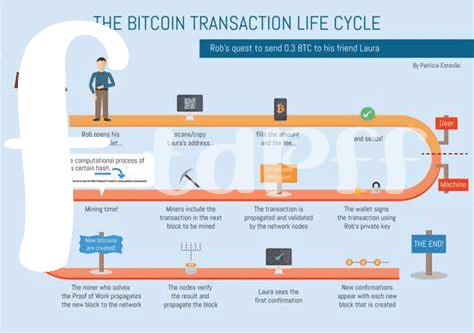

The rise of Bitcoin transactions has sparked a paradigm shift in financial regulations, challenging traditional frameworks and oversight mechanisms. The decentralized nature of cryptocurrencies presents both opportunities and risks in terms of monitoring and enforcing compliance. Regulators are grappling with the dynamic nature of digital assets, seeking to strike a balance between innovation and safeguarding against illicit activities. As virtual currencies continue to gain traction, the need for robust oversight and regulatory frameworks becomes increasingly paramount to ensure the integrity of the financial system.

Compliance Challenges for Cryptocurrency Exchanges 🔄

Cryptocurrency exchanges face a myriad of compliance challenges in navigating the ever-evolving regulatory landscape. Ensuring Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures are robust while balancing user privacy is a delicate tightrope walk. The decentralized and borderless nature of cryptocurrencies complicates traditional compliance efforts, requiring exchanges to stay ahead of emerging risks and regulatory expectations. Engaging with regulatory bodies and proactively implementing comprehensive compliance frameworks are essential steps for exchanges to thrive in an increasingly regulated environment.

To complicate matters further, the global nature of cryptocurrency transactions necessitates exchanges to grapple with differing regulatory requirements across jurisdictions. Staying abreast of evolving regulations and adapting compliance measures accordingly is crucial to maintaining operational viability and fostering trust among users. The dynamic nature of the cryptocurrency space demands a proactive approach to compliance, emphasizing the need for continuous monitoring, evaluation, and enhancement of compliance practices to mitigate risks effectively.

Technological Innovations in Anti-money Laundering Measures 🛡️

Technological advancements in the realm of anti-money laundering measures have ushered in a new era of efficiency and effectiveness in combating financial crimes. With the integration of cutting-edge algorithms and machine learning capabilities, financial institutions and regulatory bodies can now sift through vast amounts of data to pinpoint suspicious activities with precision and speed. These innovations not only streamline the detection process but also enhance the overall security infrastructure, bolstering the fight against money laundering and illicit transactions.

Moreover, the emergence of blockchain technology has redefined the landscape of financial oversight, offering a transparent and immutable ledger that can facilitate real-time monitoring and auditing of transactions. By harnessing these innovative tools, regulatory authorities can stay ahead of evolving money laundering tactics and proactively address potential risks within the cryptocurrency ecosystem. As the financial sector continues to evolve, embracing technological solutions will be paramount in fortifying the regulatory framework and safeguarding the integrity of financial systems globally.

Case Studies: Successful Prosecutions in Singapore 📚

Singapore has seen notable success in prosecuting cases related to money laundering, particularly in the realm of cryptocurrency transactions. One prominent case involved the conviction of individuals engaging in illicit activities using Bitcoin, showcasing the effectiveness of regulatory authorities in enforcing financial laws. Through rigorous investigation and cooperation with international counterparts, Singaporean authorities have been able to secure convictions and send a strong message against money laundering through digital currencies. These successful prosecutions serve as crucial precedents for future regulatory actions and highlight the importance of robust enforcement mechanisms in combating financial crimes.

Future Trends and Recommendations for Regulatory Authorities 🔮

In the rapidly evolving landscape of financial technology and digital currencies, regulatory authorities in Singapore must stay proactive in adapting to emerging trends and technological advancements. As the use of cryptocurrencies like Bitcoin continues to grow, regulatory bodies face the challenge of ensuring robust anti-money laundering measures to prevent illicit activities. Collaboration with international partners and leveraging technological innovations such as blockchain analytics can enhance regulatory oversight and enforcement. Recommendations for regulatory authorities include continuous monitoring of evolving threats, enhancing cross-border cooperation, and promoting industry compliance through clear guidelines and enforcement actions. By staying ahead of the curve, regulatory authorities can effectively address the challenges posed by the intersection of Bitcoin transactions and money laundering activities.

Legal consequences of Bitcoin transactions in Senegal